It’s one of those “nothing to see here” moments for Economists trying not to appreciate what’s really going on in China therefore the global economy. The slump in China’s automotive sector dragged on through October, with year-over-year sales down for the fourth straight month.Auto sales last month were off 12% from a year earlier to 2.38 million, the government-backed China Association of Automobile Manufacturers said Friday. With that, 2018 turned negative: Sales for the first 10 months were down 0.1% from 2017. Chinese auto sales haven’t declined on a full-year basis since its mild embrace of market forces (in the form of Special Economic Zones). Around the same time as the introduction of those, the Chinese

Topics:

Jeffrey P. Snider considers the following as important: $CNY, 5) Global Macro, China, currencies, dollar short, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, PBOC, RMB, rrr, shibor, winnie the pooh, Xi Jinping

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It’s one of those “nothing to see here” moments for Economists trying not to appreciate what’s really going on in China therefore the global economy.

The slump in China’s automotive sector dragged on through October, with year-over-year sales down for the fourth straight month.

Auto sales last month were off 12% from a year earlier to 2.38 million, the government-backed China Association of Automobile Manufacturers said Friday. With that, 2018 turned negative: Sales for the first 10 months were down 0.1% from 2017.

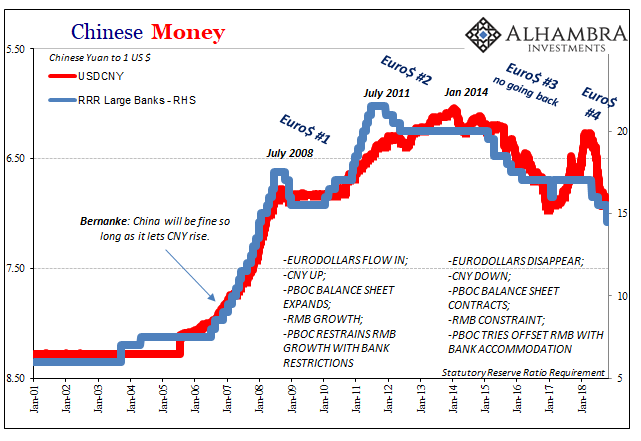

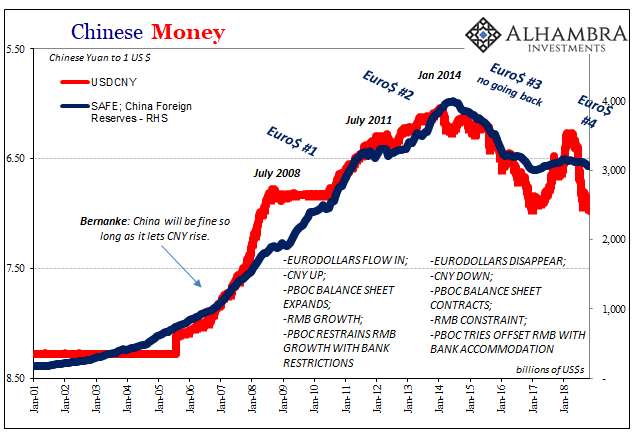

Chinese auto sales haven’t declined on a full-year basis since its mild embrace of market forces (in the form of Special Economic Zones). Around the same time as the introduction of those, the Chinese monetary system had to accept the eurodollar at its monetary base.

One year ago, not long after the Communist Party’s 19th National Congress, authorities spelled out a plan to open up their domestic brokerage and insurance industry to foreign firms. They had long resisted any such ideas, viewing the securities industry in particular as an unshakeable piece of the Chinese identity.

It is, on the one hand, an odd pairing; Communist infatuation with what many people today (wrongly) consider the epitome of capitalism. But, in November 2017, amidst all the recovery hysteria, they were running out of options. I wrote then:

The obvious question is, “what changed?” Why are the Chinese suddenly rolling out the figurative red carpet for foreign presence in businesses that are held as state security?

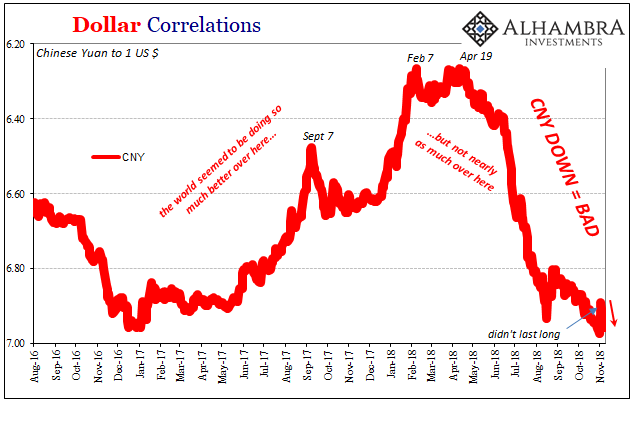

China could also use some more “dollars”, the external root problem Zhou also discussed in his missive. The Chinese have tried quite a few different things to stabilize their currency situation, to no avail. As noted earlier this week, their Hong Kong “dollar” adventure has gone off the rails, having become another great external risk to add to the PBOC’s concerns.

| The short version: they need the dollars more. What better way to get them than to invite global banks to set up shop inside the country and fund things internally. It wouldn’t be a shoe in, of course, but it would open up another channel, one that wouldn’t be dependent upon local Chinese banks nakedly swimming with the eurodollar sharks (of Tokyo). Let Morgan Stanley find (or just create) “dollars” for them and import them into China.

It’s not likely it would ever be enough for the Chinese “dollar short”, but anything at this juncture helps. Which is why last week China’s unchallenged Winnie the Pooh emperor unusually reiterated his support for the idea. |

Chinese Money 2001-2018(see more posts on USD/CNY, ) |

| Banks, for their part, remain largely noncommittal which seems to have surprised authorities. It appears as if they were thinking that by the mere mention of opening up China’s vast markets to foreign ownership Wall Street (meaning Lombard Street) shops would come flooding in with applications. Not even Goldman Sachs has submitted one yet.

Like Winnie the Pooh’s hand stuck in the honey jar, there is a similar problem for China’s financial system and its now-tenuous relationship with eurodollar funding. Having gorged for decades on the easy stuff, it’s not so simple when it starts to go wrong – and banks, uniquely situated as they are in the global monetary chain, now know it having come about it the hard way. |

Chinese Money 2001-2018(see more posts on USD/CNY, ) |

| In other words, they might’ve given the Chinese the benefit of the doubt – in 2013 or 2014. This “rising dollar” stuff since then, however, exudes only risk both liquidity as well as economic. To put it simply, China just may not be worth it in any realm. External funding is being cut off, China’s “dollar short” slowly strangled again in 2018, and now very little appetite for going domestic, either.

Authorities may have waited too long for this one. |

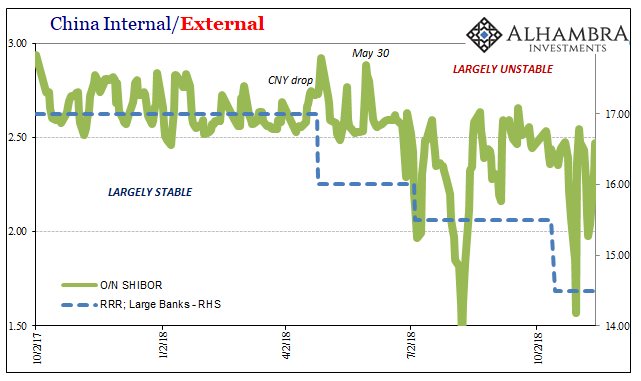

China Internal/External 2017-2018 |

| It is a titanic struggle, playing out right now in China’s markets as well as its economy. The negative “dollar” pressure is building up, even three RRR cuts totaling 250 bps in total haven’t managed to accomplish anything but amplified volatility in RMB money markets. The PBOC is trying to compel money market interest rates, but they just aren’t having it. SHIBOR, for example, is a little lower on the whole since the first RRR, but at what cost? |

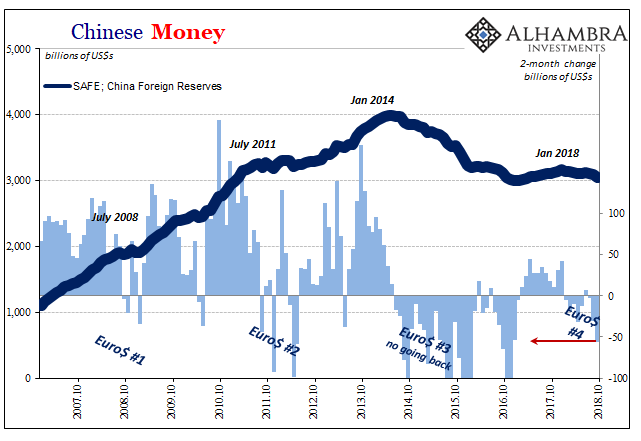

Chinese Money 2007-2018 |

| We know part of the answer from the PBOC’s balance sheet as well as the accelerated runoff of its monetary base – the very eurodollar forex on its asset side. It isn’t trade wars that have left China with few friends and outlets, it is uncorked risk. Selling automobiles might be the least of their problems. It’s hard to sell cars when there isn’t currency. It is consistent, though, with the way everything is going. Again. |

Dollar Correlations 2016-2018(see more posts on USD/CNY, ) |

Tags: $CNY,China,currencies,dollar short,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,PBOC,RMB,rrr,shibor,winnie the pooh,Xi Jinping