As more and more data rolls in even in this delayed fashion, the more what happened to end last year makes sense. The Census Bureau updated today its statistics for US trade in November 2018. Heading into the crucial month of December, these new figures suggest a big setback in the global economy that is almost certainly the reason markets became so chaotic. After all, money dealers don’t need this kind of statistical...

Read More »Lost In Translation

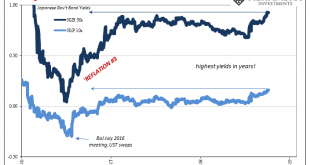

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish. At the end of last July, BoJ’s governing body made a split...

Read More »US Manufacturing Questions

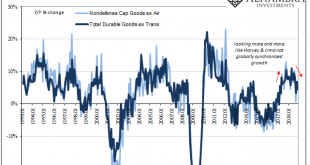

The US economic data begins to trickle in slowly. Today, the reopened Census Bureau reports on orders and shipments to and from US factories dating back to last November. New orders for durable goods rose just 4.5% year-over-year in that month, while shipments gained 4.7%. The 6-month average for new orders was in November pulled down to just 6.6%, the lowest since September 2017 (hurricanes). Durable Goods New...

Read More »Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way. Like 2017, when gold was last rising, there...

Read More »Bond Curves Right All Along, But It Won’t Matter (Yet)

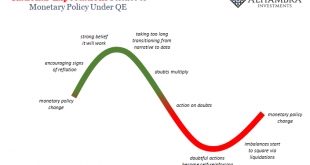

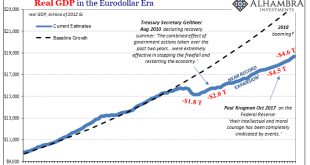

Men have long dreamed of optimal outcomes. There has to be a better way, a person will say every generation. Freedom is far too messy and unpredictable. Everybody hates the fat tails, unless and until they realize it is outlier outcomes that actually mark progress. The idea was born in the eighties that Economics had become sufficiently advanced that the business cycle was no longer a valid assumption. The mantra,...

Read More »Monthly Macro Monitor – February (VIDEO)

Alhambra Investments CEO Joe Calhoun discusses the latest information about markets, specific categories affecting the economy. [embedded content] Related posts: Monthly Macro Monitor – October 2018 (VIDEO) Monthly Macro Monitor – December 2018 (VIDEO) Monthly Macro Monitor – August Monthly Macro Monitor – September 2018 Monthly Macro Monitor –...

Read More »It’s Not That There Might Be One, It’s That There Might Be Another One

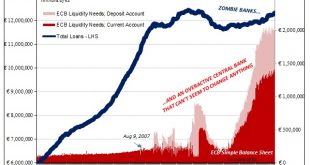

It was a tense exchange. When even politicians can sense that there’s trouble brewing, there really is trouble brewing. Typically the last to figure these things out, if parliamentarians are up in arms it already isn’t good, to put it mildly. Well, not quite the last to know, there are always central bankers faithfully pulling up the rear of recognizing disappointing reality. At the end of November, Mario Draghi went...

Read More »DKB und LGT investieren in Loanboox

Bild: Unsplash Das Fintech-Unternehmen Loanboox, eine Geld- und Kapitalmarkt-Plattform, konnte insgesamt CHF 22 Millionen in der Series B Finanzierungsrunde einsammeln. Zu den Investoren gehören unter anderem die Deutsche Kreditbank (DKB), die LGT Gruppe und weitere Kapitalanleger aus Europa und Übersee. Die Unternehmensbewertung steigt auf CHF 122 Millionen. Mit der DKB und der LGT Gruppe...

Read More »Descartes Finance expandiert

Zürich (Bild: Unsplash) Das Fintech Descartes Finance expandiert das Geschäftsmodell weiter und schliesst mit der Bank BSU einen Zusammenarbeitsvertrag ab. Damit können die Kunden und Kundenberater der Bank ab sofort über die digitale Investmentplattform ihre Anlagengeschäfte abwickeln. Descartes Finance hat für die Bank BSU in Uster nicht nur einen Robo-Advisor sowie eine digitale...

Read More »Liquidität und Steuersenkungen beflügeln China

Bild: Unsplash Kleine und mittlere Unternehmen würden von den chinesischen Reformen profitieren, erklärt Freddy Wong von Fidelity International. Chancen sehe er bei Obligationen im Infrastruktursektor, wobei flexible Anpassungen der Duration notwendig seien. "Für Chinas Märkte war 2018 ein schwieriges Jahr, in dem sich der Handelsstreit mit den USA zuspitzte und die Wirtschaft abschwächte",...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org