The combination of the dovish hold by the Federal Reserve and the eurozone’s miserable flash Purchasing Managers Index casts a pall over the economic outlook. Japan’s flash PMI remained stuck at February’s 48.9, while core inflation unexpectedly eased. Three months after the European Central Bank stopped buying bonds, the German 10-year Bund yield fell below zero for the first time since 2016. Japan’s 10-year yield is...

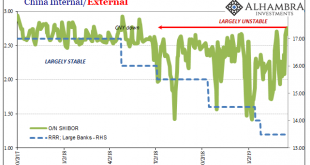

Read More »February 2019 PBOC/RMB Update

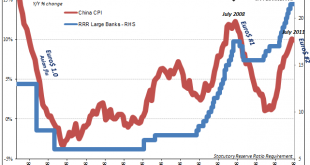

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions (here’s another). China...

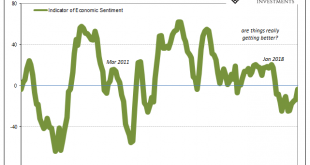

Read More »Slump, Downturn, Recession; All Add Up To Sideways

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6. That’s up from -24.7 back in October, though sentiment had likewise improved at one point last year, too. In July, the number...

Read More »There at the Beginning

Sometimes it is difficult to gain perspective. That is why it may be difficult to see the forest for the trees. It is as we spend most of our time climbing a mountain: One handhold and foothold at a time. Immediacy and urgency limit our peripheral and forward visions. The end of the first expansion since the Great Financial Crisis may be drawing close. There is a concern among officials and investors that the tools that...

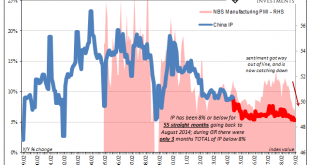

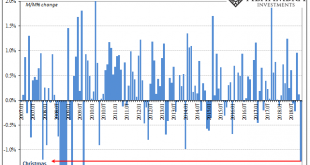

Read More »No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before. Celebrating the milestone might’ve been the proposed purpose behind the state...

Read More »Labor Shortage America has been Canceled

The holiday season was shaping up to be a good one, perhaps a very good one. All the signs seemed to be pointing in that direction, especially if you were a worker. All throughout last year, beginning partway through 2017, there wasn’t a day that went by without some mainstream story “reporting” on America’s labor shortage. It was so ubiquitous, this economic boom idea, the media created several spinoffs. The...

Read More »China Has No Choice

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China. This was amended in...

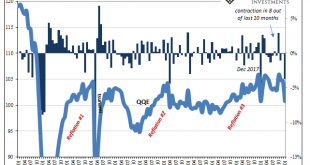

Read More »Meanwhile, Over In Asia

While Western markets breathed a sigh of relief that US GDP didn’t confirm the global slowdown, not yet, what was taking place over in Asia went in the other direction. There has been a sense, a wish perhaps, that if the global economy truly did hit a rough spot it would be limited to just the last three months of 2018. Hopefully Mario Draghi is on to something. Therefore, Q4 US GDP wasn’t as bad as feared, cushioning...

Read More »MSCI erhöht Chinas Gewicht markant

Bild: Unsplash MSCI wird die Gewichtung der chinesischen A-Aktien in seinen wichtigsten Benchmark-Indizes vervierfachen. Für Greg Kuhnert und Wenchang Ma von Investec ist dies ein Meilenstein. Nick Yeo von Aberdeen Standard Investments sieht auf lange Frist positive Effekte – speziell bei Konsumgütern. Die Gewichtung chinesischer A-Aktien in den MSCI-Indizes werden im Laufe von 2019 in drei...

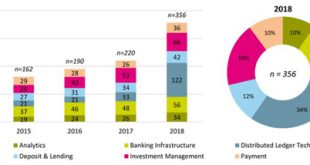

Read More »FinTech-Welle rollt weiter

Bild: Unsplash Die Hochschule Luzern hat zum vierten Mal eine Bestandsaufnahme des Schweizer FinTech-Marktes vorgenommen. Gemäss der Studie ist der schweizerische FinTech-Sektor erneut stark gewachsen und gewinnt weiter an Bedeutung. Auch dieses Jahr bestätigt sich laut der "IFZ FinTech-Studie 2019" der Hochschule Luzern, dass der FinTech-Sektor in der Schweiz gute Rahmenbedingungen geniesst. Im...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org