(I am in Mexico at the World Trade Center General Assembly, participating on a panel about USMCA–NAFTA2.0–for which approval remains elusive. It is possible that the US threatens to pull out of NAFTA 1.0 to force action by the US Congress. Mexico is due to pass legislation this week that may meet demands by the some in the US and Canada for stronger labor protections. However, with the steel and aluminum tariffs still...

Read More »FX Weekly Preview: Important Steps Away from the Abyss

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession. The economy previously contracted when the tech...

Read More »China PMIs jump in March

Industrial gauges rebound on seansonality as well as policy easing. Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report...

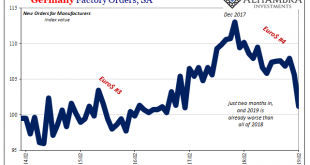

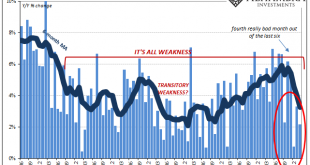

Read More »External Demand, Global Means Global

The Reserve Bank of India (RBI) cut its benchmark money rate for the second straight meeting. Reducing its repo rate by 25 bps, down to 6%, the central bank once gripped by political turmoil has certainly shifted gears. Former Governor Urjit Patel was essentially removed (he resigned) in December after feuding with the federal government over his perceived hawkish stance. Shaktikanta Das, a career bureaucrat with...

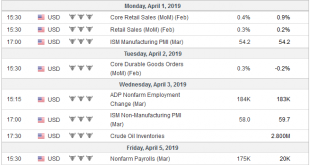

Read More »FX Daily, April 04: Limited Price Action Does not Do Justice to Macro Developments

Swiss Franc The Euro has fallen by 0.06% at 1.1207 EUR/CHF and USD/CHF, April 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are subdued despite several macro developments. The US and China may announce as early as today when the two presidents will meet to ostensibly sign a trade deal, while House of Commons effort to block a no-deal...

Read More »Retail Sales In Bad Company, Decouple from Decoupling

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks. There had been noises overseas, troubling indications that had gone on...

Read More »FX Daily, April 01: China Reanimates the Animal Spirits, While Europe Finds New Ways to Disappoint

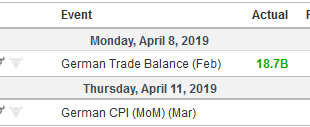

Swiss Franc The Euro has risen by 0.20% at 1.1188 EUR/CHF and USD/CHF, April 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Better than expected German retail sales ad employments reports at the end of last week has been followed by gains in China’s official PMI and Caixin’s manufacturing reading. However, the spillover from China was limited in Asia....

Read More »FX Weekly Preview: The Green Shoots of Spring

Investors have worked themselves into a lather. Equities crashed in Q4 last year amid on corporate earnings and concerns about growth. The Fed’s tightening decision in December was made unanimously. The above-trend growth, the preferred inflation measure was near target, unemployment was the lowest in a generation and real rates were historically low. There are myths in the market, like the Plunge Protection Committee,...

Read More »Monthly Macro Monitor – March 2019 (VIDEO)

Alhambra CEO discusses all the talk about the recent yield curve inversion and how he views it. [embedded content] Related posts: Monthly Macro Monitor – February (VIDEO) Monthly Macro Monitor – December 2018 (VIDEO) Monthly Macro Monitor – October 2018 (VIDEO) Monthly Macro Monitor – January 2019 Monthly Macro Chart Review – March (VIDEO) Monthly...

Read More »Europe and China

The US-China trade talks look like they may very well continue through most of the second quarter, despite how much progress is being claimed. Meanwhile, the tariffs remain in effect, but the market’s sensitivity to developments has slackened since it was clear the Trump and Xi were not going to meet at the end of this month. Europe’s relationship with China will eclipse the US-China trade talks that resume with Mnuchin...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org