Swiss Franc The Euro has risen by 0.09% to 1.0587 EUR/CHF and USD/CHF, November 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports that the Fed’s Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher...

Read More »Markets Await Fresh Developments

Overview: Last week's bond market rally has stalled. Benchmark 10-year yields are up 1-3 bp in Europe, and the three bp increase in the US puts the yield slightly below 1.50%. Equities were mixed in the Asia Pacific region. Japan, Hong Kong, South Korea, and Australia nursed losses after the regional benchmark (MSCI) rose 0.65% last week. The Stoxx 600 had a seven-session rally in tow, but it is little changed in the European morning. It rose 1.65% last week. ...

Read More »Short Run TIPS, LT Flat, Basically Awful Real(ity)

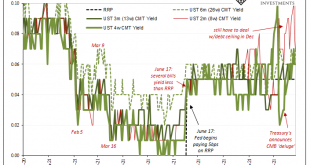

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday. Treasury also snuck $60 billion of 39-day CMB’s into the market on the 14th to go along with the two scheduled 119-day CMB’s during this period. That’s a quick $220 billion...

Read More »Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year. Or are we? Well, yes, the 10 year is back where it was but that doesn’t mean everything else is and, as you’ve probably...

Read More »Markets Turn Cautious

Overview: After a couple of sessions of taking on more risk, investors are taking a break today. Equities are mostly lower today after the S&P 500's six-day advance took it almost to its record high, while the NASDAQ's streak was halted at five sessions. The Nikkei's nearly 1.8% slide paced the Asia-Pacific session, where most bourses retreated. Europe's Dow Jones Stoxx 600 is off about 0.15% near midday after rising approximately 0.65% over the past two...

Read More »Consolidative Session as Markets Await Fresh Incentives

Overview: The markets lack a clear direction today and await fresh incentives. After gaining almost 1% yesterday, the MSCI Asia Pacific Index slipped. Japan, Hong Kong, and Australia are among the few equity markets that rose. The Dow Jones Stoxx 600 is posting minor gains, while US futures are largely steady. The S&P 500 and NASDAQ have a five-day advancing streak in tow. The US 10-year yield reached a five-month high near 1.64% yesterday and extended to...

Read More »China’s social credit system – a new Cultural Revolution

The Cultural Revolution of the 1960s was a comprehensive effort by Mao Zedong to regulate how people think and behave. Citizens were forced to read the “Red Bible” and honor the Communist Party with quasi-religious rituals. Mutual supervision was encouraged throughout all of society. People were told that the way of thinking and behavior advocated by Mao Zedong was the only correct one. Sixty years later, China is undergoing another Cultural Revolution, the goal...

Read More »Inflating Chinese Trade

There was never really any answer given by the Chinese Communists for why their own export data diverged so much from other import estimates gathered by its largest trading partners. Ostensibly different sides of the same thing, it’s not like anyone asked Xi Jinping to weigh in; they report what numbers they have and consider them authoritative. However, the United States’ Census Bureau’s tallies of China-made goods entering this country used to track very closely...

Read More »The Dollar Slips Ahead of CPI

Overview: The US dollar is trading with a lower bias ahead of the September CPI report due early in the North American session. Long-term yields softened yesterday and slipped further today, leaving the US 10-year yield near 1.56%. European benchmark yields are 3-4 bp lower. The shorter-end of the US coupon curve, the two-year yield is firmer. Equities are enjoying a slightly better tone, though Japan, Taiwan, and Australia’s markets traded heavily in the Asia...

Read More »FX Daily, October 11: Rate Expectation Adjustment Continues

Swiss Franc The Euro has fallen by 0.07% to 1.0717 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are softer and yields higher to start the new week. The dollar is mixed. Oil and industrial metals are higher. There are several developments over the weekend, but the focus seems to be on central bank action, inflation reports by the US and China, and the start of the Q3...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org