The Pando (pictured here) appears to be 107 acres of forest, but scientists have concluded that the nearly 47,000 genetically identical quaking aspen trees share a common root system. It is a single organism. It is estimated to be around 80,000 years old and weighs something of the magnitude of 13 million pounds. It may be dying. Many market participants also struggle to distinguish the forest from the trees. It is not a personal failing; it is systemic. The...

Read More »Hope Springs Eternal, or at least enough to Lift Risk Taking Today

Overview: The animal spirits have been reanimated today. Encouraged by the dramatic reversal in oil and gas prices, a deal in the US that pushes off the debt ceiling for a few weeks and talk of a new bond-buying facility in the euro area spurred further risk-taking today, ahead of tomorrow’s US employment report. The sharp upside reversal in US shares yesterday carried over in Asia and Europe today. The Hang Seng, battered lately, jumped over 3%, and the Nikkei...

Read More »Dollar Rallies as Energy Surge Quashes Animal Spirits

Overview: Investors worry that surging energy prices will sap economic activity and boost prices. It is sparking a sharp drop in equities and bonds while lifting the dollar. The Nikkei fell for the eighth consecutive session, and today's 1% drop brings the cumulative decline to 9%. South Korea's Kospi also fell by more than 1%. Some of the smaller markets in the region, like Malaysia, Indonesia, and the Philippines, rose by more than 1%. They are an anomaly. ...

Read More »What’s The Real Downside To Some of These Key Commodities?

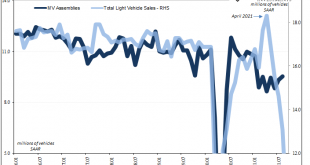

Last night, Autodata reported its first estimates for September auto sales in the US. According to its own as well as those compiled by the Bureau of Economic Analysis (the same government outfit which keeps track of GDP), vehicle sales have been sliding overall ever since April. For a couple months in the middle of Uncle Sam’s helicopter-fed frenzy, the number of vehicle units had surged to a high of more than 18 million (seasonally-adjusted annual rate) in both...

Read More »Market Economy Beats Planned Economy

Throughout the next weeks, we will regularly feature the keynote speeches held by our distinguished experts at this year’s digital Free Market Road Show. The times we are living in – the pandemic – are times when our fundamental values are threatened maybe more than ever in modern times. More than ever in modern times because we are living not in a time of containment, with an Iron Curtain, or a Bamboo Curtain, dividing the world in two as in the Cold...

Read More »Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »More About Less New Orders

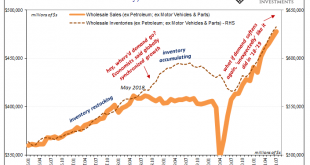

The inventory saga, planetary in its reach. As you’ve heard, American demand for goods supercharged by the federal government’s helicopter combined with a much more limited capacity to rebound in the logistics of the goods economy left a nightmare for supply chains. As we’ve been writing lately, a highly unusual maybe unprecedented inventory cycle resulted (creating “inflation”). The worse the shipping snafus, the more was ordered and piled into it – if for no...

Read More »Hard to Be Sterling

Overview: Energy prices pulled back late yesterday, but it offered little reprieve to the bond market where the 10-year benchmark yields in the US, UK, Sweden, and Switzerland reached new three-month highs. November WTI traded to almost $76.70 before reversing lower and leaving a potentially bearish shooting star candlestick in its wake. The US S&P 500 and NASDAQ gapped lower and did not recover, setting the stage for today’s drop in Asia. All the major...

Read More »Soaring Energy Prices Lift Yields, Weigh on Equities and the Greenback Pops

Overview: Rising energy prices and yields are helping lift the US dollar and weighing on equities. November WTI has pushed above $76, while Brent traded above $80, and natural gas is up for the fourth consecutive session, during which time it has risen by about 25%. The US 10-year yield has surged to almost 1.53%, up more than 20 bp since the middle of last week. Near 32 bp, the US 2-year yield is at a new 18-month high. European yields are 3-5 bp higher, with...

Read More »Taper, No Tantrum

Overview: The market's reaction to the FOMC statement was going according to our script, with the dollar backing off on a buy rumor sell the fact type of activity until Powell provided an end date for the tapering (mid-2022) before providing a start date (maybe next month). This spurred a dollar rally. Equities pulled back but recovered. The dollar is paring its gains today. It is lower against the other major currencies, but the yen, and the euro, which had...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org