There was never really any answer given by the Chinese Communists for why their own export data diverged so much from other import estimates gathered by its largest trading partners. Ostensibly different sides of the same thing, it’s not like anyone asked Xi Jinping to weigh in; they report what numbers they have and consider them authoritative. However, the United States’ Census Bureau’s tallies of China-made goods entering this country used to track very closely with China’s General Administration of Customs (GAC) trade data overall (for all regions). This made sense given how trade is closely tied together by eurodollar conditions worldwide. If China’s exporting a lot more to the US, almost certainly they’re shipping practically the same everywhere else (the

Topics:

Jeffrey P. Snider considers the following as important: $CNY, 5.) Alhambra Investments, Census Bureau, China, china general administration of customs, commodities, currencies, economy, EuroDollar, exports, Featured, Federal Reserve/Monetary Policy, global trade, imports, Markets, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

There was never really any answer given by the Chinese Communists for why their own export data diverged so much from other import estimates gathered by its largest trading partners. Ostensibly different sides of the same thing, it’s not like anyone asked Xi Jinping to weigh in; they report what numbers they have and consider them authoritative.

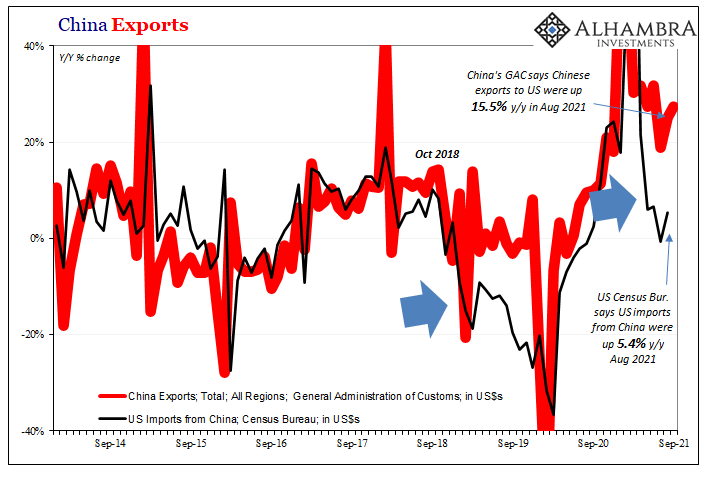

However, the United States’ Census Bureau’s tallies of China-made goods entering this country used to track very closely with China’s General Administration of Customs (GAC) trade data overall (for all regions). This made sense given how trade is closely tied together by eurodollar conditions worldwide.

If China’s exporting a lot more to the US, almost certainly they’re shipping practically the same everywhere else (the data all agreed; see: below).

That all changed with the onset of the worst of Euro$ #4, following October 2018’s landmine. From then on, the Chinese kept reporting far more going out to the rest of the world – as well as what they said ended up in the US – than what anyone especially America calculated had come in.

Interesting how it was the post-landmine economy of a globally synchronized downturn/recession rather than the beginning of “trade wars” when this discrepancy appeared and took on such obvious proportions, making it more likely an economic rather than purely political dispute. In other words, it really does look like the Communists may have been more willing to manage their numbers only once the global economy faded quickly after that late 2018 shock.

Outside the Western media and local confused Economists wondering why Jay Powell’s equally bewildered Fed cut rather hiked rates, who cared about tariffs after that?

This pattern is again repeating in 2021. Since Census hasn’t yet updated US trade for September 2021 while GAC just did late last night, we’ll use the August comparisons here to illustrate this point.

| According to China, the country shipped 15.5% more (in US$ terms) to the United States in August 2021 than it had in August 2020.

Yet, Census indicates the US only received 5.4% more (in US$ terms) from China in August 2021 versus August 2020. Same months. Same currency. Supposed to be the same countries. And that’s on top of the prior year’s similarly-sized discrepancy. Not a small difference, and they’ve gotten even bigger in 2-year terms. For this September update, GAC tallied a 28.1% year-over-year increase in total exports heading out to the rest of the world. |

|

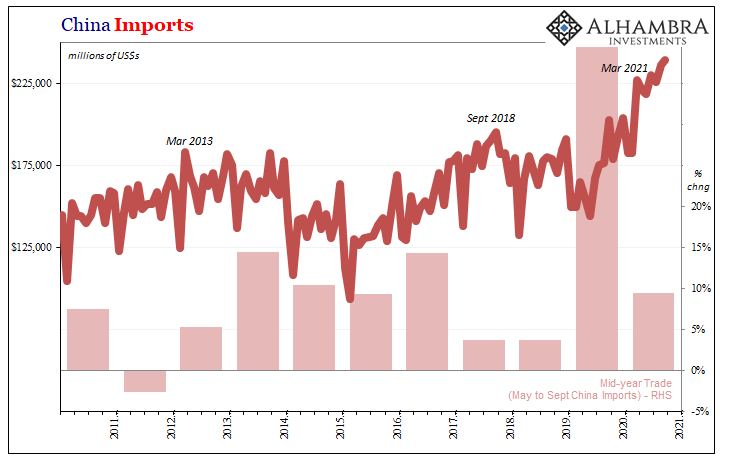

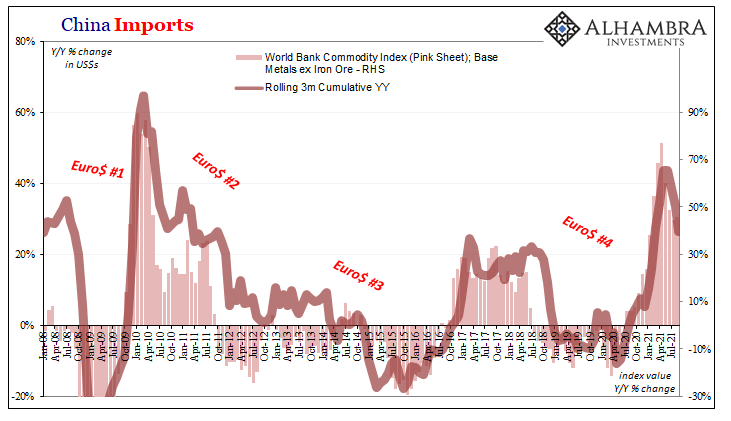

| With this as background, we have to wonder about Chinese imports from the rest of the world (they don’t buy much at all from the United States anyway). It is what’s inbound into China where much of global trade and redistribution takes place, therefore the marginal direction for the entire global economy (including from places like suddenly less optimistic and productive Germany).

The Chinese manufacture goods for the rest of the world, and based on that manufacturing have ordered raw materials (and capital goods) both to make those end user goods as well as to create the capacities to produce them and more (investment). |

|

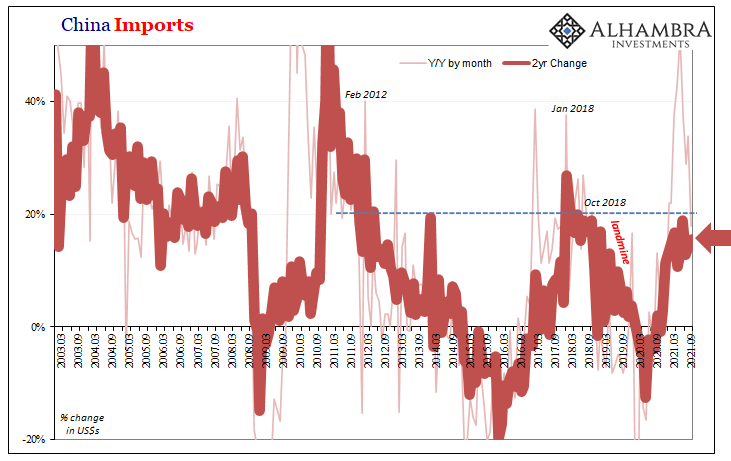

| China’s customs bureau declared a 17.6% year-over-year increase last month for imported goods. That was down sharply from 33.1% in August and well below most estimates (all these yearly comparisons have large base effects). The 2-year change for reported imports was just more than 15% (per year), right in that same lackluster range.

Same as what was the peak of 2017-18, with a more recent slowdown becoming apparent (after April 2021): |

|

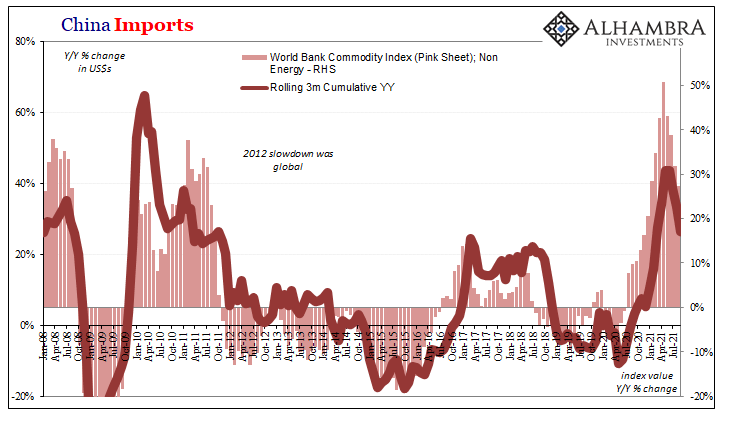

| Where this really does start to make a big difference is “growth scare” or whatever anyone wants to call this possible global economy rolling over.

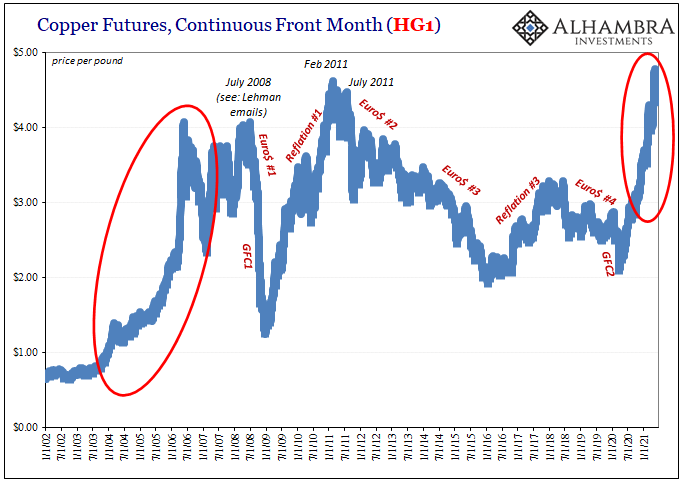

And I don’t mean just the reported GAC figures, more likely what goods and materials the Chinese in reality are bringing in regardless of the official figures. If they are maybe, possibly being a touch overzealous on the export side, what might that mean for imports that are, even if massaged here, not really very good? This might then suggest what commodities (outside of oil, obviously) already are: |

|

| Perhaps a little further along than at the start of going the wrong way.

Later tonight, China’s NBS will report that country’s CPI and PPI, and then next week (Sunday night in the US) there’ll be FAI, Retail Sales, and Industrial Production along with third quarter GDP. Each of those is already expected to be ugly, uglier than they already have been (maybe a lot less than 1% q/q for GDP, compared to the previous small 1.3% increase Q2 from Q1). |

Tags: $CNY,Census Bureau,China,china general administration of customs,commodities,currencies,economy,EuroDollar,exports,Featured,Federal Reserve/Monetary Policy,global trade,imports,Markets,newsletter