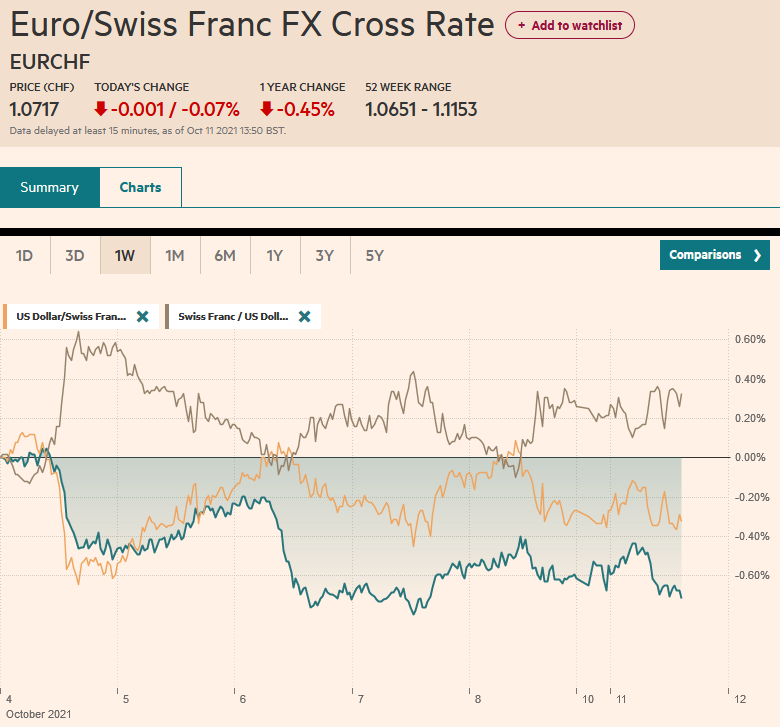

Swiss Franc The Euro has fallen by 0.07% to 1.0717 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are softer and yields higher to start the new week. The dollar is mixed. Oil and industrial metals are higher. There are several developments over the weekend, but the focus seems to be on central bank action, inflation reports by the US and China, and the start of the Q3 earnings season. Shares rallied in Japan and Hong Kong, but most of the other large markets in the region fell. Recall that the MSCI Asia Pacific slipped last week, its fourth consecutive weekly decline. Europe’s Dow Jones Stoxx 600 is paring last week’s nearly 1% gain. US futures are heavy as well.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Austria, Bank of England, Canada, Chile, China, Currency Movement, Czech, Featured, Japan, newsletter, Poland, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.07% to 1.0717 |

EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

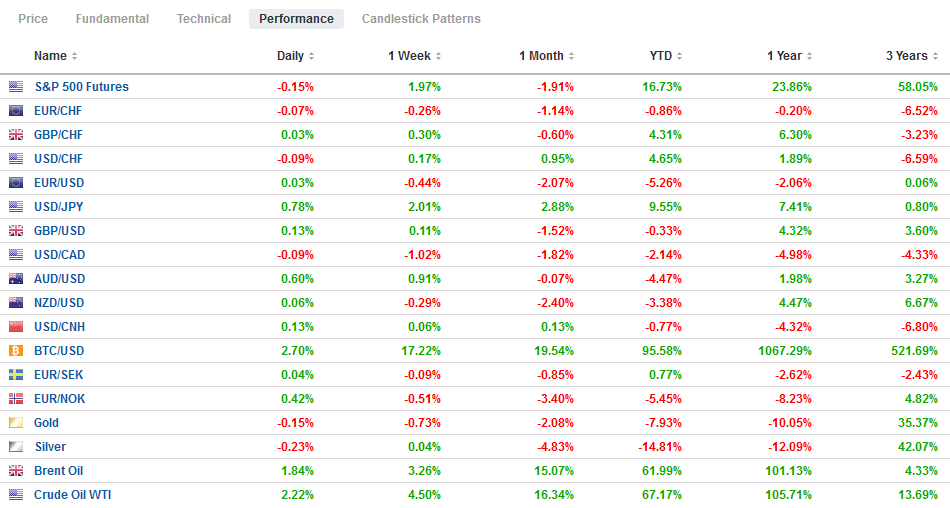

FX RatesOverview: Equities are softer and yields higher to start the new week. The dollar is mixed. Oil and industrial metals are higher. There are several developments over the weekend, but the focus seems to be on central bank action, inflation reports by the US and China, and the start of the Q3 earnings season. Shares rallied in Japan and Hong Kong, but most of the other large markets in the region fell. Recall that the MSCI Asia Pacific slipped last week, its fourth consecutive weekly decline. Europe’s Dow Jones Stoxx 600 is paring last week’s nearly 1% gain. US futures are heavy as well. There is no cash market for US Treasuries today, though yields are higher in Europe and setting new three-month highs. The re-opening of Sydney may be helping to give the Australian dollar a boost. After snapping a four-week drop last week, it is the strongest of the majors (~0.4%). Sterling had initially gained on the back of the hawkish rhetoric for BOE officials but surrendered the gains by midday in Europe. The yen is the weakest of the majors, off more than 0.6%, with the greenback approaching JPY113.00. Emerging market currencies are mixed, though central European currencies are underperforming. The JP Morgan Emerging Market Currency Index is off for the sixth consecutive session. It has risen only once since the FOMC meeting. Crude oil is moving higher, with November WTI pushing above $81 and Brent is near $84. Coal, iron ore, and copper prices are also higher. Rising yields saps demand for gold, which had spiked above $1780 after the US jobs data but quickly reversed lower. It is holding support near $1750. |

FX Performance, October 11 |

Asia Pacific

Ideas that Japan’s new Prime Minister Kishida was considering new capital gains tax were denied, and this helped Japanese stocks extend their recovery. Recall Japanese shares fell from September 27 through October 6, losing about 9%. There were several factors and the new Japanese government’s intentions, with talk of a “new capitalism” and “redistribution” playing a role. Although Japanese stocks did better at the end of last week, the Nikkei still lost 2.5%, its third consecutive weekly decline. The weaker yen may have helped lift Japanese shares too. The Nikkei’s 1.6% gain today was the largest in a couple of weeks. The combination of higher energy prices and a weaker yen may help break deflation’s grip.

China’s Shanxi province was hit by flooding and landslides. Reports suggest 60 coal mines, more than 370 other types of mines, and 14 plants dealing with dangerous chemicals were shut. This seemed to help underpin the industrial commodity prices today. Separately, US Trade Representative Tai and China’s Vice Premier Liu met virtually before the weekend, which pre-pandemic used to be called a phone call. Beijing’s relatively muted response to last week’s reports of US military presence in Taiwan suggests officials there likely already knew of it. Could that help explain the stepped-up PLA intrusion in Taiwan’s air identification zone? Still, Beijing has not needed that pretext to enter into other neighbor’s waters, like Malaysia and the Philippines.

The dollar is higher against the yen for the third consecutive session. It finished last week at its best level of the year, above JPY112.20. It held above JPY112.00 today and jumped to almost JPY113.00. This is its best level since late 2018. The greenback has broken out, and the market will look for the upper end of the new range, which might be near JPY115.00. The Australian dollar’s close last week above $0.7300, and news that Sydney is re-opening, encouraging follow-through buying today. The Aussie has approached $0.7350. There is an option for about A$360 at $0.7365, expiring tomorrow. Support may be about the $0.7330 area that holds an expiring option today (~A$300 mln) and tomorrow (~A$420 mln). The greenback slipped to near last month’s low against the Chinese yuan near CNY6.43. After dipping below CNY6.4350, the dollar recovered to almost CNY6.4440. The PBOC set the dollar’s reference rate at CNY6.4479, a little firmer than the median (Bloomberg survey) of CNY6.4471. The PBOC’s money market operation was a net drain of CNY190 bln, and this seemed to dampen hopes of a near-term easing. Money market rates jumped, and the benchmark 10-year yield rose to a three-month high of nearly 3%.

Europe

The Bank of England’s rhetoric remains hawkish. This is resulting in a dramatic backing up of UK rates. The market is moving to price in a rate hike this year. The December short-sterling interest rate futures now imply a yield of 32 bp. That is a 14 bp increase since the BOE meeting on September 23. The implied yield of the June 2022 contract has risen 26 bp over the same period. Ironically, sterling itself is about a cent lower. The activist MPC member Saunders who has voted to reduce the BOE’s bond-buying immediately endorsed the market developments. At the same time, Governor Bailey warned of the need to prevent inflation from becoming “embedded.” This also echoes the warning by the BOE’s chief economist Pill.

Austria’s Prime Minister Kurz resigned over the weekend rather than face a confidence vote this week. Instead, he will head up his party in parliament, and Foreign Minister Schallenberg will reportedly take over the prime minister’s duties. This looks to be sufficient to preserve the unlikely coalition with the Greens. Separately, as Czech Prime Minister Babis lost a close election, his ally and President Zeman was rushed to the hospital, leaving the outcome uncertain. Zeman, who is unorthodox, could have still given the mandate to form a coalition to Babis, whose party is still the largest. Lastly, the fallout from Poland’s high court decision at the end of last week is still not known. The court ruled that where Poland has not specifically deferred to the EU, Polish law is superior. The primacy of EU law had been thought to be the basis of the bloc in the first place. Still, it was challenged by the German Constitutional Court last year, which claimed the European Court of Justice overstepped its authority in a ruling about QE. Poland has been clashing with Brussels and risks 36 bln euro (~$42 bln) Recovery Fund money.

The euro was turned back from an attempt at $1.16 and is testing the $1.1555 area in late morning turnover in Europe. The single currency remains in the range set last Wednesday (~$1.1530-$1.1605). There is a 1.1 bln euro option at $1.16 that expires today. There is another one tomorrow for 1.4 bln euros at $1.1615 that will also expire. On the downside, the near-term risk extends to around $1.1490, which is the (50%) retracement of the rally from March 2020 that ended ironically on January 6. Sterling was bid to a two-week high near $1.3675 in late Asia, but it returned to opening levels (~$1.3615) near midday in London. The intraday momentum indicators are getting stretched, and new buying may materialize in the $1.3480-$1.3500 area.

America

Canada is closed for the Thanksgiving holiday, and the US bond market is closed for a partial holiday, while equities will trade. The US employment data missed expectations and was distorted by the pandemic impact on hiring teachers. It was the first monthly report after the expiration of the federal unemployment insurance $300 a week benefit. While around half of the states dropped from the program before it ended, there was no big impact on the data, contrary to many expectations. Still, others have not given up on the claim and retreated to ideas that elevated savings are the key deterrent. Still, it appears that the number one issue is the virus. In terms of Fed policy, it is not seen as a game-changer. Tapering is still on track for next month. The implied yield of the September 2022 Fed funds futures contract is rising for its sixth consecutive session and at 21 bp, suggesting more than a 25 bp hike has been discounted.

Whereas the US jobs data disappointed, Canada’s report exceeded expectations. It grew 193k full-time positions, which would be as if the US created 2 mln jobs given the relative size. While the US participation rate slipped, Canada’s jumped to 65.5%, matching the pre-pandemic level. Not only did the participation rate rise, but the unemployment rate fell to 6.9% from 7.1%. There has been a sharp backing up of Canadian money market rates. Consider that the June 2022 Banker Acceptance interest rate futures contract’s implied yield has risen by more than 20 bp since the central bank met a month ago. The implied yield rose every day last week for a cumulative gain of almost nine basis points. It was the fifth consecutive weekly increase. Since that Bank of Canada meeting, the Canadian dollar has been the strongest major currency, rising about 1.9% against the US dollar.

The Canadian dollar is edging higher today in quiet turnover. It has slipped through the pre-weekend low a little above CAD1.2450 to set a new 2.5-month low. The 200-day moving average (~CAD1.2515) may now offer resistance. We are monitoring a possible head and shoulders top that projects toward CAD1.23. Emerging market currencies remain out of favor, and the Mexican peso reflects this development. The greenback is chopping around nine-month highs against the peso. Last week’s high was near MXN20.8865, and it looks poised to retest it. The upper Bollinger Band is found by MXN20.8715 today. Above there, the MXN21.00 beckons, while the high for the year was set in early March around MXN21.6360. Note that Chile’s central bank meets on Wednesday and is expected to hike its overnight target by 75 bp to 2.25%. The key rate began at 50 bp this year and was hiked by 25 bp in July and then 75 bp in August. September inflation was reported last week at 5.3% and was stronger than expected (5%).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Austria,Bank of England,Canada,Chile,China,Currency Movement,Czech,Featured,Japan,newsletter,Poland,U.K.