Overview: The US dollar is trading with a lower bias ahead of the September CPI report due early in the North American session. Long-term yields softened yesterday and slipped further today, leaving the US 10-year yield near 1.56%. European benchmark yields are 3-4 bp lower. The shorter-end of the US coupon curve, the two-year yield is firmer. Equities are enjoying a slightly better tone, though Japan, Taiwan, and Australia’s markets traded heavily in the Asia Pacific region. Hong Kong’s market was closed due to a typhoon. Europe and the US futures are posting small gains. In the foreign exchange market, sterling and Scandis are leading the way higher. The yen is a laggard as the dollar consolidates its recent gains above JPY113.00. The freely accessible emerging

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, EMU, Featured, inflation, newsletter, trade, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Overview: The US dollar is trading with a lower bias ahead of the September CPI report due early in the North American session. Long-term yields softened yesterday and slipped further today, leaving the US 10-year yield near 1.56%. European benchmark yields are 3-4 bp lower. The shorter-end of the US coupon curve, the two-year yield is firmer. Equities are enjoying a slightly better tone, though Japan, Taiwan, and Australia’s markets traded heavily in the Asia Pacific region. Hong Kong’s market was closed due to a typhoon. Europe and the US futures are posting small gains. In the foreign exchange market, sterling and Scandis are leading the way higher. The yen is a laggard as the dollar consolidates its recent gains above JPY113.00. The freely accessible emerging market currencies are helping lift the JP Morgan Emerging Market Currency Index for the second consecutive session. If these gains are maintained, it would be the first back-to-back gain in a month. November WTI is straddling the $80 area ahead of OPEC’s oil market assessment due tomorrow. Gold is firm, testing the $1770 area. China’s iron ore prices snapped a five-day advance- and copper is recouping yesterday’s loss, the first in four days. |

Asia Pacific

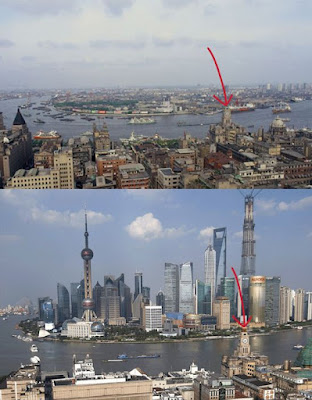

China’s trade surplus grew for the sixth consecutive month, and at $66.76, it defied expectations for a narrowing. The surplus was a result of both stronger exports and weaker imports. Exports rose 28.1% year-over-year, accelerating from 25.6%, and at almost $306 bln is a new record. Economists had expected a decline. Imports rose 17.6% year-over-year, nearly half the 33.1% increase reported in August. Coal and gas imports rose, while crude oil and copper imports eased. The politically sensitive trade surplus with the US rose to $42 bln to bring the year-to-date surplus to $280 bln.

China reported that while bank lending rose in September, loans from the shadow banking sector slowed. New yuan loans, a measure of bank lending, increased at CNY1.660 trillion from CNY.1220 trillion. Although activity increased, economists were looking for more. Aggregate financing, which combined bank lending and shadow banking activity, slowed to CNY2.9 trillion from CNY2.955 trillion. Expectations for an increase to above CNY3 trillion were disappointed. Tomorrow, September CPI and PPI figures are due. Subdued CPI is seen furthering the case for a near-term cut in reserve requirements.

Japan’s core machinery orders were weaker than expected, falling 2.4% in August, unwinding the 0.9% gain in July, and defying expectations for a 1.4% gain (Bloomberg survey). The weakness was concentrated in the manufacturers’ orders (-13.4% month-over-month after rising 6.7% in July). Supply-chain problems likely depressed orders for steel, vehicles, and production equipment. Foreign orders are not included in the core report, fell nearly 15% in August.

The dollar is consolidating its surge against the yen and is confined to less than a 30-pip range above JPY113.35. Over the last four sessions, the dollar has rallied from about JPY111.25 to JPY113.80. The driving force has been the rise in US rates, in a broad framework that sees the BOJ lagging well behind in this monetary cycle. A $555 mln option at JPY113 expires today, and only a break of this level would temper the bullish stance. The Australian dollar found support in the $0.7330 area and recovered its poise to challenge the $0.7360 area. Yesterday’s high was near $0.7385, ahead of resistance at $0.7400. There is a A$450 mln option at $0.7350 expires today. The greenback slipped for a second session against the Chinese yuan. It found offers near CNY6.45, where a billion-dollar option expires today. Options there are also set to expire Thursday and Friday. The PBOC set the dollar’s reference rate at CNY6.4612, a little firmer than the CNY6.4598 projection (Bloomberg survey).

Europe

Perhaps it is a bit cynical, but it does seem as if Prime Minister Johnson wanted to execute Brexit so badly that he was willing to do it badly and then fight to change it after the fact. The idea of a border in the middle of the Irish Sea was a joke, and Johnson’s predecessor recognized it as such. But like the Dogecoin that began as a joke in the crypto space but now has a “life” of its own, the Northern Ireland Protocol embodied that impractical idea of keeping Northern Ireland inside the Single Market. After winning an outright parliamentary majority on it, the Johnson government now insists on significant changes to the treaty. There are two rubs. The first is the required border checks for food and animal products. Reports suggest the UK did not commit the resources to implement it and now wants it to be redrawn. Johnson claimed that a fifth of all EU-bloc parameter checks took place on the regulatory border between the rest of the UK and Northern Ireland. The second peeve is that the European Court of Justice is the ruling authority. But more than that, UK negotiator Frost seemed to suggest any role for EU institutions in Northern Ireland is undemocratic.

The Northern Ireland Protocol allows Northern Ireland’s assembly to vote in four years whether to retain it. A simple majority is sufficient to jettison it (though it takes another two years to end it). However, the UK threatens to trigger Article 16, a limited escape hatch, allowing unilateral action if severe economic, social, or environmental hardship. It needs to be limited in scope and duration and can only include measures that are strictly necessary. Ditching the European Court of Justice does not seem to fit. In terms of customs, the EU will reportedly offer today to meet the UK halfway. It will offer to lift up to 50% of the customs checks on goods and more than half on the meat and plants. Moreover, in an attempt to de-escalate the tensions, the EU’s chief negotiator, Sefcovic, will acknowledge that the protocol has been problematic and solutions are worth discussing.

The UK’s August GDP rose by 0.4%, missing the forecast, and adding insult to injury, July growth was revised to -0.1% from 0.1%. August industrial output, including manufacturing production, was stronger than expected (0.8% and 0.5%, respectively), but this seemed to be a function of shifting July activity into August. July industrial output was revised to 0.3% from 1.2%, and manufacturing production fell by 0.6%, rather than unchanged as it was initially reported. Services output rose by 0.3%, though the July series was revised to -0.1% from flat. The trade balance deteriorated. Lastly, we note that in the IMF’s updated forecasts, unlike the US, Canada, and Japan, the UK economy is seen to be smaller (~3%) in 2024 than had been projected in 2019 before the pandemic.

The euro slipped to a marginal new low for the year yesterday, slightly below $1.1525. However, it has recovered to $1.1560. Yesterday’s high was $1.1570, and the single currency has not been above $1.16 since last Wednesday. It takes a move above $1.16 to help lift the tone. Sterling slipped to a four-day low yesterday, a little below $1.3570, but it recovered and briefly and marginally rose above yesterday’s high (which was just above $1.3635). There is an option for almost GBP400 mln at $1.36 that expires today. Monday’s high near $1.3675 was the highest sterling has been since September 28, when it last traded above $1.3700. The intraday momentum indicators warn of the likelihood of a heavier tone in the European afternoon/ North American morning.

America

Today’s focus is squarely on the September US CPI report. While prices remain elevated, they are not accelerating. The median forecast in Bloomberg’s survey has the year-over-year rate unchanged at 5.3%. It would be the fourth consecutive month of 5.3%-5.4%. The core rate peaked in June at 4.5% and is expected to be unchanged at 4.0% in September. Some observers say that the magnitude of the rise says something about the duration, but we are skeptical. The bulk of the increase so far appears to be related to either the pandemic and the related supply chain issues (e.g., vehicles) or energy. Fed officials have acknowledged that price pressures are stronger than they had expected and may last longer, but much of it is still seen to be temporary. Nevertheless, by announcing that it will finish bond-buying around the middle of next year, this will leave H2 22 for rate hikes if warranted. Remember, as recently as last month, half of the Fed officials did not see the need to raise rates in 2022. One US investment bank seems to concur with the dovish half and has forecast no hike next year. Looking at the Fed funds futures strip, the market has been very aggressive in pricing in more than 25 bp hike in September and is nearly pricing in a 50% chance of a second hike in the December contract. The FOMC minutes that will be released later today will be scrutinized for insight, but tapering next month is seen as a done deal.

The US reportedly is proposing to Europe to replace the 25% tariff imposed by the Trump administration on steel imports with a “tariff-rate quota,” which allows for a specific amount of exports to the US, above which a higher duty would kick in. The US and EU trade officials will meet to discuss. Europe’s retaliatory tariffs are set to automatically increase on December 1. The tariff-rate quota is a mechanism permitted under the WTO, and the fact that the US cited national security, gives it a wider berth. The EU chafes under claims of national security, which is not being taken at a time of war, or another international emergency. Nor can it appeal to the WTO as the appellate process remains paralyzed. At the same time, US producers, with the highest output in a decade and record profits, are worried that China and Russian producers just run their steel through Europe to access the US market. As a result, some are insisting that European steel meets some domestic content requirements.

The dollar is trading heavily against the Canadian dollar. It slipped to a new 2.5-month low near CAD1.2435 yesterday, and although it recovered a bit in late dealings, the greenback is pinned near the lows. It was unable to resurface above CAD1.2480. The June 2022 BA futures implied yield rose 8 bp yesterday, nearly as much as last week. Initial support is now seen near CAD1.24, and the CAD1.2365 area corresponds to a (61.8%) retracement of the US dollar’s rally since the end of May. The head and shoulders objective is closer to CAD1.23. After making a marginal new seven-month high yesterday near MXN20.9040, the greenback reversed lows, and follow-through selling today has sent it slightly below MXN20.68. There is an option for nearly $400 mln at MXN20.75 that expires today.

Tags: #USD,China,Currency Movement,EMU,Featured,inflation,newsletter,Trade,U.K.