Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: billion 40-day on the 19th; billion 27-day on the 20th; and billion 48-day just yesterday. Treasury also snuck billion of 39-day CMB’s into the market on the 14th to go along with the two scheduled 119-day CMB’s during this period. That’s a quick 0 billion above and beyond what was expected before the October 13 announcement. The effect of bill supply on bill yields and therefore collateral constraints so far is…not large. . Nearly a quarter trillion of these “ad hoc” issues stuffed into barely two weeks, and yet while front rates have gone up, they’ve

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, China, Collateral, CPI, currencies, Deflation, economy, Featured, Federal Reserve/Monetary Policy, global dollar shortage, growth scare, inflation, inflation breakevens, Markets, newsletter, Nominal Interest Rates, oil prices, PBOC, real rates, T-Bills, tic, TIPS, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

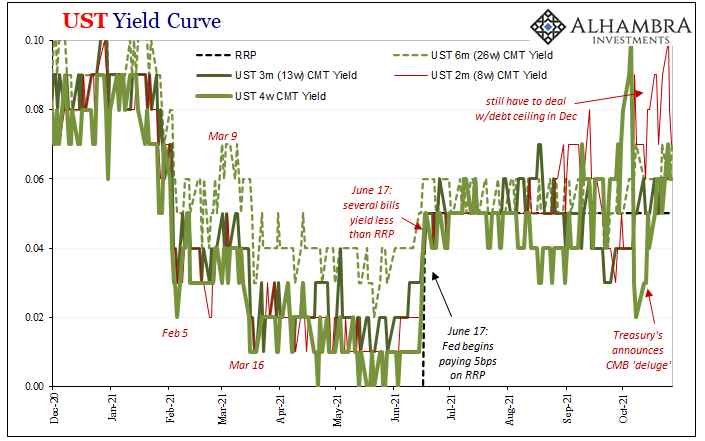

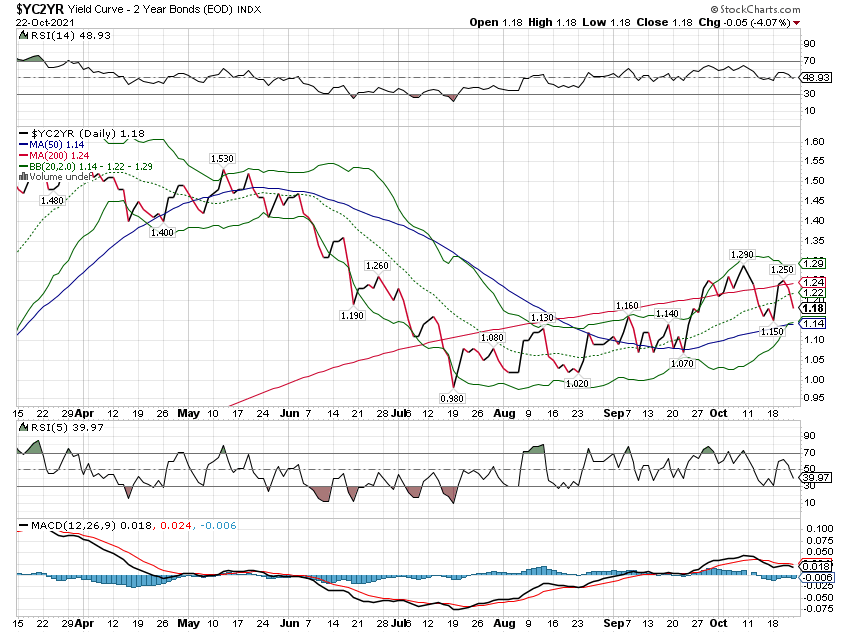

| Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday. Treasury also snuck $60 billion of 39-day CMB’s into the market on the 14th to go along with the two scheduled 119-day CMB’s during this period.

That’s a quick $220 billion above and beyond what was expected before the October 13 announcement. The effect of bill supply on bill yields and therefore collateral constraints so far is…not large. |

|

| Nearly a quarter trillion of these “ad hoc” issues stuffed into barely two weeks, and yet while front rates have gone up, they’ve hardly gone up by much at all. In fact, the 8-week regular T-bill is the only raised up and that’s more about December (debt ceiling comes back) than it is supply.The rest of them remain fixated around 5 or 6 bps.

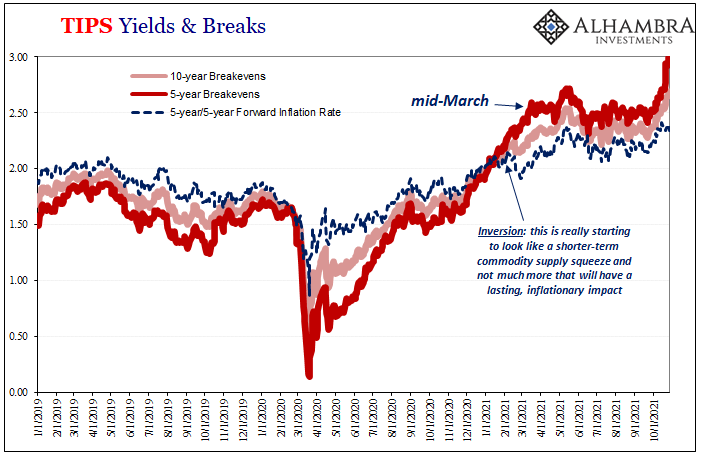

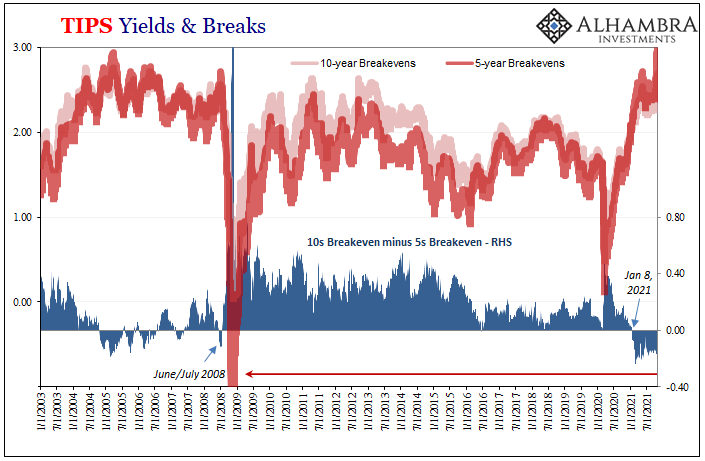

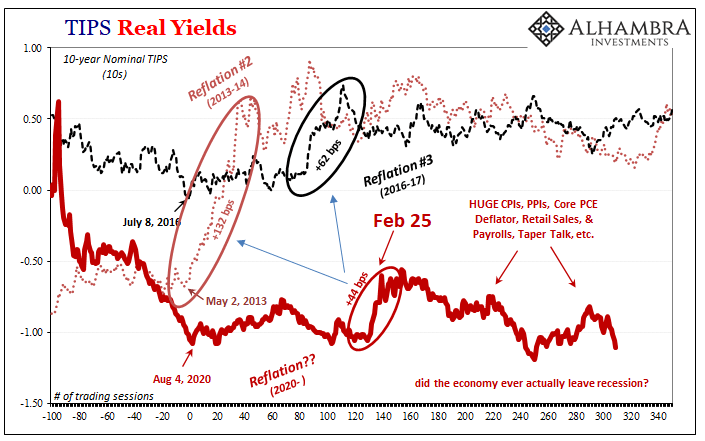

While certainly providing some level reprieve, the lack of further upward fluctuation in them might help us explain what else is going on further down the curve – and therefore the true picture of economic potential heading toward 2021’s finish. This – along with real yields – is the story what’s missing from most commentary otherwise focused on TIPS and inflation. And even to the latter, while breakevens have indeed spiked since late September, near vertically in the 5-year, this obscures the behavior along the rest of that particular curve, too. As has been the case all year, since January 8, the 5-year breakeven rate is “inverted” given how the 10-year breakeven drags. |

|

| Because of this inversion, it doesn’t contribute all that much to the 5-year/5-year forward inflation rate which – even today – only matches the most recent high rate set back in May.

The market is saying, quite emphatically, whatever the government will be forced to pay out in CPI protection (how TIPS are priced; basically, the lagging oil price effect on the CPI) this will remain firmly contained in the shorter run. To put the exclamation on it, the 5s over 10s inversion in terms of breakevens is now, by far, the most on record. |

|

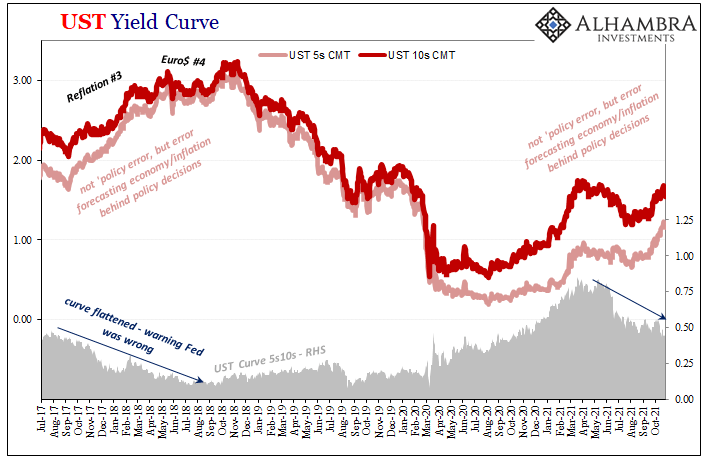

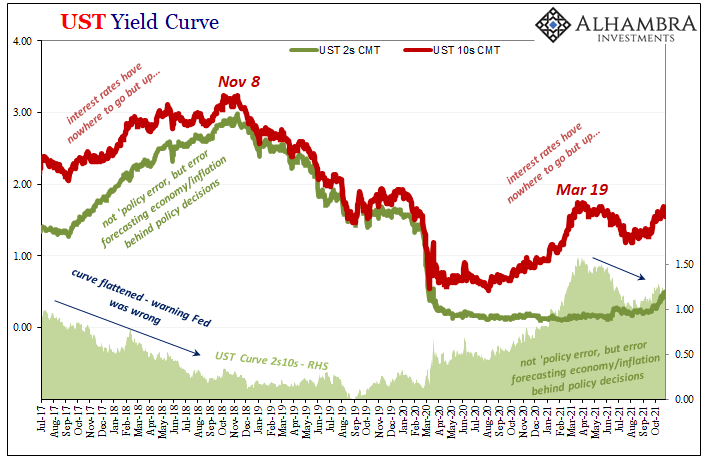

| In short, price effects in the short run and then this is where the rest of the curve takes right over – and not in any good nor inflationary way.

The nominal yield curve keeps flattening, today the difference between the nominal 5-year rate and that at the 10-year maturity sinking fast to just 38 bps. That’s the lowest since August 2020, when yields last reached their prior lows. The spread between the 2-year and 10-year dropped to just 104 bps. That flattening in the nominal yield curve is actually and perfectly consistent with the upside down trading of TIPS breakevens as well as, if not more so, the same growing pessimism and rising deflation potential (outside the short-term) priced into the nominal side of TIPS. |

|

| That side, the real side, real yields are real awful and getting worse the higher energy prices go. | |

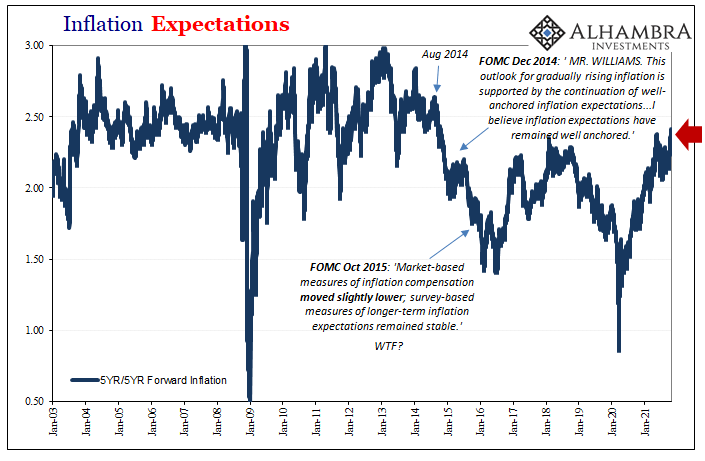

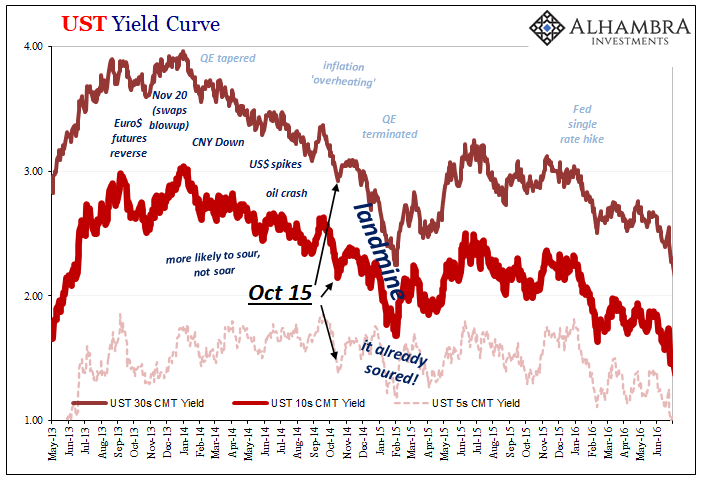

| There is no taper “tantrum” anywhere here, certainly not Emil Kalinowski’s more appropriate description of 2013 as the short-lived taper celebration. These curves are even missing the more frequent suggestions of stagflation as this “growth scare” part becomes more difficult to ignore and dismiss.

The bond market moving in the direction of nominal growth and inflation would be more like it had been during 2013’s celebratory selloff; steepening curve with rapidly rising real rates. |

|

| We’ve got serious flattening and further downward in real rates that haven’t once yet recovered from recession lows.

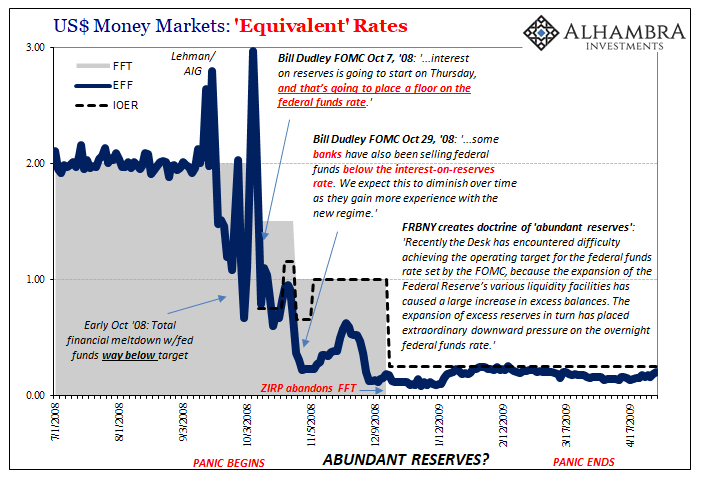

These actions are not some “policy error”, either, especially given the small effect from the deluge of cash management bills. In other words, put it all together, bonds (globally) are saying the current “inflation” is still going to be transitory, if painful in gasoline prices along the way, and this is enough (it always seems to be) to convince the FOMC to turn “hawkish” despite the fact the underlying economy is absolutely nothing like what the Fed is modeling and the media keeps saying.

On the contrary, the way (and the speed at which) the curves are contorting, there is more being priced into that growing “growth scare” as any of the other. |

|

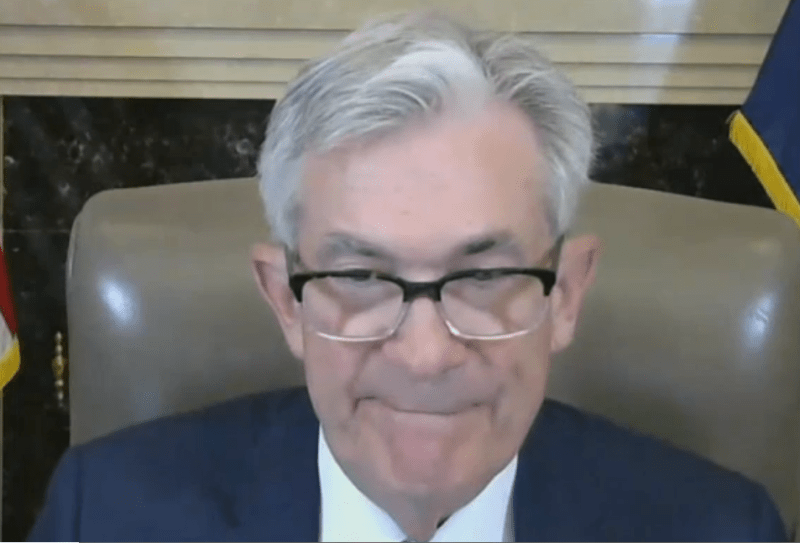

Talking about these same yield curve distortions in 2019, I wrote about the great lengths people will go to dismiss these relatively clear signals; forget inverted TIPS or the utterly disgusting potential of real rates, just look at the very simple message from the flat yield curve which proved (since all the way back into 2017) to end up spot on as to growth, inflation, and the predictable way in which Jay Powell’s Fed would get it all wrong:

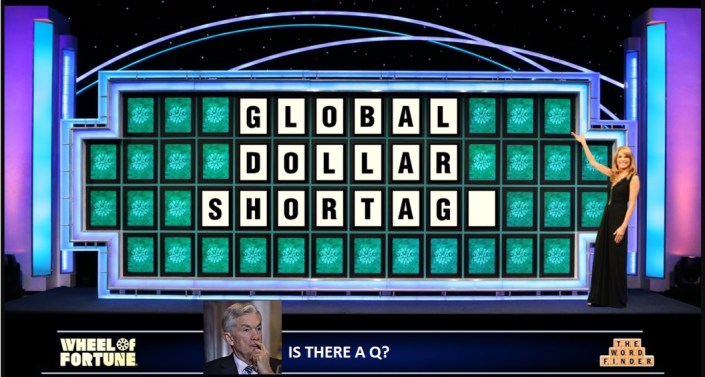

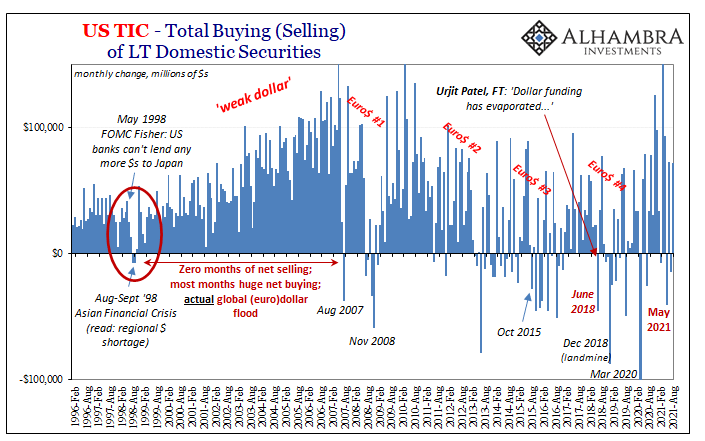

With short run TIPS breakevens running wild, how can anyone say there’s a dollar shortage and dramatically rising deflationary potential right now? Easy, actually. The mountain of data and the repeating behavior of the (bond) market and curves has already spotted you the first nineteen letters. |

|

Tags: Bonds,China,collateral,CPI,currencies,Deflation,economy,Featured,Federal Reserve/Monetary Policy,global dollar shortage,growth scare,inflation,inflation breakevens,Markets,newsletter,Nominal Interest Rates,oil prices,PBOC,real rates,T-Bills,tic,TIPS,U.S. Treasuries,Yield Curve