It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch. Where have we heard that before? Everywhere, actually, but especially in China. Whether early last year, last August, and now again...

Read More »Bank of Canada’s Turn

Overview: The recent equity rally is stalling. Asia Pacific equities were mixed, with Japan, South Korea, and Australia, among the major bourses posting gains. Europe’s Dow Jones Stoxx 500 is slipping lower for the second consecutive session, ending a four-day bounce. US equity futures are little changed. The US 10-year yield is edging higher at 2.86%, while European yields are slightly lower. The greenback is firm against most of the major currencies. The Australian...

Read More »Is It Being Demanded?

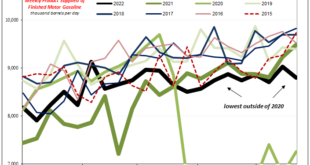

Shipping container rates have been dropping since early March – right around the time when we had just experienced our “collateral days” and then stood by to witness chaotic financial fireworks, inversions, the whole thing. The bane of the logistical supply-side snafu-ing, it has been container redistribution mucking the goods economy up.The recent and sharp decline in container rates, according to Freightos, is because China’s been closed down by Xi’s pursuit of...

Read More »Macro and Prices: Sentiment Swings Between Inflation and Recession

(On vacation for the rest of the month. Going to Portugal. Commentary will resume on June 1. Good luck to us all.)The market is a fickle mistress. The major central banks were judged to be behind the inflation curve. Much teeth-gashing, finger-pointing. Federal Reserve Chair Powell was blamed for denying that a 75 bp hike was under consideration. Bank of Japan Governor Kuroda was blamed for keeping the 0.25% cap on the 10-year Japanese Government Bond yield....

Read More »Synchronizing Chinese Prices (and consequences)

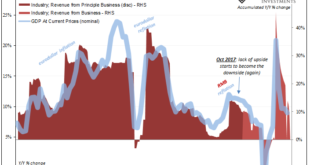

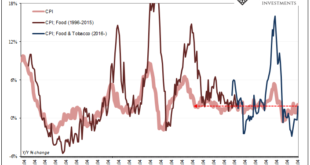

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things. To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from...

Read More »Dollar and Yen Surge

Overview: Global equities are bleeding lower. Several large markets in the Asia Pacific region, including Hong Kong, Taiwan, and India are off more than 2%. Japan and Australian bourses fell by more than 1.5%. Europe's Stoxx 600 is off more than 2% and giving back the gains recorded in the past two sessions plus some. US futures are extending yesterday's loses. The sharp sell-off of equities has given the sovereign bond market a strong bid. The 10-year US Treasury...

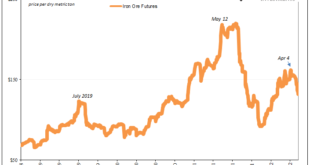

Read More »Industrial Synchronized Demand

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April. This despite supply bottlenecks and production shortfalls which continue to plague each. Copper has now fallen to its lowest since last...

Read More »The Week Ahead: US CPI and PPI Set to Soften

The Fed's 50 bp rate hike is behind us. Another 50 bp hike is expected next month. The April employment report will do little to calm the anxiety about the "too tight" labor market. The decline in the participation rate was disappointing and this coupled with decline in Q1 productivity raies questions about the economy's non-inflationary speed limit. One of the fascinating things about the markets is that sometimes the cause take place after the effect. This...

Read More »Fed Day

Overview: The markets are mostly treading water ahead of the FOMC decision later today. Tech stocks tumbled in Hong Kong and the Hang Seng fell a little more than 1%, while India was the worst performer in the region falling over 2% following an unexpected and intra-meeting hike by the Reserve Bank of India. It raised the repo rate to 4.4% from 4.0%. Europe's Stoxx 600 is a little lower and has been unable to close the gap from Monday created from the lower...

Read More »Weekly Market Pulse: Welcome Back To The Old Normal

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around. Or at least that’s how it’s remembered. Whether the cigar-chomping central banker was really...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org