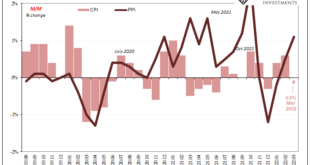

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%. Balancing those were the prices for main food staples, especially pork, the latter having declined an rather large 9.3% last month from the month before. Keeping energy but removing...

Read More »Central Banks on a Preset Course Reduces Significance of High-Frequency Data

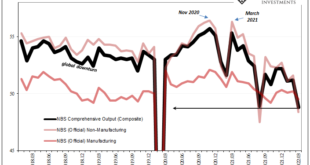

Arguably the most important data next week is the flash PMI. It is not available for all countries, but for those generally large G10 economies, the preliminary estimate is often sufficiently close to the final reading to steal its thunder. Moreover, and this applies to high-frequency data more broadly, given the overshoot of inflation in most counties, with some exceptions, notably in Asia, central banks appear to be on set courses. The near-term data are...

Read More »China’s Imports Outright Declined In March, And COVID Was The Reason Why But Not Really

The guy said this was going to be the future. Not just of China, for or really from the rest of the world. Way back in October 2017, at the 19th Communist Party Congress newly-made Emperor Xi Jinping blurted out his grand redesign for Socialism with Chinese Characteristics. A country once committed to quantity of economic growth above everything else would, moving forward, come to prioritize instead the quality of it. This message was a clear signal, way back when,...

Read More »PBOC Trim Reserve Requirements: Delilvers Wet Noodle after Earlier Disappointment

After posting the daily analysis, the PBOC announced a 25 bp cut in required reserves. This is said to free up around CNY530 bln or around $83 bln. It may help explain the failure to cut the benchmark Medium-Term Lending Facility. Some rural banks may see a 50 bp cut in reserve requirements. It seems like it is too small of move to satisfy expectation or address the growing economic challenges. More monetary and fiscal stimulus will be necessary to help offset the...

Read More »Good Friday

Overview: Most centers are closed for the holidays today. The Asia Pacific equity markets were open and moved lower following the losses on Wall Street yesterday. The weakness of the yen failed to underpin Japanese shares. China disappointed most observers by failing to cut the one-year medium-term lending facility rate (2.85%) and shares slipped. The dollar is mostly higher. It is up for the 11th consecutive session against the Japanese yen. The euro fell to its...

Read More »Short Covering in the US Treasury Market Extends the Yield Pullback

Overview: What appears to be a powerful short-covering rally in the US debt market has helped steady equities and weighed on the dollar. Singapore and South Korea joined New Zealand and Canada in tightening monetary policy. Attention turns to the ECB now on the eve of a long-holiday weekend for many members. The tech-sector led the US equity recovery yesterday, snapping a three-day decline. Most of the major markets in Asia Pacific advanced but Taiwan and India. ...

Read More »Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an “expeditious” campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower. After the equity losses in the US yesterday, including a 2.2% drop in the NASDAQ, Asia Pacific equities...

Read More »Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two. Running red-hot to the point of near-horror, that’s “our” Federal Reserve. The FOMC minutes...

Read More »US Jobs, EMU CPI, Japan’s Tankan, and China’s PMI Highlight the Week Ahead

This year was supposed to be about the easing of the pandemic and the normalization of policy. Instead, Russia's invasion of Ukraine threw a wrench in the macroeconomic forecasts as St. Peter’s victories broke the brackets of the NCAA basketball championship pools. The war has pushed up the price of energy, metals, and foodstuffs, which seemed to be advancing prior to the conflict. High-frequency economic data are important because of the insight generated about...

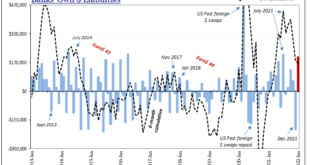

Read More »It Wouldn’t Be TIC Without So Much Other

With the Fed (sadly) taking center stage last week, and market rejections of its rate hikes at the forefront, lost in the drama was January 2022 TIC. Understandable, given all its misunderstood numbers are two months behind at their release. There were some interesting developments regardless, and a couple of longer run parts that deserve some attention. Picking up where TIC left off from December, when more indicated bad (tight money) than good (not as tight),...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org