U.S. Gold Imports from Switzerland Monthly It seems as if the tide has changed as the U.S. imported a record amount of gold from Switzerland in July. Normally, the flow of gold from the United States has been heading toward Switzerland. For example, when the U.S. exported a record 691 metric tons (mt) of gold in 2013, Switzerland received 284 mt, which accounted for 41% of the total. Compare that to the paltry 3...

Read More »Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Submitted by Christoph Gisiger via Finanz und Wirtschaft, Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash. «Paper currency lies at...

Read More »Dynamics of the World Income Distribution

In a Resolution Foundation report, Adam Corlett examines the “Elephant Curve.” The curve shows that between 1988 and 2008 income growth in the 70th to 95th percentile range of the world income distribution was much lower than for almost all other percentiles. Since the lower middle class of rich countries is situated around the 80th percentile of the distribution the Elephant curve has been interpreted as evidence for stagnating middle class incomes in the rich countries. Corlett...

Read More »FX Daily, September 13: Much Noise, Weak Signal

Swiss Franc The last ECB meeting and Dragh’s hawkish comments is for us the main reason of the euro strength, this despite stronger Swiss GDP growth. We see a mismatch between the weak ISM Non-Manufacturing PMI and the St. Louis and Atlanta Fed GDP trackers. Click to enlarge. Federal Reserve Our approach to Fed-watching is clear: Among the cacophony of voices, the Troika of Fed leadership, Yellen, Fischer and...

Read More »Attack The Fed’s War On Savers, Workers And The Unborn (Taxpayers)

Submitted by David Stockman via Contra Corner blog, The central banks have gone so far off the deep-end with financial price manipulation that it is only a matter of time before some astute politician comes after them with all barrels blasting. As a matter of fact, that appears to be exactly what Donald Trump unloaded on bubble vision this morning: By keeping interest rates low, the Fed has created a “false stock...

Read More »Jan Skoyles Appointed Research Executive At GoldCore

(Media Release - September 8, 2016 - Immediate Release) – Jan Skoyles - @Skoylesy has been appointed Research Executive at international gold specialist @GoldCore . As a recognized thought leader in the gold and fintech space, Jan will augment GoldCore’s research capabilities and will focus on the UK economy and gold’s role as an important diversification, payment and savings vehicle. As one of the world's largest and fastest growing gold bullion delivery...

Read More »The Dos Santos Succession Saga

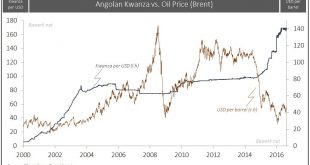

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August. That also...

Read More »Toward Stagflation

Norway Real House Price Per M2 We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades. The road toward such outsized gains in property is not paved...

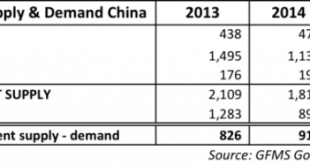

Read More »Spectacular Chinese Gold Demand Fully Denied By GFMS And Mainstream Media

Submitted by Koos Jansen of BullionStar In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729...

Read More »Yuan and Why

(I write a monthly column for a Chinese paper. Here is a draft of it) It is as if Hamlet, the confused prince of Denmark, has taken up residence in Beijing. The famed-prince wrestled with “seeming” and “being”. So are Chinese officials. They seem to be relaxing their control over financial markets but are they really? Are they tolerating market forces because they approve what they are doing, such as driving interest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org