Submitted by Jan Skoyles via GoldCore.com, Introduction Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society. The Presidential campaign has been dominated for months and again this week by the...

Read More »Yuan Not

Summary: The yuan has weakened and Chinese shares have sold off, yet global capital markets are taking little notice. August 2015 and again in January 2016, markets seemed to be hypersensitive. Yuan’s decline has been modest, orderly, and not eliciting a negative response by policymakers, including US Treasury Dept. There were two dogs that did not bark this year. There are the Japanese yen, which despite...

Read More »The Great Physical Gold Supply & Demand Illusion

Submitted by Koos Jansen from Bullionstar.com Gold supply and demand data published by all primary consultancy firms is incomplete and misleading. The data falsely presents gold to be more of a commodity than a currency, having caused deep misconceptions with respect to the metal’s trading characteristics and price formation. Numerous consultancy firms around the world, for example Thomson Reuters GFMS, Metals Focus,...

Read More »FX Daily, October 19: FX After China GDP

Swiss Franc The Swiss Franc has strengthened against the pound as global uncertainty persists in the form of the UK’s Brexit vote and the US Presidential Election. Looking ahead it seems the CHF may soften a little as we learn of the new President, I found it very interesting that yesterday Paddy Power paid out on any bets for Hilary Clinton to become President in the United States. This is a great indication of the...

Read More »FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

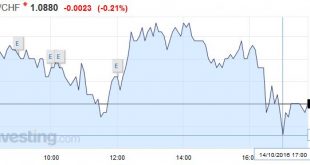

Swiss Franc EUR/CHF - Euro Swiss Franc, October 14 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm against most of the major currencies, but within yesterday’s ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the...

Read More »Great Graphic: China’s PPI and Commodities

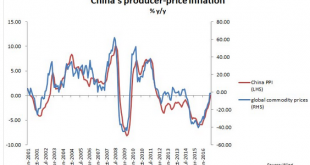

Summary: China’s PPI rose for the first time in four years. It is related to the rise in commodities. Yet there are good reasons there is not a perfect fit between China’s PPI and commodity prices. US and UK CPI to be reported next week, risk is on the upside. China reported its first increase in producer prices in four years earlier today. As one might suspect, producer prices are often driven by commodity...

Read More »FX Daily, October 13: Dollar Edges Higher, though US Rates Soften

Swiss Franc The EUR/CHF remains in the range of 1.0815 to 1.0980. The SNB usually intervenes below 1.0850. I am expecting that speculators are reducing their CHF short positions. More tomorrow. EUR/CHF - Euro Swiss Franc, October 13 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm, and the euro has slipped below $1.10 for the first time since late-July. Although the dollar’s...

Read More »Why Krugman, Roubini, Rogoff And Buffett Hate Gold

Why Krugman, Roubini, Rogoff And Buffett Dislike Gold By Jan Skoyles Edited by Mark O’Byrne A couple of weeks ago an article appeared on Bitcoin Magazine entitled ‘Some economists really hate bitcoin’. I read it with a sigh of nostalgia. As someone who has been writing about gold for a few years, I am used to reading similar criticisms as those bitcoin receives from mainstream economists, about gold. As with...

Read More »Will The ECB Buy Stocks?

Authored by Nick Kounis and Kim Liu via ABN AMRO, Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility We think the ECB could legally buy ETFs that fit its requirements… … but it would be controversial and we question the benefits An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme …and assuming a...

Read More »Is The US Dollar Set To Soar?

Which blocs/nations are most likely to face banking/liquidity crises in the next year? Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it’s generally unwise to let that enthusiasm become the basis of one’s bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org