Submitted by Koos Jansen from BullionStar.com Withdrawals from the vaults of the Shanghai Gold Exchange, which can be used as a proxy for Chinese wholesale gold demand, reached 1,406 tonnes in the first three quarters of 2016. Supply that went through the central bourse consisted of at least 905 tonnes imported gold, roughly 335 tonnes of domestic mine output, and 166 tonnes in scrap supply and other flows recycled...

Read More »Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past few months suggests that the lower ‘levels’...

Read More »Trumpflation Takes A Breather As Global Stocks Rise, Oil Jumps On Renewed OPEC “Deal Optimism”

With the Trumpflation euphoria easing back slightly overnight, leading to a modest paring in the USD index and US Treasury yields, Asian and European stocks rose, while US equity futures rebounded to just shy of new all time highs, as crude jumped on renewed optimism that OPEC will agree to cut output; Italian equities underperformed ahead of the Italian referendum; metals rebounded from last week’s losses as yields dropped and the dollar halted its longest winning streak versus the euro....

Read More »If TPP is Dead…

Summary: TPP may be dead, but China is spearheading an alternative regional free trade deal. It is not as ambitious as the US-led TPP. China and Russia are eager to re-establish spheres of influence. The US election results delivered the coup de grace to the multilateral trade agreement called Trans-Pacific Partnership. It was initially championed by the Obama Administration as a key pillar of its pivot to...

Read More »You’ll Only Understand Trump and Brexit If You Understand the Failure of Globalization

[See also The Numbers Show Trump Win NOT Due to Racism and Sexism] You can only understand the victory of Donald Trump and Brexit once you understand the failure of globalization … Trump Trump made rejection of globalization a centerpiece of his campaign. In his July 21st acceptance speech as the Republican nominee, he said: Americanism, not globalism, will be our credo. The Boston Globe bannered this headline on...

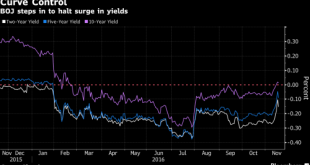

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »FX Daily, November 16: The Greenback Remains Resilient

Swiss Franc The Swissie has remained very strong against a much weaker pound but the outlook is still very shaky. The principal reason for the changes are of course the election of Donald Trump which has sent some big ripples through financial markets. The Swiss Franc did strengthen significantly as we saw uncertainty ahead of the election but following the result it was more the pound making headway with some big...

Read More »You’ll Only Understand Trump and Brexit If You Understand the Failure of Globalization

[See also The Numbers Show Trump Win NOT Due to Racism and Sexism] You can only understand the victory of Donald Trump and Brexit once you understand the failure of globalization … Trump Trump made rejection of globalization a centerpiece of his campaign. In his July 21st acceptance speech as the Republican nominee, he said: Americanism, not globalism, will be our credo. The Boston Globe bannered this headline on Thursday: “Trump won. Globalization lost. Now...

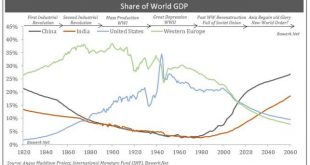

Read More »Toward a New World Order?

Share of World GDP A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future. As an experiment, assume, as most long term forecasters do,...

Read More »China Update

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: The evolving political situation in China is worth monitoring. China’s trade surplus with the US has fallen this year. It has been roughly 20 years since China was formally labeled a currency manipulator. Trump has indicated he would do so. There have...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org