Technical Divergence Successfully Maintained In an update on gold and gold stocks in mid June, we pointed out that a number of interesting divergences had emerged which traditionally represent a heads-up indicating a trend change is close (see: Divergences Emerge for the details). We did so after a big down day in the gold price, which actually helped set up the bullish divergence; this may have felt...

Read More »Gold – Macroeconomic Fundamentals Improve

A Beginning Shift in Gold Fundamentals A previously outright bearish fundamental backdrop for gold has recently become slightly more favorable. Ironically, the arrival of this somewhat more favorable situation was greeted by a pullback in physical demand and a decline in the gold price, after both had defied bearish fundamentals for many months by remaining stubbornly firm. The eternal popularity contest… - Click to...

Read More »Black Holes for Capital – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Race to the Bottom Last week the price of gold fell $17, and that of silver $0.30. Why? We can tell you about the fundamentals. We can show charts of the basis. But we can’t get into the heads of the sellers. We can say that in the mainstream view, the dollar is rising. The dollar, in their view, is not measured in gold...

Read More »An Idea Whose Time Has Come, Report 1 July 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. “On résiste à l’invasion des armées; on ne résiste pas à l’invasion des idées.” These are the actual words written by Victor Hugo in Histoire d’un Crime (History of a Crime).Translated literally, it means an invasion of armies can be resisted; an invasion of ideas cannot be resisted. However, there are many alternative...

Read More »Merger Mania and the Kings of Debt

Another Early Warning Siren Goes Off Our friend Jonathan Tepper of research house Variant Perception (check out their blog to see some of their excellent work) recently pointed out to us that the volume of mergers and acquisitions has increased rather noticeably lately. Some color on this was provided in an article published by Reuters in late May, “Global M&A hits record $2 trillion in the year to date”, which...

Read More »Cryptocurrency Technicals – Navigating the Bear Market

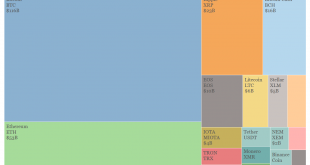

A Purely Technical Market Long time readers may recall that we regard Bitcoin and other liquid big cap cryptocurrencies as secondary media of exchange from a monetary theory perspective for the time being. The wave of speculative demand that has propelled them to astonishing heights was triggered by market participants realizing that they have the potential to become money. The process of achieving more widespread...

Read More »Lift-Off Not (Yet) – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Wrong-Way Event. Last week we said something that turned out to be prescient: This is not an environment for a Lift Off Event. An unfortunate technical mishap interrupted the latest moon-flight of the gold rocket. Fear not true believers, a few positive tracks were left behind. [PT] Fundamental Developments The price of...

Read More »Retail Capitulation – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Small Crowds, Shrinking Premiums The prices of gold and silver rose five bucks and 37 cents respectively last week. Is this the blast off to da moon for the silver rocket of halcyon days, in other words 2010-2011? We will look at the basis signals in a bit. But for now, we want to comment on the absolutely moribund state...

Read More »Industrial Commodities vs. Gold – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Oil is Different Last week, we showed a graph of rising open interest in crude oil futures. From this, we inferred — incorrectly as it turns out — that the basis must be rising. Why else, we asked, would market makers carry more and more oil? We are grateful to Peter Tenebrarum at Acting Man and Steve Saville at The...

Read More »In Gold We Trust, 2018

The New In Gold We Trust Report is Here! As announced in our latest gold market update last week, this year’s In Gold We Trust report by our good friends Ronald Stoeferle and Mark Valek has just been released. This is the biggest and most comprehensive gold research report in the world, and as always contains a wealth of interesting new material, as well as the traditional large collection of charts and data that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org