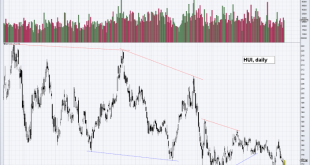

A Surprise Rout in the Bond Market At the time of writing, the stock market is recovering from a fairly steep (by recent standards) intraday sell-off. We have no idea where it will close, but we would argue that even a recovery into the close won’t alter the status of today’s action – it is a typical warning shot. Here is what makes the sell-off unique: 30 Year Bond and 10 Year Note Yields, Nov 2016 - Oct 201830 year...

Read More »Yield Curve Compression – Precious Metals Supply and Demand

Hammering the Spread The price of gold fell nine bucks last week. However, the price of silver shot up 33 cents. Our central planners of credit (i.e., the Fed) raised short-term interest rates, and threatened to do it again in December. Meanwhile, the stock market continues to act as if investors do not understand the concepts of marginal debtor, zombie corporation, and net present value. People believe that the Fed...

Read More »US Equities – Approaching an Inflection Point

A Lengthy Non-Confirmation As we have frequently pointed out in recent months, since beginning to rise from the lows of the sharp but brief downturn after the late January blow-off high, the US stock market is bereft of uniformity. Instead, an uncommonly lengthy non-confirmation between the the strongest indexes and the broad market has been established. The chart below illustrates the situation – it compares the...

Read More »Submerged Lighthouse Syndrome – Precious Metals Supply and Demand

Fundamental Developments – The Gap Keeps Widening Last week, the lighthouse went down 24 meters (gold went down $24), or 50 inches (if you prefer, silver went down 50 cents). However, let’s take a look at the only true picture of supply and demand. Are the fundamentals dropping with the market price? They done whacked our lighthouse! [PT] Image credit: Skip Willits - Click to enlarge Gold and Silver...

Read More »Fundamental Price of Gold Decouples Slightly – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Fundamental Price has Deteriorated, but… Let us look at the only true picture of supply and demand in the gold and silver markets, i.e., the basis. After peaking at the end of April, our model of the fundamental price of gold came down to the level it reached last November. $1,300. Which is below the level it...

Read More »Gold Sector – An Obscure Indicator Provides a Signal

The Goldminbi In recent weeks gold apparently decided it would be a good time to masquerade as an emerging market currency and it started mirroring the Chinese yuan of all things. Since the latter is non-convertible this almost feels like an insult of sorts. As an aside to this, bitcoin seems to be frantically searching for a new position somewhere between the South African rand the Turkish lira. The bears are busy...

Read More »Stock Market Manias of the Past vs the Echo Bubble

The Big Picture The diverging performance of major US stock market indexes which has been in place since the late January peak in DJIA and SPX has become even more extreme in recent months. In terms of duration and extent it is one of the most pronounced such divergences in history. It also happens to be accompanied by weakening market internals, some of the most extreme sentiment and positioning readings ever seen...

Read More »A Scramble for Capital

A Spike in Bank Lending to Corporations – Sign of a Dying Boom? As we have mentioned on several occasions in these pages, when a boom nears its end, one often sees a sudden scramble for capital. This happens when investors and companies that have invested in large-scale long-term projects in the higher stages of the production structure suddenly realize that capital may not be as plentiful as they have previously...

Read More »Crying Wolf – Precious Metals Supply and Demand

Quantity Theory Revisited The price of gold fell another ten bucks and that of silver another 28 cents last week. Perspective: if you are waiting for the right moment to buy, the market is offering you a better deal than it did last week (literally, the market price of gold is at a 7.2% discount to the fundamental price vs. 4.6% last week). If you wanted to sell, this wasn’t a good week to wait. Which is your...

Read More »Getting Their Pound of Flesh – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Regulated to Death The price of gold fell $13, and that of silver $0.23. Perspective: if you’re waiting for the right moment to buy, the market now offers you a better than it did last week. If you wanted to sell, this wasn’t a good week to wait. Which is your intention, and why? Obviously, last week the sellers were more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org