The new IGWT report for 2019 will be published at the end of May… …and for the first time a Mandarin version will be released as well. In the meantime, our friends at Incrementum have decided to release a comprehensive chart book in advance of the report. The chart book contains updates of the most important charts from the 2018 IGWT report, as well as a preview of charts that will appear in the 2019 report. A brief summary of the contents: A Turn of the Tide in Monetary Policy: Events in Q4 clearly showed that a “monetary U-turn” is currently on its way, which means that further large-scale experiments like MMT, GDP targeting and negative interest rates might be expected in the course of the next severe

Topics:

Pater Tenebrarum considers the following as important: 6) Gold and Austrian Economics, 6b) Austrian Economics, Chart Update, Featured, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The new IGWT report for 2019 will be published at the end of May……and for the first time a Mandarin version will be released as well. In the meantime, our friends at Incrementum have decided to release a comprehensive chart book in advance of the report. The chart book contains updates of the most important charts from the 2018 IGWT report, as well as a preview of charts that will appear in the 2019 report. A brief summary of the contents:

|

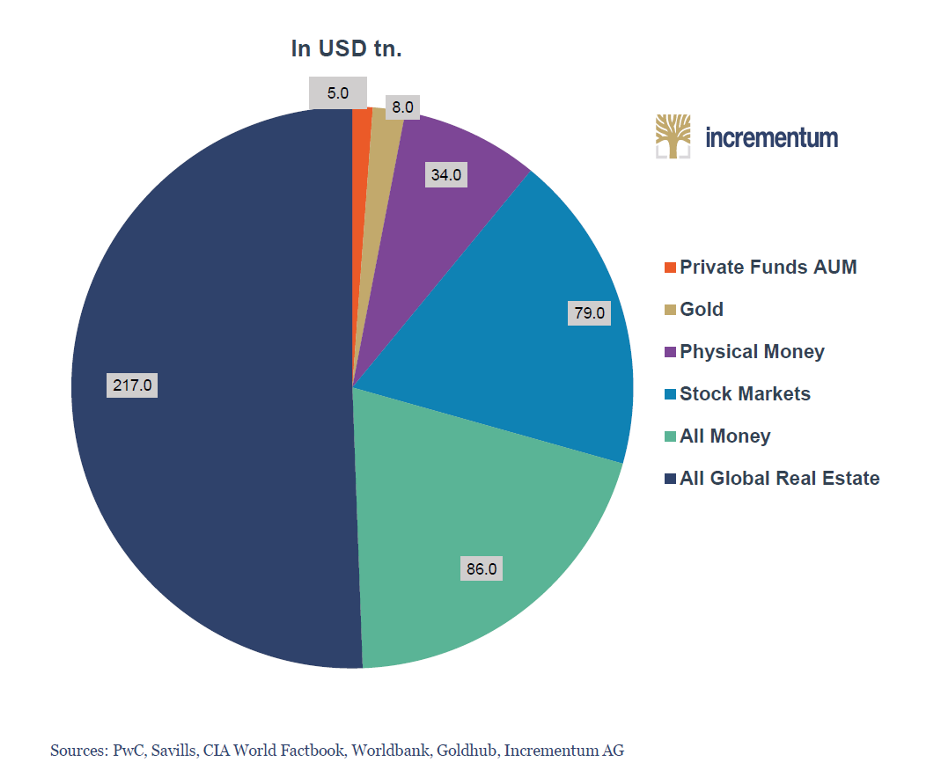

Gold and other financial assets |

The file can be downloaded here:

Preview-Chartbook of the “In Gold we Trust”-Report 2019 [PDF]

Enjoy!

PS: Pater briefly out of order again…

As regular readers may have guessed already, we were once again inconvenienced health-wise over the past week or so, but we are now at our desk again.

Tags: Chart Update,Featured,newsletter,Precious Metals