Published: Friday October 20 2017Mervyn King, Governor of the Bank of England between 2003 and 2013, discusses monetary policy since the financial crisis and what comes next with Cesar Perez Ruiz, Chief Investment Officer of Pictet Wealth Management.You once said that central banks need to be ‘as boring as possible’. Is that still the case today?Central banks should respond to developments in the economy as predictably as possible, so the news should not be about debates within a policy...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

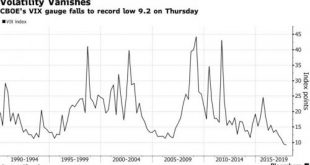

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

Read More »Federal Reserve President Kashkari’s Masterful Distractions

The True Believer How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard. Photo credit: Linda Davidson / The Washington Post -...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »Hard Assets In An Age Of Negative Interest Rates

Time is the soul of money, the long-view – its immortality. Hard assets are forever, even when destroyed by the cataclysms of history. It is the outlook that perpetuated the most competent and powerful aristocracies in continental Europe, well up through World War I and, in certain prominent cases, beyond; it is the mindset that has sustained the most fiscally serious democratic republic in the Western world, that of...

Read More »Fed Quack Treatments are Causing the Stagnation

Bleeding the Patient to Health There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years. Instantaneous relief! No matter what your affliction is, snake oil cures them all. - Click to enlarge For example, from antiquity...

Read More »Here Are The Cities Of The World Where “The Rent Is Too Damn High”

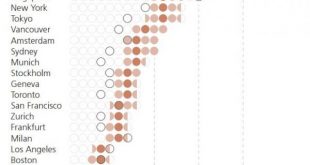

In ancient times, like as far back as the 1990s, housing prices grew roughly inline with inflation rates because they were generally set by supply and demand forces determined by a market where buyers mostly just bought houses so they could live in them. Back in those ancient days, a more practical group of world citizens saw their homes as a place to raise a family rather that just another asset class that should be...

Read More »Here Are The Cities Of The World Where “The Rent Is Too Damn High”

In ancient times, like as far back as the 1990s, housing prices grew roughly inline with inflation rates because they were generally set by supply and demand forces determined by a market where buyers mostly just bought houses so they could live in them. Back in those ancient days, a more practical group of world citizens saw their homes as a place to raise a family rather that just another asset class that should be day traded to satisfy their gambling habits. But, thanks to the...

Read More »Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder

Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder - 'Commodities King' Gartman sees $1,400 gold surge in months- "Gold is the one currency that will do the best of all..."- Pullback below $1300 "is relatively inconsequential"- Use gold price weakness to be a buyer "no question"- Bullish on gold due to central banks and easy monetary policy and gold will be even higher in euro terms- Gold will be the best of all, as a result of QE and expansionary policies-...

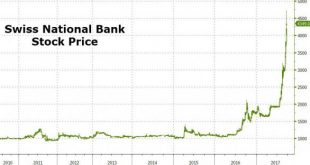

Read More »Is The Swiss National Bank A Fraud?

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. SNB Stock Price, 2010 - 2017(see more posts on Swiss National Bank Stock, ) - Click to enlarge That sounds like a ‘tulip’ bubble-like ‘fraud’… Bitcoin and SNB, 2013 - 2017(see more posts on Bitcoin, Swiss National Bank Stock, ) - Click to enlarge The SNB is up over 120% in Q3 so far – more than double...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org