Bleeding the Patient to Health There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years. Instantaneous relief! No matter what your affliction is, snake oil cures them all. - Click to enlarge For example, from antiquity until the late-19th century, bloodletting was used to treat nearly every disease. Reputable medical references recommended bloodletting as a cure for acne, asthma, cancer, epilepsy, gout, indigestion, insanity, leprosy, pneumonia, scurvy, tuberculosis, and everything in between. Bloodletting was even

Topics:

MN Gordon considers the following as important: Central Banks, Debt and the Fallacies of Paper Money, Featured, newslettersent, U.S. Federal Debt, U.S. Gross Domestic Product

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Bleeding the Patient to HealthThere’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years. |

|

| For example, from antiquity until the late-19th century, bloodletting was used to treat nearly every disease. Reputable medical references recommended bloodletting as a cure for acne, asthma, cancer, epilepsy, gout, indigestion, insanity, leprosy, pneumonia, scurvy, tuberculosis, and everything in between. Bloodletting was even used to treat hemorrhaging.

The practice was simple enough. A surgeon, often a barber, would open a vein and drain blood from the patient. Somehow, this was supposed to cure them of disease. The fundamental idea was that a sick person could be bled to health. Induced fainting, via bloodletting, was even considered beneficial. However, the results were often fatal. On December 13, 1799, George Washington returned from a cold-winters horseback ride across his estate with a raspy throat. So, he requested bloodletting to make his sore throat better. Over a ten-hour period, roughly 126 ounces of blood was drained from his system. The next day Washington’s treatment culminated in perfect success. Because of the bloodletting, Washington never suffered from a sore throat again. He had received a permanent cure. Namely, he croaked. Wouldn’t a tablespoon or two of honey and lemon have been a better solution to the sore throat problem? Sure, it would have been less effective. But it would have been a great deal less terminal as well. |

George Washington: so-so land speculator, successful revolutionary & general, founding father, first president of the US, and reportedly no friend of foreign entanglements. - Click to enlarge Here seen in those all too brief final hours, enjoying a sore throat for the very last time, orbited by family and assorted quacks. We don’t know who’s who in this picture, but this is obviously a room brimming over with decidedly fatal good intentions. There is a picture of Lincoln’s deathbed (which shows his prostrate body crammed into a tiny room with his wife and 15 politicians and generals, who are trying their best to look solemn and grimly resolved to carry on) that gives off similarly morbid vibes. There is a major difference though: almost no-one is contemplating Lincoln with the thoughtful, calculating looks Washington is at the receiving end of here. Lincoln was probably judged a hopeless case and had been crossed off everybody’s Rolodex already (a hole in the head is rarely conducive to one’s continued life and career). By contrast, Washington still offered the quacks a chance to speed up the healing process by devising ingenious ways of killing him. Admittedly, the cure really is hard to beat in terms of its permanence. It is an apodictic certainty that Washington never complained about a sore throat again. |

Curing a Debt Problem with CreditCertainly, repeated observation of the practice must have shown bloodletting’s cure-all powers to be a dubious proposition at best. You’d think that after several thousand years of failure the practice would have been tabled. But it wasn’t. In fact, by the 17th century, many doctors knew bloodletting was more harmful than beneficial. But the practice persisted for another 200 years. How come? From what we gather, doctors didn’t want to acknowledge their limitations. Although they had garnered an astute understanding of how the human anatomy functioned, they had yet to discover cures for practically all diseases. Thus, the common belief was that it was better to give a bloodletting treatment than no treatment at all. These days, many diseases are still without cures. But progress has been made. Doctors and surgeons no longer imagine bloodletting to be the ultimate cure-all. Only a true medical quack would carry out such a barbarous treatment. Unfortunately, the same cannot be said for present day monetary policy. We live under a system of outright quackery. What else, but a quack monetary system, would prescribe ever increasing expansions of credit as a cure-all for a debt problem? Nonetheless, perpetual increases of credit underpin today’s wild and zany debt based fiat money system. This, no doubt, is akin to attempting to bleed a patient to health. It also guarantees a slow and painful death. |

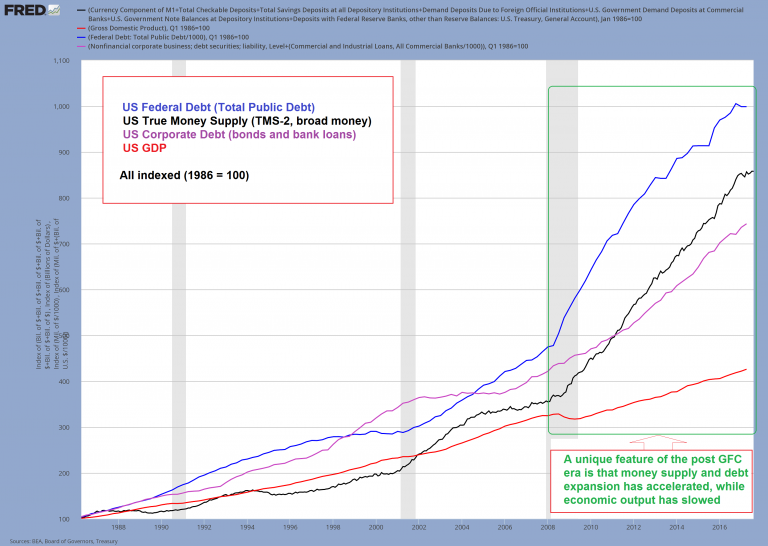

US Fedaral Debt, Tru Money Supply, Corporate Debt and GDP, 1988 - 2016(see more posts on U.S. Federal Debt, U.S. Gross Domestic Product, ) This chart depicts causes and effects of the snake-oil cure applied by our vaunted central planners. - Click to enlarge It shows federal debt, corporate debt, the broad true money supply, and lastly, economic output as measured by GDP – all indexed to 100 in 1986, the year bubble blower extraordinaire, Alan Greenspan, took the helm at the Fed. However, we want to direct your attention to the cesura of 2008, when Greenspan’s successor, Ben Bernanke was tasked with bailing out yet another imploding bubble of the fiat money era. According to “experts” of his ilk, these things kin of “just happen”. The boom-bust cycle is seen as akin to a natural catastrophe, like an earthquake or an asteroid strike. No-one is ever responsible for it, least of all the people who directly and indirectly manipulate all the figures charted above, and certainly no-one ever “sees it coming”. The latter assertion involves a rather glaring omission – it requires one to ignore the hundreds, or more likely even thousands, of people who did and do see it coming. Why are they so studiously ignored? The problem is probably that the people with the slightly better functioning crystal balls often have a tendency to assign blame correctly. You see, it is not an earthquake after all, and it certainly isn’t a “market failure”, or a “lack of regulations” that is behind the increasingly dangerous succession of ever larger credit expansions and crashes. Stop and think about this chart for a moment. At the time when the Greenspan/Bernanke housing bubble co-production (implemented in line with the unsolicited advice dispensed by another bunch of “experts”*) blew up in everyone’s face, was there anyone who didn’t understand that a giant debt problem had been discovered? There is of course more to it than that; business cycle theory is a tad more intricate. But credit expansion is at its heart, and there always comes a moment in time when understanding that part of it requires nothing but a smattering of common sense. And now ponder the response of the central planners to the debt crisis. What on earth made them think that expanding money and credit at accelerated rates was the “solution” to a giant debt problem? Common sense is evidently in very short supply at the Eccles building – contrary to money from thin air, which they can never run out of. |

Fed Quack Treatments are Causing the StagnationOn Tuesday, Fed Chair Janet Yellen, a quack, reeled back her78-month plan for the national monetary policy of the United States. If you recall, this was the grand plan she rolled out last week. Apparently, she’s already having some reservations. At the National Association for Business Economics in Cleveland, Yellen said:

To be fair, Yellen was speaking about the pace at which the Fed will raise the federal funds rate. Though this is different than her plan to unwinding the Fed’s balance sheet, we suspect that, in time, this same rationale will be used to justify further Fed asset purchases. The point is, the Fed only knows only one cure-all treatment for the economy’s stagnation. Always wrong, but never in doubt. Credit expansion is the Fed’s perennial solution. Alas, like bloodletting barbers of the 19th century, it’s a quack treatment that has buried the economy under irreconcilable levels of debt. Yet the quacks who deliver it are oblivious to the fact that their treatment is not a cure for the economy’s stagnation, but rather the cause. Perhaps in two thousand years from now they’ll come to grips with this. |

This seems a very good opportunity to quote Ludwig von Mises, who pointed out: “However conditions may be, it is certain that no manipulations of the banks can provide the economic system with capital goods. - Click to enlarge What is needed for a sound expansion of production is additional capital goods, not money or fiduciary media. The boom is built on the sands of banknotes and deposits. It must collapse.” |

Footnote:

* The “money quote” Paul Krugman will never be able to live down follows below; not for a lack of trying, mind – once he expended an entire NYT column in a vain attempt to deny that his words actually meant what they obviously mean:

“To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.”

Tags: central banks,Featured,newslettersent,U.S. Federal Debt,U.S. Gross Domestic Product