“Like watching paint dry,” is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen’s decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, “have no fear, The SNB knows what it’s doing.” As we reported previously, In...

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

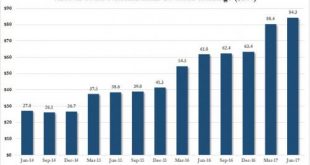

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

Read More »21st Century Shoe-Shine Boys

Anecdotal Flags are Waved “If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.” – Joseph Kennedy It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning,...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one ‘entity’ has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since...

Read More »The Government Debt Paradox: Pick Your Poison

Lasting Debt “Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted. The Obama administration...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one 'entity' has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since mid-July, as the Financial Times noted in a story about its...

Read More »How to Make the Financial System Radically Safer

Preventing the Last Crisis Clear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism. The terrible scourge of bruxism and its potentially terrifying...

Read More »FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Summary: Following strong Q2 GDP figures, risk is that Bank of Canada’s rate hike anticipated for October is brought forward. ECB’s guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley’s comments are the most important. Four central banks from high income countries hold policy is making...

Read More »Six Banks Join UBS’s “Utility Coin” Blockchain Project

Here’s a piece of news that the remaining human members of Wall Street’s FX sales and trading desks probably don’t want to hear. According to the Financial Times, six of the world’s largest banks have decided to join a blockchain project called “utility coin” that will allow banks to settle trades in securities denominated in different currencies without a money transfer. What’s worse, the banks expect to begin...

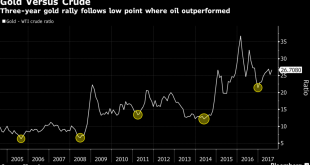

Read More »U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There

U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There US Treasury Secretary Steve Mnuchin visits Fort Knox Gold Later tweeted ‘Glad gold is safe!’ Only the third Treasury Secretary to visit the fortified vault, last visit was 1948 Last Congressional visit was 1974 Speculation over existence of gold in Fort Knox is rife Concerns over Federal Reserves lack of interest in carrying to an audit on gold Gold was last counted in 1953, nine years before Mnuchin was born Mnuchin may be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org