Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationEconomic and earnings growth continue to offer good momentum and the possibility of upside surprises for 2018, so we remain overweight DM equities.However, uncertainties over other key aspects of the outlook mean that investors may be unwise to lower their defences. We are keeping tail risk mitigation in portfolios.EM equities should continue to perform in 2018, but the leadership could shift from growth...

Read More »Global Asset Allocation Update

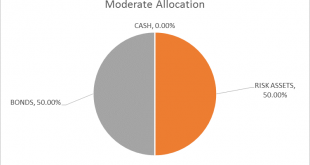

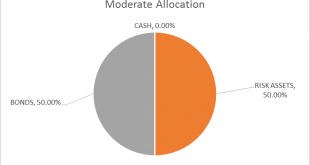

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash. Prediction is very difficult, especially about the future… Niels Bohr Every time I see that quote I think to myself, “but that...

Read More »House View, November 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe remain constructive on equities, which are being underpinned in particular by robust earnings growth.However, there are signs of pressure, especially in forex markets, and occasional spikes in volatility are likely, notably as a result of geopolitical risk. It is worth considering risk mitigation for portfolios put options on equity indices are one way to protect some of the downside.US tax cuts could...

Read More »Global Asset Allocation Update

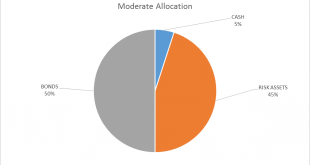

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise. Moderate Allocation - Click to enlarge No...

Read More »House View, October 2017

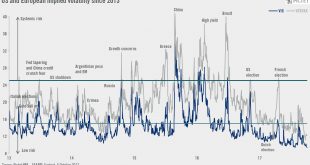

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationHeadline volatility on equity markets remains low, and given robust economic and earnings growth we are still constructive on equities, particularly the euro area and Japan. We are neutral on the US, selective on Swiss stocks, and underweight the UK.However, there are signs of pressure, notably in forex markets, and headline volatility could rise in the coming months. Moreover, geopolitical risk remains...

Read More »Hard Assets In An Age Of Negative Interest Rates

Time is the soul of money, the long-view – its immortality. Hard assets are forever, even when destroyed by the cataclysms of history. It is the outlook that perpetuated the most competent and powerful aristocracies in continental Europe, well up through World War I and, in certain prominent cases, beyond; it is the mindset that has sustained the most fiscally serious democratic republic in the Western world, that of...

Read More »Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a...

Read More »House View, September 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationThere are two ways to hedge geopolitical risk: buying gold or buying protection for portfolios. We prefer the latter, to take advantage of current low volatility and because gold’s gains so far this year reflect the depreciation of the dollar.We remain constructive on DM equities, particularly the euro area and Japan. We are neutral on the US, underweight UK and selective in Swiss equities.Low correlations...

Read More »Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand. Which means,...

Read More »Monthly Investment Strategy Highlights, August 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe retain a slight overweight in DM equities owing to good fundamentals, but it is especially important at present to be well protected against downside risk.Markets appear unduly complacent, and volatility could rise in the coming months. This will create opportunities for tactical trading and especially hedge funds.Low correlations and a pick-up in disruptive M&A are already creating an improved...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org