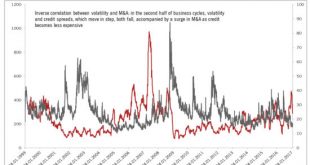

Pictet Wealth Management’s positioning in fast-evolving markets.Asset allocationImproved earnings growth should support attractive returns on developed-market equities.We still expect Treasury yields to rise this year. The 35-year fall in long-term interest rates, during which government bonds provided both strong returns and protection, has probably ended. The protection that government bonds provide for portfolios is therefore set to come at a cost again.Volatility on equity markets is...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

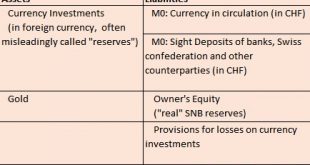

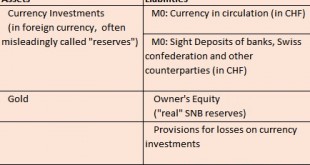

The Q1/2016 update on the SNB investment strategy and its assets. The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.The SNB balance sheet looks as follows: In this post we will...

Read More »Financial markets looking for a second wind

Published: 17th March 2016 Download issue: Financial markets search for a second wind Equity markets in developed economies rebounded in February, after spending December and January in an attitude of crisis. We think that this is just a tactical rebound, rather than a return to the bull market that prevailed on equity markets from 2009 to 2014. The fundamentals that limit the upside for equities have not changed; meanwhile, the limits of central bank policy are becoming increasingly...

Read More »The markets’ pole star is fading

Published: 11th November 2015 Download issue: Since 2009, major central banks such as the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BoJ) and others have largely determined the trends in the major asset classes of both emerging and developed countries: equities, sovereign and corporate bonds, and currencies. Investors found their guiding light in the central banks. Markets are once again likely to find themselves under their influence in 2016, but without as...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

We regularly publish the SNB asset structure by currency, rating & duration and the investment strategy. They shall be a template for the tactical asset allocation along these dimensions for other conservative asset managers – CHF holdings certainly excluded because the SNB nearly exclusively buys foreign assets. The SNB balance sheet looks as follows: In this post we will concentrate on the assets side, investment strategy and composition of “FX reserves”.See more on liabilities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org