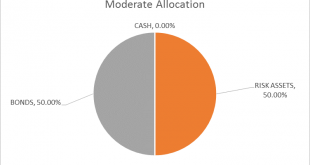

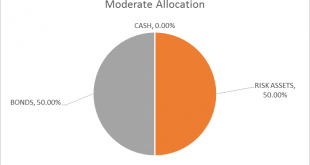

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months. The most significant change from last month is the continued...

Read More »Monthly Investment Strategy Highlights, July 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationAs central bank support starts to be withdrawn, volatility could well rise.We are still slightly long equities, since fundamentals are supportive, but have bought put options on the S&P 500 to guard against downside risks. A rise in volatility will create opportunities for tactical trading and especially hedge funds.CommoditiesOil prices fell again in June, but now appear close to what we assess as the...

Read More »Monthly Investment Strategy Highlights, June 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationMarkets have continued to rally on strong fundamentals. It has been important to stay invested, and we continue to favour DM equities. However, markets appear unduly complacent, and we have taken advantage of current low volatility to scale back our risk exposure.We reduced our equity overweight in June by selling part of our Global Defensives equities, and also cut most of our US high yield position. We...

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs. Based on the bond markets there has been little change in the growth and inflation outlook since the last asset allocation update. Based on...

Read More »Monthly Investment Strategy Highlights, May 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets. Asset AllocationMarkets are starting to revise their expectations for the Trump administration. We still see some prospect of a US fiscal stimulus, but it is likely to be later (not kicking in before 2018) and less ambitious than hoped.Improving economic performance and strong earnings growth support our positive stance on DM equities, despite high valuations. However, room for disappointment is limited.We expect core...

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but...

Read More »Monthly Investment Strategy Highlights, April 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets. Asset allocationThe first quarter was exceptionally strong for risk assets, and the outlook remains good for developed market (DM) equities.We remain comfortable with our overweight in developed market equities, but it would be wise not to take too much risk in the coming quarter.EM assets may offer attractive opportunities on a tactical basis.CurrenciesThe US dollar probably has only limited further upside, absent a...

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle. Post meeting, a lot of the rise came out of the market. Nominal and...

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle. Post meeting, a lot of the rise came out of the market. Nominal and...

Read More »Monthly Investment Strategy Highlights, March 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe remain comfortable with our overweight position in developed-market (DM) equities and believe there are good reasons to be positive on Japanese equities,With volatility low and risks looming in the short term, this is a good time to add protection to portfolios. We have bought derivative protection on EUR high yield bonds and a call option on gold.Expecting yields on core sovereign bonds to rise further...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org