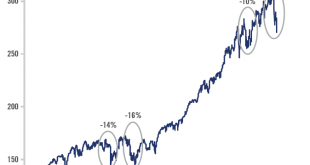

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWhile the recent sell-off might have been overdone in view of fundamentals that remain basically sound, market gyrations and our expectation of further volatility mean we remain neutral equities overall. The current environment favours active management and a tactical allocation approach, exemplified by the partial sale of equity options we acquired to protect portfolios in early...

Read More »House View, October 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe remain underweight or neutral across a number of risk asset classes and overweight liquidity in light of enduring uncertainties, but stand ready to deploy cash as tactical opportunities present themselves.We are neutral DM equities, but pockets of opportunity still exist (in the UK and Japan, for example). EM equities are becoming interesting, but with the risk of further earnings...

Read More »House View, September 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe maintain our neutral stance on equities overall on a rolling three-to-six month basis. We do have a more upbeat assessment further out, but the autumn is shaping up to be a sensitive time for risk assets overall.Recent sell-offs validate our cautiousness regarding emerging-market (EM) assets in general. But valuations are becoming more interesting and we do have a bullish short-term...

Read More »House View, August 2018

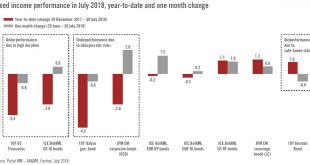

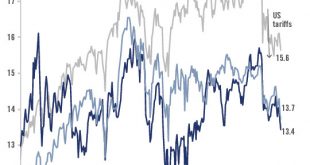

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six- month basis we are maintaining our neutral stance on developed-market equities in general in light of increasing trade and political frictions, but we remain more upbeat on their prospects further out.We have a bullish short-term stance on Asian (ex-Japan) equities given their increasingly attractive valuations but we are paying close attention to...

Read More »Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and...

Read More »House View, July 2018

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation On a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer. Recent sell-offs have vindicated our cautiousness regarding...

Read More »House View, July 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer.Recent sell-offs have vindicated our cautiousness regarding emerging-market assets in general. But valuations are becoming more interesting, and...

Read More »Global Asset Allocation Update

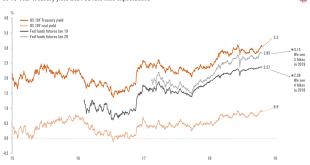

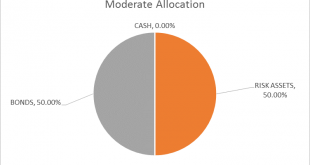

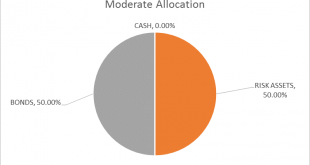

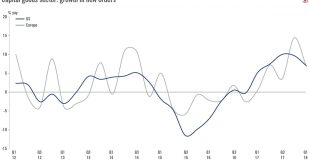

The risk budget is unchanged this month. For the moderate risk investor the allocation to bonds and risk assets is evenly split. There are changes this month within the asset classes. How far are we from the end of this cycle? When will the next recession arrive and more importantly when will stocks and other markets start to anticipate a slowdown? These are critical questions for investors and ones that can’t be...

Read More »House View, June 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOverall, we remain cautiously optimistic about risk assets. We expect economic growth to rebound after a ‘soft patch’ and corporate profitability remains strong, as revealed in Q1 earnings reports.But we recognise that the environment is becoming more challenging for investors. The current environment requires active managers’ heightened sense of adaptability.While we are bearish on euro...

Read More »Global Asset Allocation Update

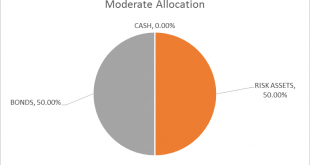

The risk budget changes this month as I add back the 5% cash raised in late October. For the moderate risk investor, the allocation to bonds is still 50% while the risk side now rises to 50% as well. I raised the cash back in late October due to the extreme overbought nature of the stock market and frankly it was a mistake. Stocks went from overbought to more overbought and I missed the rally to all time highs in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org