Both Brazil and Mexico are in a good position to benefit from the current improvement in market sentiment. However, when comparing the factors driving the currencies of both countries, we think there are relatively more near-term positives for the Mexican peso than for the Brazilian real. These include: (1) the peso will maintain its carry advantage for some time; (2) hedging-related flows should be mixed for the real, but could net as a drag; (3) Mexico’s near-term...

Read More »Three (Rate Cuts) And GDP, Where (How) Does It End?

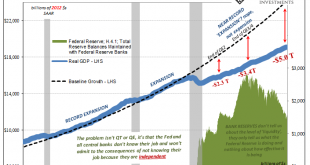

The Federal Reserve has indicated that it will now pause – for a second time, supposedly. Remember the first: after raising its benchmark rates apparatus in December while still talking about an inflationary growth acceleration requiring even more hikes throughout 2019, in a matter of weeks that was transformed into a temporary suspension of them. Expecting the easy disappearance of “transitory” factors, that Fed pause was to be followed by the second half rebound...

Read More »The Inventory Context For Rate Cuts And Their Real Nature/Purpose

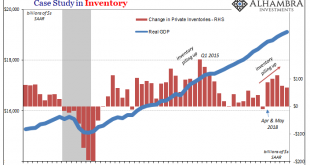

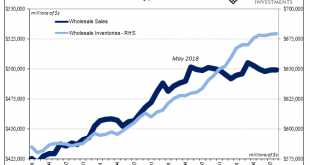

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process. An economy for whatever reasons slows down. That leads to inventory piling up across the various levels of the supply chain....

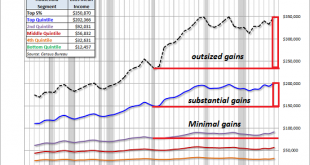

Read More »The Political Parties and the Media Have Abandoned the Working “Middle Class”

Where is the line between “working class” and “middle class”? Maybe there isn’t any. Defining the “middle class” has devolved to a pundit parlor game, so let’s get real for a moment (if we dare): the “middle class” is no longer defined by the traditional metrics of income or job type (blue collar, white collar), but by an entirely different set of metrics: 1. Household indebtedness, i.e. how much of the income is devoted to debt service, and 2. How much of the...

Read More »FOMC Preview

The FOMC begins a two-day meeting today with the decision due out tomorrow afternoon. The Fed is widely expected to cut rates 25 bp for the third meeting in a row. What’s next? RECENT DEVELOPMENTS US data have undeniably softened in September. Weakness in the manufacturing sector appears to have spread to the wider economy. ISM PMI, jobs, CPI, PPI, and retail sales all came in weaker than expected. So too have inflation expectations. October data is just...

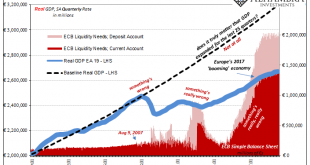

Read More »The Big Risks Left (and Right) In Europe

Another local election in Germany, another stunning defeat for the ruling center. How many more of these does anyone need before they realize the electorate is going to keep migrating toward the poles? And it all stems from the one reason; there is no and has been no economic growth. But because the so-called establishment has insisted the economy is booming, or it was, people are doing what people always do. They look for someone, anyone who can give them a...

Read More »Monthly Macro Monitor: Market Indicators Review

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations. The yield curve has also steepened as the 10 year Treasury yield rose faster than the 2 year. This...

Read More »Dollar Firm as Two-Day FOMC Meeting Begins

The dollar continues to gain traction as the two-day FOMC begins; US political uncertainty has entered a new phase Yesterday marked the third time that UK Prime Minister Johnson lost a vote for elections; he will try again today Weak South Africa data support our call for imminent easing; the threat of sanctions against Turkey are back on the table Lower than expected Tokyo October CPI was reported The dollar is mostly firmer against the majors as the FOMC’s two-day...

Read More »More Points For, And Pointing To, The Midpoint

It’s not surprising that the Census Bureau would report another weird sideways trend in wholesale sales. After all, the agency has already produced that kind of pattern in the related data for durable goods. For reasons that aren’t going to be explained, economic activity across the supply chain from producers to consumers has been curtailed. That hasn’t mean outright shrinking in seasonally adjusted forms, but it also doesn’t mean growth, either. I’m guessing there...

Read More »EM Preview for the Week Ahead

EM has been on a good run but this week will be a big test. Brexit uncertainty may finally end. Or it may not. A delay would be positive for EM, whilst a potential hard Brexit would be negative. The Fed meets Wednesday and key US data will be reported during the week, culminating with the jobs report Friday. The dollar has been on its back foot as September data have come in weaker than expected, so any sort of positive data surprises this week could add to the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org