Where is the line between “working class” and “middle class”? Maybe there isn’t any. Defining the “middle class” has devolved to a pundit parlor game, so let’s get real for a moment (if we dare): the “middle class” is no longer defined by the traditional metrics of income or job type (blue collar, white collar), but by an entirely different set of metrics: 1. Household indebtedness, i.e. how much of the income is devoted to debt service, and 2. How much of the household spending is funded by debt. 3. The ability of the household to set aside substantial savings / capital investment. 4. The security of the households’ employment. 5. The dependence of the household wealth on speculative asset bubbles inflated by central bank policies. 6. The percentage of the

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, middle-class, newsletter, working class

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Where is the line between “working class” and “middle class”? Maybe there isn’t any.

Defining the “middle class” has devolved to a pundit parlor game, so let’s get real for a moment (if we dare): the “middle class” is no longer defined by the traditional metrics of income or job type (blue collar, white collar), but by an entirely different set of metrics:

1. Household indebtedness, i.e. how much of the income is devoted to debt service, and

2. How much of the household spending is funded by debt.

3. The ability of the household to set aside substantial savings / capital investment.

4. The security of the households’ employment.

5. The dependence of the household wealth on speculative asset bubbles inflated by central bank policies.

6. The percentage of the household income that is unearned, i.e. derived not from labor but from productive assets.

7. The exposure of the households’ employment to automation, AI or offshoring.

8. How much of the household income is government transfers: benefits, subsidies, etc.

After writing about the middle class and America’s class structure in depth for over a decade, it seems to me the actual, real-world class structure is something along these lines:

1. No formal earned income, dependent on government transfers, possibly supplemented by informal “black market” income; no family wealth.

2. The Working Poor, those laboring at minimum wage or part-time jobs with few if any benefits. This class depends on government transfers to get by: EBT (food stamps), housing subsidies, school lunch subsidies, Medicaid, etc. Highly exposed to reductions in hours, tips, gigs, etc. and layoffs.

3. The “muddle class” which muddles through on earned income, much of which goes to debt service (student loans, auto loans, mortgages, credit cards) and skyrocketing big-ticket expenses: rent, healthcare, childcare, etc. Unable to save enough to move the needle on household capital, any net worth is dependent on speculative asset bubbles continuing to inflate. Highly exposed to layoffs or destabilizing changes in employment status: from full-time to part-time, loss of benefits, etc.

4. The Protected Class with secure income/earnings and benefits: this includes the nomenklatura of government employees, mid-level technocrat / managerial employees in academia, government-funded non-profits, etc., and retirees with Medicare, Social Security and other income (pensions, unearned investment income, etc.) and family assets (home owned free and clear, substantial 401K nest eggs, etc.)

5. “Winner Take Most” Corporate America / market-economy households: top managers and salespeople, entrepreneurs, successful business owners, speculators in financialization/asset bubbles, marketers, those earning substantial royalties, etc. Most work crazy-hard and make sacrifices, as per this article from The Atlantic: Why You Never See Your Friends Anymore: Our unpredictable and overburdened schedules are taking a dire toll on American society.

6. The wealthy and super-wealthy. Many continue working hard despite being worth tens of millions or hundreds of millions of dollars, as per this article from NYT.com: Why Don’t Rich People Just Stop Working? Are the wealthy addicted to money, competition, or just feeling important? Yes.

7. The upper reaches of this class constitute a Financial Aristocracy / Oligarchy / New Nobility, those who have leveraged mere wealth into political, social and financial power.

8. The Mobile Creatives Class, currently small but expanding, which essentially obsoletes the entire status quo of working for an employer (often to get benefits), going heavily into debt for a college degree, vehicle, house, wedding, etc., hiring employees and paying outrageous prices to live in an overcrowded, soul-destroying city, etc.

Where is the line between “working class” and “middle class”? Maybe there isn’t any. The old definitions of working and middle class were social more than financial–the middle class was better educated (school teacher, etc.) than the working class (factory worker, skilled tradesperson) but both could aspire to owning a home and giving their children a more secure life than they had started with.

The working class was not limited to the working poor: working-class jobs provided security and social mobility, just like white-collar middle class jobs.

What differentiates classes now is debt, employment security and the ability to build household capital that isn’t just a sand castle of speculative bubble “wealth.” The worker with tradecraft skills (welding, logger, etc.) has more security and earning power than a college graduate with few skills that can’t be outsourced or automated.

Many college graduates work in sectors that are highly exposed to layoffs and downsizing once the economy contracts: food and beverages, hospitality, etc.

All of which leads us to a highly verboten conclusion: both political parties and the corporate media have abandoned the 2/3 of the workforce that is working/middle class. The bottom 20% dependent on government transfers has more security than those earning just enough to disqualify the household for transfers, while the top 15% in the Protected Class are doing just fine unless they’re over-indebted.

The winner take most class and the wealthy dominate both political parties and the media which is now dependent on advertising that appeals to the top 10% of households that collect more than 50% of the national income.

The political parties take care of the government dependent class to keep the rabble from rebelling, and they keep the government gravy train flowing to the Protected Class (healthcare, national defense, academia, government employees) to insure their support at election time, but they take their marching orders from the Aristocracy / Oligarchy that fund their campaigns and enrich them with $100,000 speaking fees, seats on the board of directors, etc.

The Working/Middle Class gets nothing but lip-service, and that’s been the case for decades. The political parties and the media abandoned the Working/Middle Class long ago, buttering their bread with the soaring wealth of the Aristocracy / Oligarchy and relegating everyone outside the Protected Class who labors for their livelihood to the servitude of politically impotent tax donkey / debt-serfdom.

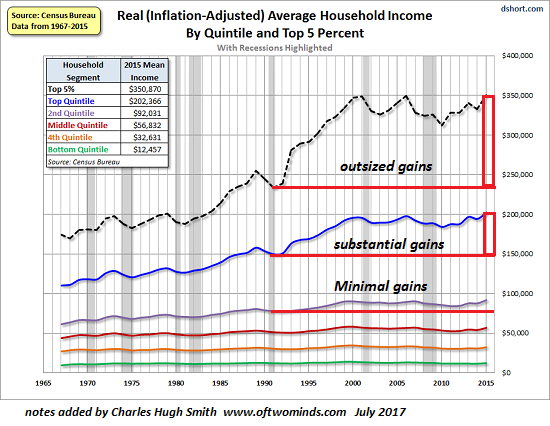

| Please examine these charts closely. They look busy but show that income inequality has been rising for over three decades.

Here’s income by quintile. The top 5% have done extremely well, the Protected Class 15% below them have done just fine, and the bottom 80%, well, who cares about them as long as they’re politically passive and make their loan payments? |

Real Average Household Income, 1965-2015 |

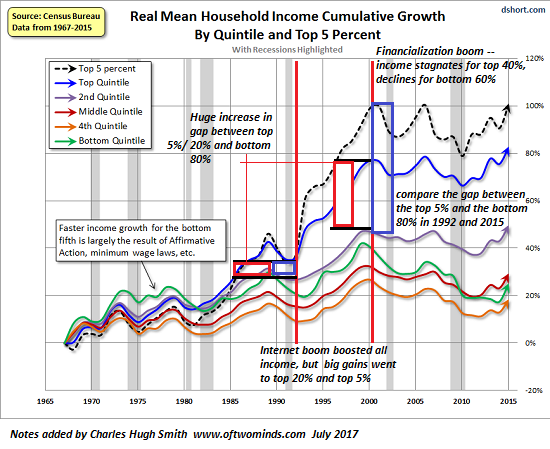

| Cumulative income reveals the widening gap between the bottom 80% and the top 5%. The gap was not very big in the early 1990s, but look at it now: |

Real Mean Household Income Cumulative Growth, 1965-2015 |

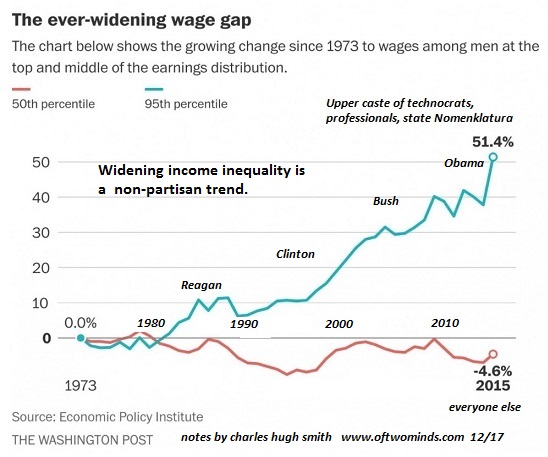

| Another chart of the top 5% pulling away from the rest of us: |

The ever-widening wage gap, 1973-2015 |

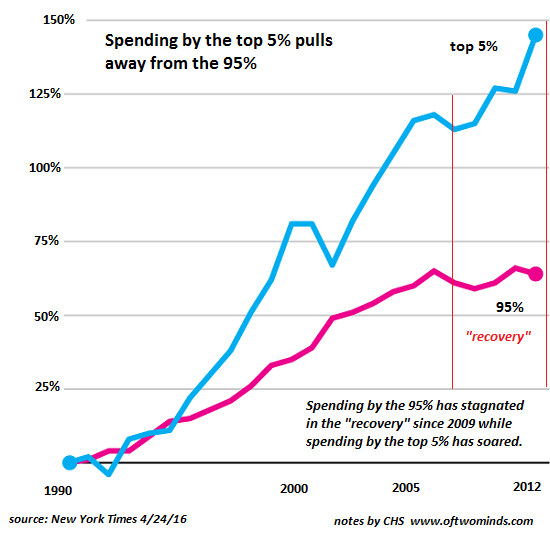

| No wonder the media depends on luxury/aspirational advertising: the top 5% are the only ones with the money and credit to blow on status-signifying fripperies: |

Spending by the top 5 % pulls away from the 95% |

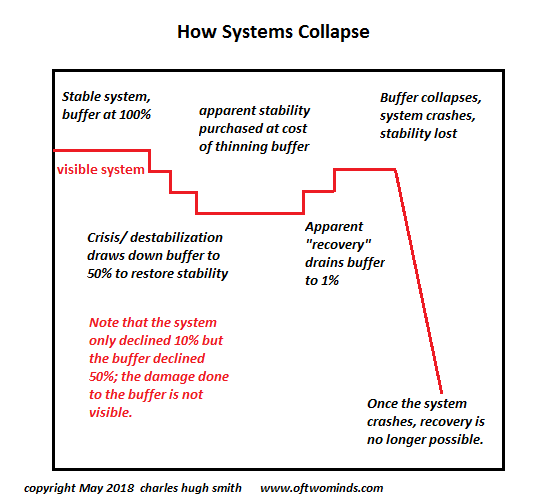

| Where does this lead? To this–a collapse of buffers: debt is not income, and eventually the buffers of borrowing more to keep afloat thin and break down. When the financial buffers of the middle two-thirds of working / middle class households break down, the economy and the social-political order will break down, too.

Don’t think it won’t happen just because it hasn’t happened yet. |

How Systems Collapse |

Tags: Featured,middle-class,newsletter,working class