We are beginning to become more constructive on EM. The main trigger for some optimism is the shifting US-China dynamic. In our view, the partial trade deal reveals weakness on the part of the US. Reports suggest China will begin pushing for all existing tariffs to be dropped as part of Phase 2, which would be very positive for EM. That is still likely months away but this shifting dynamic bears watching. We will be putting out a longer MarketView piece on this topic...

Read More »Welcome to the USSR: the United States of Suppression and Repression

We’re all against “fake news,” right? Until your content is deemed “fake news” in a “fake news” indictment without any evidence, trial or recourse. When propaganda is cleverly engineered, people don’t even recognize it as propaganda: welcome to the USSR, the United States of Suppression and Repression. The propaganda in the U.S. has reached such a high state that the majority of people accept it as “pravda” (truth), even as their limbic system’s BS detector is...

Read More »Economic Decay Leads to Social and Political Decay

If we want to make real progress, we have to properly diagnose the structural sources of the rot that is spreading quickly into every nook and cranny of the society and culture. It seems my rant yesterday (Let Me Know When It’s Over) upset a lot of people, many of whom felt I trivialized the differences between the parties and all the reforms that people believe will right wrongs and reduce suffering. OK, I get it, there are differences, but if the “reform” doesn’t...

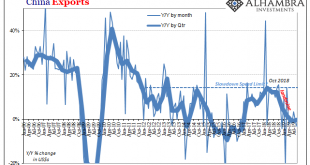

Read More »China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we...

Read More »Dollar Broadly Weaker as Brexit Deal Takes Shape

The dollar remains under pressure due to weak US retail sales and rising optimism on Brexit and the trade war Brexit negotiations remain tense and we should expect a higher than usual noise-to-signal ratio at this stage China said its goal is to stop the trade war and remove all tariffs US has a full data schedule; we remain constructive on the US economic outlook UK reported September retail sales; Sweden’s unemployment rate hit a 4-year high of 7.4% Australia...

Read More »Let Me Know When It’s Over

Maybe it’s my cheap seat or my general exhaustion, but the whole staged spectacle is beyond tiresome; I’ve had my fill. Let me me know when it’s over: yes, all of it: the impeachment, the trade dispute with China, U.S. involvement in Syria, the manic stock market rally and the 2020 election. I’m not interested in following every twist and turn of the endless trauma-drama because none of it changes anything: Swapping Pence for Trump changes nothing, and then swapping...

Read More »Dollar Resilient as Cracks in Risk-On Appear

Some cracks have appeared in the market’s risk-on sentiment We continue to believe that recent developments take some pressure off the Fed to cut rates again this month Our base case for a Brexit delay has been strengthened; UK reported weak labor market data The situation is Turkey continues to develop negatively for asset prices; trade data out of China once again showed the impact of the trade war and the resulting global slowdown RBA minutes were released; Japan...

Read More »EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect. Brexit negotiations have accelerated but we note that any deal must...

Read More »The Ultimate Heresy: Technology Can’t Fix What’s Broken

Technology can’t fix what’s broken, because what’s broken is our entire system.. The ultimate heresy in today’s world isn’t religious or political: it’s refusing to believe that technology can not only solve all our problems, it will do so painlessly and without any sacrifice. Anyone who dares to question this orthodoxy is instantly declared an anti-progress (gasp!) Luddite, i.e. a heretic in league with the Devil. Even worse, if that’s possible, is declaring that...

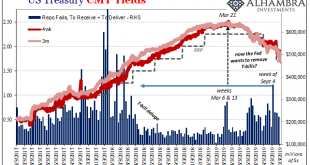

Read More »Never Attribute To Malice What Is Easily Explained By Those Attributing Anything To Term Premiums

There will be more opportunities ahead to talk about the not-QE, non-LSAP which as of today still doesn’t have a catchy title. In other words, don’t call it a QE because a QE is an LSAP not an SSAP. The former is a large scale asset purchase plan intended on stimulating the financial system therefore economy. That’s what it intends to do, leaving the issue of what it actually does an open question. The SSAP is what’s coming next. A small scale asset purchase plan...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org