How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year. From last August: In spite of...

Read More »Downward Home Prices In The Downturn, Too

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that way. From yesterday:...

Read More »More Down In The Downturn

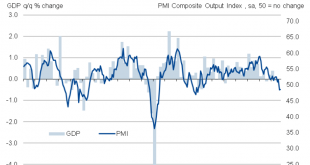

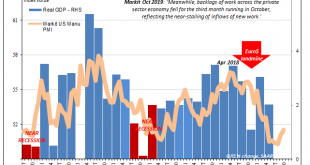

Flash PMI’s from IHS Markit for the US economy were split in October. According to the various sentiment indicators, there’s a little bit of a rebound on the manufacturing side as contrary to the ISM’s estimates for the same sector. Markit reports a sharp uptick in current manufacturing business volumes during this month. The manufacturing index came in at 51.5, up from a revised reading of 51.1 in September based almost entirely on the production subset. But at the...

Read More »Macro Housing: Bargains and Discounts Appear

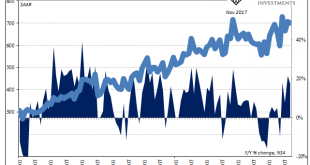

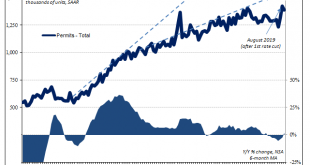

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it. When policymakers talk about interest rate stimulus, they largely mean the mortgage space. Homebuilders, at least, responded in August 2019 to the first rate cut in a decade exactly the way the FOMC had imagined when...

Read More »The Unraveling Quickens

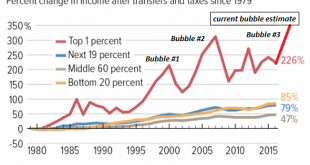

Even if we don’t measure the erosion of intangible capital, the social and political consequences of this impoverishment are manifesting in all sorts of ways. The central thesis of my new book Will You Be Richer or Poorer? is the financial “wealth” we’ve supposedly gained (or at least a few of us have gained) in the past 20 years has masked the unraveling of our intangible capital: the resilience of our economy, our social capital, i.e. our ability to find common...

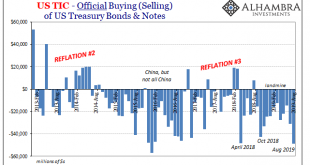

Read More »August TIC: Trying To Get Collateral Out of the Shadows

The second most frustrating aspect of trying to analyze global shadow money is how the term “shadow” really applies in this case. It’s not really because banks are being sneaky, desperately maintaining their cover for any number of illicit activities they are regularly accused of undertaking. The money stays in the shadows for the simple reason central bankers don’t know their jobs; even after a somehow Global Financial Crisis in 2008, they don’t realize the full...

Read More »A New Stage of the US-China Conflict

The US-China diplomatic relationship may be entering a new stage. The balance of power between the key players – Trump, China, the US Congress, and the Democrats – is changing and their roles are being reshuffled. This might be enough to break the endless cycle of agreements and re-escalations. In short, we think both Trump and Chinese officials have a greater incentive to reach a deal (or at least not to escalate) this time around. Meanwhile, the rising antagonist...

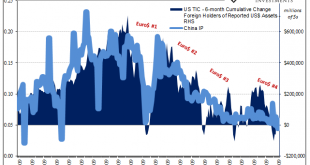

Read More »The Dollar-driven Cage Match: Xi vs Li in China With Nowhere Else To Go

China’s growing troubles go way back long before trade wars ever showed up. It was Euro$ #2 that set this course in motion, and then Euro$ #3 which proved the country’s helplessness. It proved it not just to anyone willing to honestly evaluate the situation, it also established the danger to one key faction of Chinese officials. The entire world slowed in 2012 following #2, but until the bottom of #3 it wasn’t really clear what that might mean. For a very long time,...

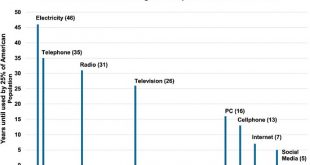

Read More »Prying Open the Overton Window

If you’re truly interested in finding solutions to humanity’s pressing problems, then start helping us pry open the Overton Window. The Overton Window describes the spectrum of concepts, policies and approaches that can be publicly discussed without being ridiculed or marginalized as “too radical,” “unworkable,” “crazy,” etc. The narrower the Overton Window, the greater the impoverishment of public dialog and the fewer the solutions available. Those holding power in...

Read More »What We’ve Lost

This is only a partial list of what we’ve lost to globalism, cheap credit and the Tyranny of Price which generates the Landfill Economy. A documentary on the decline of small farms and the rural economy in France highlights what we’ve lost in the decades-long rush to globalize and financialize everything on the planet— what we call Neoliberalism, the ideology of turning everything into a global market controlled by The Tyranny of Price and cheap credit issued to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org