Both Brazil and Mexico are in a good position to benefit from the current improvement in market sentiment. However, when comparing the factors driving the currencies of both countries, we think there are relatively more near-term positives for the Mexican peso than for the Brazilian real. These include: (1) the peso will maintain its carry advantage for some time; (2) hedging-related flows should be mixed for the real, but could net as a drag; (3) Mexico’s near-term negative risk event (US not ratifying the USMCA) seems less impactful than the negative tail risk for Brazil (former president Lula being released and allowed to run for president again). Approaching Peak Interest Rate Differentials The external environment will dictate how important carry will be as a

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Both Brazil and Mexico are in a good position to benefit from the current improvement in market sentiment. However, when comparing the factors driving the currencies of both countries, we think there are relatively more near-term positives for the Mexican peso than for the Brazilian real. These include: (1) the peso will maintain its carry advantage for some time; (2) hedging-related flows should be mixed for the real, but could net as a drag; (3) Mexico’s near-term negative risk event (US not ratifying the USMCA) seems less impactful than the negative tail risk for Brazil (former president Lula being released and allowed to run for president again).

Approaching Peak Interest Rate Differentials

The external environment will dictate how important carry will be as a driver of relative performance.

Our underlying assumption is that the US-China conflict will simmer down for the time being—at least as far as its impact on asset prices. Lower volatility means a return to a search-for-yield investment mindset, and Mexico is one of the few places with both a high yield and acceptable economic fundamentals.

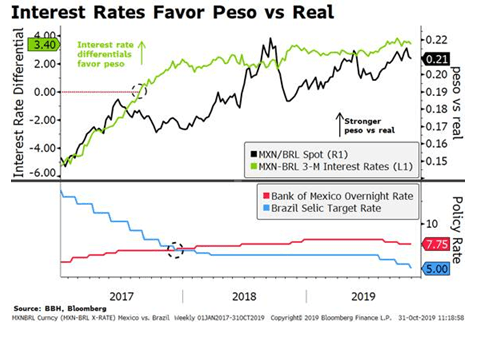

| December 2017 was a historical moment in EM history: the Mexican central bank rate rose above the Brazilian Central Bank’s (BCB) Selic rate for the first time. Since then, the differential has continued to widen in favour of the peso, reaching close to 3.5% annualized today. We should expect to reach peak rate differential (in the short end of the local curve) sometime in the next few months, but rates will remain far apart and are unlikely to meet again anytime soon. The BCB is expected to cut the Selic rate by another 25-50 bps, with the risk skewed to the downside towards the 4.50% level. Banxico’s target rate should continue to decline through 2020 and maybe into 2021 towards the 6.00% level (down 150-175 bps from today), with the risk skewed towards a cautious and gradual approach. Despite two Banxico MPC members voting in favour of more aggressive cuts in the last meeting, we doubt the doves will have enough sway to front-load easing. |

Interest Rates Favor Peso vs Real |

Conflicting FX Hedging Dynamics in Brazil

Hedging activity by local asset managers could create a natural resistance against continued real appreciation for the foreseeable future. One of the most popular trades for Brazil’s local funds has been long domestic equities along with a short real hedge. We expect this trade to be a recurring feature of Brazilian markets for as long as (a) locals remain bullish equities and (b) the carry cost to be long dollars remains this low. Anecdotal reports suggest that these trades have been largely cleaned out during the recent move lower in USD/BRL. In other words, local investors are ready to reload on short real positions as opportunistic hedges as the currency appreciates. There is no equivalent force pushing against the peso, as far as we know.

Separately, a recent tax change (CSLL) that should come into effect early next year has been giving the real a temporary boost. The new legislation will force financial institutions holding assets abroad to increase their FX hedges (selling dollar and buying real) to make up for the extra tax. Estimates place these flows at around $8 bln, but it’s hard to say how much of this is still to come since each bank will handle its hedge differently. What we do know is that this issue is well understood by investors and at least part of its effect has already been priced in, so it shouldn’t be a big driver of real appreciation from here on.

Near-Term Event Risks: Lula vs. USMCA

The biggest visible near-term negative tail risk for Brazil’s asset prices is the release of leftist former President Lula. There are a couple of ways this can happen, but the most impactful one would be if the Supreme Court overrules de decisions by the former judge Sergio Moro because of political bias. In this case, Lula could run for president again. We think markets are too complacent towards this risk, probably because the odds are small, and the 2022 elections are so far off. We agree, but also warn that if this were to happen – and it could before the end of the year – the real would see a sharp sell-off on the headlines.

For Mexico, the risk of USMCA not being approved may catch investors off guard. We think this is a small risk, especially after so many sanguine comments from both the Trump administration and the Democrats about it passing by Thanksgiving. Yet there are several potential stumbling blocks ahead of ratification, such as the impeachment process against Trump, labor standard demands by the Democrats and, more recently, a discussion about creating stronger rules about where auto companies can make cars and parts. But even if it doesn’t pass, we think the only way this could be a significant negative event for Mexican assets is if it comes along with a deterioration of the relationship with the US, or if anti-Mexico sentiment gets weaponized during the presidential elections.

Tags: Articles,Emerging Markets,Featured,newsletter