The dollar remains resilient; optimism towards a Phase One deal continues to support risk appetite There was also optimism from Fed Chairman Powell yesterday; the US economy is not out of the woods yet Turkish President Erdogan started deploying Russia’s S-400 missile system, raising the specter of sanctions Hong Kong reported weak October trade data; Philippine central bank Governor Diokno said a December cut was possible The dollar is mostly firmer against the...

Read More »Darn, This Is Inconvenient: Apple Is Destroying the Planet to Maximize Profits

Stripmining the planet to maximize profits isn’t progressive or renewable–it’s just exploitive and destructive. How do we describe the finding that the planet’s most widely-owned super-corporation is destroying the planet to maximize its smartphone sales and profits? Shall we start with “inconvenient?” Yes, we’re talking about Apple, famous for coercing customers to upgrade their Apple phones and other gadgets if not annually then every couple years, as the most...

Read More »Drivers for the Week Ahead

The dollar was surprisingly resilient last week; we look for further dollar gains ahead It is a holiday shortened week in the US, but there are still some major data releases There is a fair amount of eurozone data this week; UK Prime Minister Johnson unveiled his Tory manifesto Hong Kong held local elections this weekend; tensions between Japan and Korea appear to have eased, but questions remain The dollar was surprisingly resilient last week. Despite the lack of...

Read More »What’s Been Normalized? Nothing Good or Positive

What’s been normalized are policies and cultural norms that seek to enrich and protect the few at the expense of the many. When the initially extraordinary fades into the unremarkable background of everyday life, we say it’s been normalized. Put another way, we quickly habituate to new conditions, and rationalize our ready acceptance of what was previously unacceptable. Technology offers many examples of extraordinary advances quickly becoming normalized as we...

Read More »Dollar and Equities Sink as Trade Pessimism Rises

Pessimism regarding a Phase One trade deal has intensified; further muddying the waters are recent US Congressional actions FOMC minutes contained no surprises; regional Fed manufacturing surveys for November continue South Africa is expected to cut rates by 25 bp to 6.25% Korea reported trade data for the first twenty days of November; Indonesia kept rates steady at 5.0%, as expected The dollar is mostly weaker against the majors in very narrow ranges as markets...

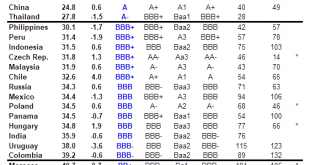

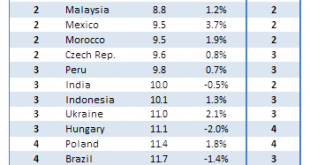

Read More »EM Sovereign Rating Model For Q4 2019

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance. These scores...

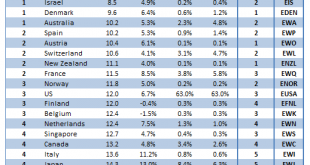

Read More »DM Equity Allocation Model For Q4 2019

Global equity markets continue to power higher US-China trade tensions have eased MSCI World made a new all-time high today near 2290 and is up 23% YTD Our 1-rated grouping (outperformers) for Q4 2019 consists of Ireland, Sweden, Israel, Denmark, and Australia Our 5-rated grouping (underperformers) for Q4 2019 consists of the UK, Hong Kong, Greece, Germany, and Portugal Since our last update on August 21, our proprietary DM equity portfolio has risen 6.7%, slightly...

Read More »Political and Social Conflict Is Accelerating: Here’s Why

All the status quo “fixes” only hasten the collapse of the status quo. That economic, social and political conflict is accelerating is self-evident. What’s open to debate are the core drivers of conflict / disorder /unraveling. Here’s the core self-reinforcing dynamic in my view: 1. The status quo elites can no longer mask soaring costs of essentials nor soaring wealth / income inequality between the top .01% (Oligarchs), the top 9.99% who enrich the Oligarchs with...

Read More »EM FX Model for Q4 2019

EM FX has rallied sharply in recent weeks, helped by growing optimism that we’ve seen the worst of the US-China trade war Given our more constructive outlook on EM, we believe MSCI EM FX should eventually test the 1657.50 high from July We see continued divergences within the asset class Our 1-rated (strongest fundamentals) grouping for Q4 2019 consists of TWD, THB, PHP, CNY, and KRW Our 5-rated (weakest fundamentals) grouping for Q4 2019 consists of ZAR, TRY, LKR,...

Read More »Dollar Stabilizes as Markets Await Fresh Drivers

Press reports suggest that the mood in Beijing is pessimistic after President Trump pushed back against tariff rollbacks Fed Chair Powell met with President Trump and Treasury Secretary Mnuchin yesterday Hungary is expected to keep rates steady; the deadline to form a government in Israel is fast approaching RBA released dovish minutes from its November policy meeting The dollar is mostly firmer against the majors as markets await fresh drivers. Kiwi and Stockie are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org