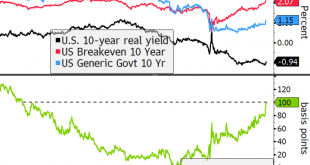

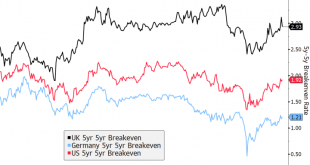

The US curve continues to steepen; real US yields have become less negative; UST supply will remain an issue as $38 bln of 10-year notes will be sold today; Brazil reports December IPCA inflation Yields in Europe and UK are following the trend higher in the US markets, but not as fast; Italy is facing another bout of political instability; BOE Governor Bailey pushed back against negative rates Japan’s government will declare a state of emergency for Osaka, Kyoto, and...

Read More »2021: If It Wasn’t For Bad Luck, We Wouldn’t Have No Luck At All

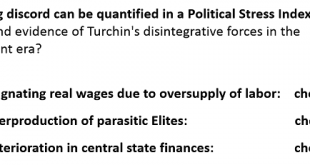

If we have indeed begun a sustained “reversal of fortune”, it might be prudent to consider the possibility we’re only in the first inning of a sustained run of back luck.In our self-deluded hubris, we reckon we’ve moved beyond the influence of fortune, a.k.a. Lady Luck: our technologies are so powerful and our monetary policies so godlike that nothing as random as luck could ever crush our limitless expansion. Thus does hubris beg for a comeuppance: the greater the...

Read More »The Tyranny Nobody Talks About

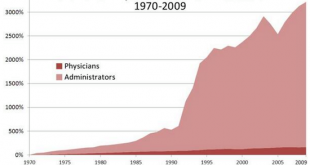

All the tricks to hide our unaffordable cost structure have reached marginal returns. Reality is about to intrude. There is much talk of tyranny in the political realm, but little is said about the tyrannies in the economic realm, a primary one being the tyranny of high costs: high costs crush the economy from within and enslave those attempting to start enterprises or keep their businesses afloat. Traditionally, costs are broken down into fixed costs such as rent...

Read More »The Coming War on Wealth and the Wealthy

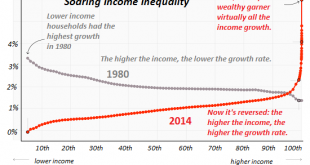

Here’s looking at you, Federal Reserve–thanks for perfecting ‘legalized looting’ and neofeudalism in America. The problem with pushing a pendulum to its maximum extreme on one end is that it will swing back to the other extreme minus a tiny bit of friction. America has pushed wealth/income inequality, unfairness and legalized looting to the maximum extreme. Now it will experience the swing back to the other extreme. This will manifest in a number of ways, one of...

Read More »2020 Was a Snack, 2021 Is the Main Course

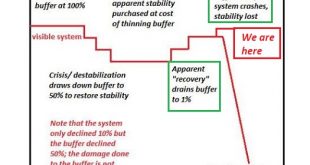

One of the dishes at the banquet of consequences that will surprise a great many revelers is the systemic failure of the Federal Reserve’s one-size-fits-all “solution” to every spot of bother: print another trillion dollars and give it to rapacious financiers and corporations. Though 2020 is widely perceived as “the worst year ever,” it was only a snack. The real banquet of consequences will be served in 2021. The reason 2020 was only a snack is that systems...

Read More »2020 the “Worst Year Ever”–You’re Joking, Right?

So party on, because “the worst year ever” is ending and the rebound of financial markets, already the greatest in recorded history, will only become more fabulous. Of the lavish banquet of absurdities laid out in 2020, one of the most delectable is Time magazine’s December 14 cover declaring that 2020 was the “worst year ever.” You’re joking, right? In history’s immense tapestry of human misery, it’s not even in the top 100 worst years. Consider 1177 B.C., when...

Read More »Big Media: Selling the Narrative and Crushing Dissent for Fun and Profit

The profit-maximizing Big Tech / Big Media Totalitarian regime hasn’t just strangled free speech and civil liberties; it’s also strangled democracy. The U.S. has entered an extremely dangerous time, and the danger has nothing to do with the Covid virus. Indeed, the danger long preceded the pandemic, which has served to highlight how far down the road to ruin we have come. The danger we are ill-prepared to deal with is the consolidation of the private-sector media and...

Read More »Drivers for the Week Ahead

As of this writing, a stimulus deal is close and a US government shutdown Monday may have been avoided; the Fed gave US banks the go-ahead to resume stock buybacks Friday; Fed manufacturing surveys for November will continue to roll out; weekly jobless claims will be reported on Wednesday due to the holiday All eyes remain on Brexit; things are getting very tricky now in terms of timing; with the UK going into stricter lockdown, we believe the pressure is building on...

Read More »When Social Capital Becomes More Valuable Than Financial Capital

This devaluation of financial wealth–and its transformation to a dangerous liability– will reach extremes equal to the current extremes of wealth-income inequality. Financial capital–money–is the Ring that rules them all. But could this power fall from grace? Continuing this week’s discussion of the idea that that extremes lead to reversions, let’s consider the bedrock presumption of the global economy, which is that money is the most valuable thing in the Universe...

Read More »Dollar Continues to Soften Ahead of FOMC Decision

Optimism on a stimulus deal remains high; the FOMC decision will be key; the dollar tends to weaken on recent FOMC decision days November retail sales will be the US data highlight; Markit reports preliminary December PMI readings; Canada reports November CPI The latest Brexit headlines are sounding optimistic; UK November CPI came in weaker than expected; eurozone December preliminary PMI provided an upside surprise; EU regulators lifted their curb on bank...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org