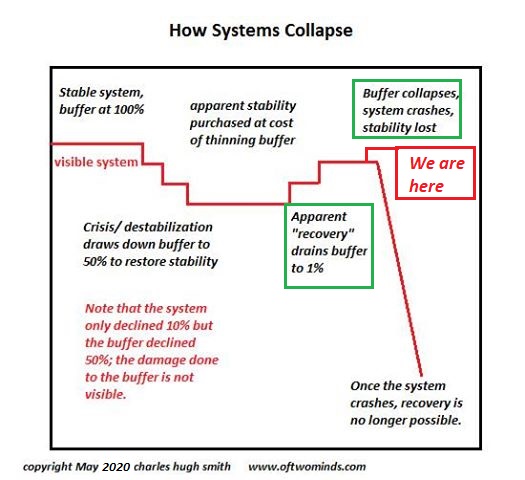

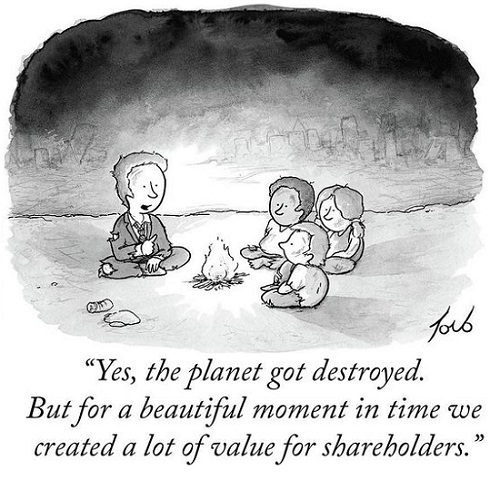

One of the dishes at the banquet of consequences that will surprise a great many revelers is the systemic failure of the Federal Reserve’s one-size-fits-all “solution” to every spot of bother: print another trillion dollars and give it to rapacious financiers and corporations. Though 2020 is widely perceived as “the worst year ever,” it was only a snack. The real banquet of consequences will be served in 2021. The reason 2020 was only a snack is that systems didn’t break down in 2020. The reason 2021 is the main course is that systems will break down, and once broken, they cannot be restored. I made the chart below to explain how systems fail and why they cannot be restored. Systems have numerous sources of potential fragility: Systems can be tightly bound to

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

One of the dishes at the banquet of consequences that will surprise a great many revelers is the systemic failure of the Federal Reserve’s one-size-fits-all “solution” to every spot of bother: print another trillion dollars and give it to rapacious financiers and corporations. Though 2020 is widely perceived as “the worst year ever,” it was only a snack. The real banquet of consequences will be served in 2021. The reason 2020 was only a snack is that systems didn’t break down in 2020. The reason 2021 is the main course is that systems I made the chart below to explain how systems fail and why they cannot be restored. Systems have numerous sources of potential fragility:

2. Systems can be hollowed out by self-interested insiders who mistakenly believe the system can survive endless looting. 3. Systems can be weakened by perverse incentives that provide strong incentives to under-invest in core functions and divert revenues to profiteering and extraction (stock buybacks, bonuses to managers, etc.) 4. Systems can appear robust to casual observers because insiders cloak the decay of function, accountability and transparency. 5. The decline of functionality / results can be hidden by bureaucratic obscurity (accounting statements in which all the important information is buried in footnotes starting on page 217, etc.) and by complexity thickets that reduce accountability to near-zero: no one is responsible for the decay of function, accountability and transparency. 6. Process replaces results as the Prime Directive of the system. Devoting resources to following processes rather than to getting results generates an illusion of functionality even as the ability to evolve and adapt is lost. 7. Buffers that enabled effective responses to crisis are stripped to the bone as redundancy and resilience are discounted as “hurting profits” or “needless expenses.” 8. Insiders and the public / customers wrongly assume money can solve all of these systemic frailties. But money cannot buy trust, competence, institutional depth, productive incentives or anything else that is essential to robust, anti-fragile systems. |

|

| Americans are unprepared for the collapse of core systems. The secular faith holds that corporate ownership of core systems, centralized state control and the relentless pursuit of infinite greed will magically manifest the best of all possible worlds because self-enrichment by any means available is what perfects systems.

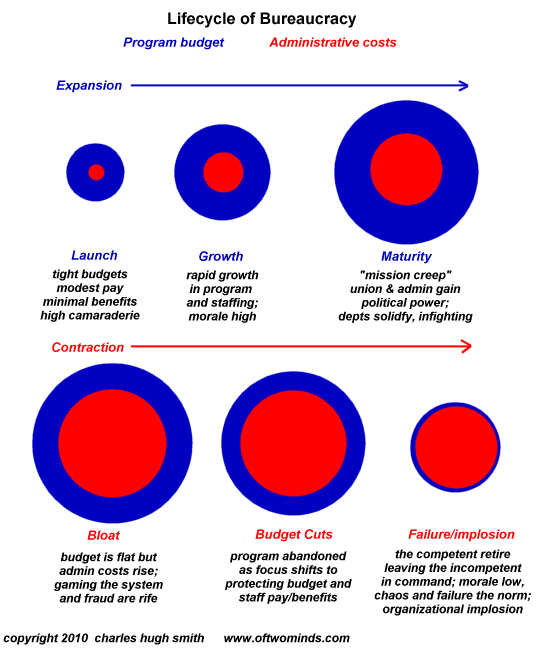

Unfortunately for America, this faith has it exactly backwards: self-enrichment by any means available is what hollows out and fatally weakens systems. The relentless pursuit of infinite greed (“investing” in stock buybacks, legalized looting, etc.) has destroyed the moral foundation of society and the economy: there is no civic virtue or public good left. These empty phrases cannot hide that America is a moral cesspool so corrupted by greed and self-interest that the nation can no longer even recognize its own moral dissolution. The second graphic I prepared a decade ago depicts the lifecycle of bureaucracy which can be either private-sector or public: the initial purpose of the organization that inspired the innovators and initial managers is slowly replaced by self-interest, and those who were willing to sacrifice to serve this purpose quit in disgust or are marginalized as “threats” to self-serving insiders. The competent leave or are forced out, leaving those of supreme incompetence in power, managers who’ve been selected for loyalty to the Prime Directive, protecting insider looting from outside interference via a mastery of public relations (“managing the narrative”) and obfuscation. The core function of the organization becomes masking dysfunction, ossification, sclerosis and the looting of insiders. The loss of function, accountability and transparency are hidden from prying eyes, and whistleblowers–the most dangerous threats to self-serving insiders–are hunted down and destroyed. It is not coincidence that America’s “growth sectors” are corruption and public relations (“managing the narrative”) because the best way to cloak corruption and systemic failure is to manage the narrative by suppressing dissent and eradicating whistleblowers. Unbeknownst to most Americans, many core systems are already in the first stages of collapse. No corporate sector does a better job of masking dysfunction and profiteering than healthcare, and so the collapse of healthcare systems will surprise everyone who swallowed the sector’s glossy PR. The entire financial system is hopelessly compromised, corrupt, self-serving and obsessed with maximizing personal gains by any means available. One of the dishes at the banquet of consequences that will surprise a great many revelers is the systemic failure of the Federal Reserve’s one-size-fits-all “solution” to every spot of bother: print another trillion dollarsand give it to rapacious financiers and corporations. I suggest dining lightly on the feast of consequences because the courses of systemic failure will continue being served the entire year. So save some appetite for the really big systemic collapses that are only now being slid into the oven. |

Tags: Featured,newsletter