A great many essential components in America are on ‘indefinite back order’, including the lifestyle of endless globally sourced goodies at low, low prices.Setting aside the “transitory inflation” parlor game for a moment, let’s look at what happens when critical parts are unavailable for whatever reason, for example, they’re on back order or indefinite back order, i.e. the supplier has no visibility on when the parts will be available. If the part that blew out is...

Read More »The Banality of (Financial) Evil

The financialized American economy and State are now totally dependent on a steady flow of lies and propaganda for their very survival. Were the truth told, the status quo would collapse in a putrid heap.Go ahead and be evil, because everyone else is evil, too, because being evil serves everyone’s interests far better than maintaining integrity, for integrity will cost you more than you can afford. In other words, lying, fraud, embezzlement, misrepresentation of...

Read More »Please Don’t Pop Our Precious Bubble!

It’s a peculiarity of the human psyche that it’s remarkably easy to be swept up in bubble mania and remarkably difficult to be swept up in the same way by the bubble’s inevitable collapse. Allow me to summarize the dominant zeitgeist in America at this juncture of history: Grab yourself a big gooey hunk of happiness by turning a few thousand bucks into millions– anyone can do it as long as they visualize abundance and join the crowd minting millions. Beneath the...

Read More »The Upside of a Stock Market Crash

[unable to retrieve full-text content]A drought-stricken forest choked with dry brush and deadfall is an apt analogy. While a stock market crash that stairsteps lower for months or years is generally about as welcome as a trip to the guillotine in Revolutionary France, there is some major upside to a crash.

Read More »The Smart Money Has Already Sold

Generations of punters have learned the hard way that their unwary greed is the tool the ‘Smart Money’ uses to separate them from their cash and capital. The game is as old as the stock market: the Smart Money recognizes the top is in, and in order to sell all their shares, they need to recruit bagholders to buy their shares and hold them all the way down. Once the catastrophic losses have been taken by the bagholders, then the Smart Money slowly builds up positions...

Read More »Why the Global Economy Is Unraveling

Global supply chain logjams and global credit/financial crises aren’t bugs, they’re intrinsic features of Neoliberalism’s fully financialized global economy. To understand why the global economy is unraveling, we have to look past the headlines to the primary dynamic of globalization: Neoliberalism, the ideological orthodoxy which holds that introducing market dynamics to sectors that were closed to global markets generates prosperity for all. This is known as...

Read More »Dear Fed: Are You Insane?

So sorry, America, but your central bank is certifiably insane, and it’s not going to magically work out. History definitively shows that speculative bubbles always pop–always. Every speculative bubble mania, regardless of its supposed uniqueness–“it’s different this time”–pops. No speculative bubble has ever “reached a permanently high plateau” and then remained on the plateau for years. So what does the Federal Reserve do? It inflates the biggest speculative...

Read More »The End of Global Tourism?

August 9, 2021Viewed as a complex non-linear system, the pandemic varinants can only be controlled by drastically pruning the physical connections between disparate global groups, which means effectively ending the unrestricted flow of individuals around the planet. Just a few days after the official acknowledgement of the pandemic in late January, 2020, Joseph Norman, Yaneer Bar-Yam, and Nassim Taleb published a short paper, Systemic Risk of Pandemic Via Novel...

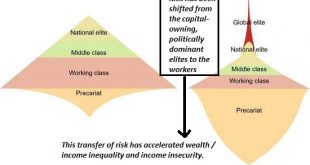

Read More »While the Herd Slumbers, Risk Is Rocketing Higher

This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy. One of the most consequential financial trends of the past 50 years has been ignored to the point of invisibility. I’m referring to the transfer of risk from the top tier to the middle and working classes. This transfer of risk has been broad-based, covering the...

Read More »The Moment Wall Street Has Been Waiting For: Retail Is All In

[unable to retrieve full-text content]The ideal bagholder is one who adds more on every downturn (buy the dip) and who refuses to sell (diamond hands), holding on for the inevitable Fed-fueled rally to new highs. Old hands on Wall Street have been wary of being bearish for one reason, and no, it's not the Federal Reserve: the old hands have been waiting for retail--the individual investor-- to go all-in stocks. After 13 long years, this moment has finally arrived: retail is all in. If you...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org