When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure...

Read More »The IRS Will Tax Less of an Estate in 2023

In 2012, the American Taxpayer Relief Act (ATRA) established, for the first time, a permanent estate tax and gift tax exemption. The exemption is the amount an individual can pass on at death without paying estate taxes. The legislation set the exemption at $5 million per person, indexed for inflation. Five years later, Congress decided the exemption was not large enough and passed the Tax Cuts and Jobs Act of 2017 (TCJA), which increased the lifetime exemption...

Read More »2023 Retirement Plan Contribution Limits

Worried about saving enough for retirement? You can put away more next year. The IRS has just announced the new retirement plan contribution limits for 2023. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan increases to $22,500, up from $20,500. For individuals 50 and older, the catch-up contribution limit goes to $7,500, up from $6,500. So, if you qualify for catch-up...

Read More »Weekly Market Pulse: Good News, Bad News

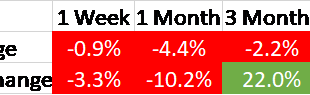

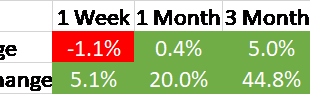

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday. The same could be said of bonds which also had a good week, with the aggregate index up 2.3%. The stock market rally probably says...

Read More »The Cleanest Dirty Shirt

The Cleanest Dirty Shirt It’s easy to overestimate the problems the United States faces while underestimating its strengths. The challenges are certainly significant. Politics have seldom been so divisive. The government is running an annual deficit of over a trillion dollars, with a total debt many times that. Inflation has spiked. The Fed has been hiking interest rates at a pace that could imperil the economy. There is enormous wealth disparity. Economic growth has...

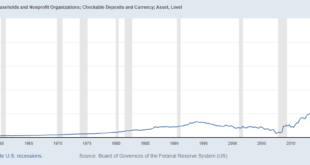

Read More »Powell’s Epiphany: There is No Free Lunch p2 Neutralizing the Money is Inflationary

Pandemic Wealth Effect The top 1% of the US made about $14T or $4.2M per person. The next 19% made about $20T or $318,000 per person. The next 30% made about $5T or $50,000 per person. The bottom 50% made about $1T or $6,000 per person. The resulting inflation is at a 40yr high and Powell wants the money back. Let’s recap what happened in the last 2 to 3 years. In addition to the Fed providing liquidity during the pandemic, there was a coordinated effort between...

Read More »SPECIAL REPORT: Follow The Money Series – Dawn Of A New Era

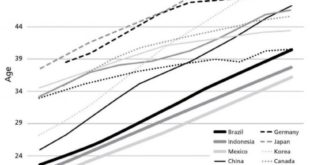

With inflation recently hitting a high not seen since 1981, it is now apparent that the factors that drove the disinflation trend of the last four decades are coming to an end. Globalization and demographics, the two big factors that combined to hold down prices and wages for so long, are reversing, and so too is the downtrend in prices, wages, and interest rates. While 1970s levels of inflation seem unlikely, several trends are converging to keep upward pressure on...

Read More »Weekly Market Pulse: Did Powell Just Blink?

Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close. Then, “the article” hit the front page of the WSJ: Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes By Nick Timiraos The article led with this quote:...

Read More »Market Currents: Fed Confusion

The Federal Reserve seems confused about its role in inflation and unemployment. Alhambra’s Steve Brennan and Joe Calhoun discuss it. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Weekly Market Pulse: Just A Little Volatility

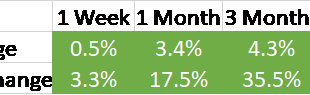

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is. Stocks were down slightly Monday and Tuesday fearing the worst and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org