Here we are again in the final quarter of the year when thoughts turn to Thanksgiving and Christmas and… reviewing your financial house. Oh, that’s not on your list? Well, let’s put it there because financial issues cannot be on automatic pilot. Things change and you need to keep current. Here are 16 items you need to review before the end of the year. Tax Loss Harvesting No one wants to pay more taxes than necessary (at least no one I know) and harvesting capital...

Read More »Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish. Interest rates are going up they said, no matter how much it hurts, no matter how many people have to be put on the unemployment line, because that’s the only way to kill this inflation, to...

Read More »Market Currents: Don’t Listen to Buy and Hold Investing Advice

For decades a Buy and Hold strategy was a staple of financial advice. But should it be? Alhambra CEO separates myth and reality. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Markets,newsletter,Real Estate,stocks

Read More »Weekly Market Pulse (VIDEO)

Are investors at the point of maximum pessimism? Alhambra CEO Joe Calhoun talks about a horrible 3rd quarter, sentiment, and where investors can look right now. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year. The 10-year Treasury yield rose from 2.97% to 4% just a few days before the end of the quarter. The 3-7 year Treasury index – our...

Read More »Medicare Part B Premiums Will Go Down in 2023

In a world where the price of everything is going up, Medicare recipients get a price cut beginning January 1, 2023. The Centers for Medicare and Medicaid Services (CMS) just announced that the monthly premium for Medicare Part B, which covers doctor visits, diagnostic tests, and other outpatient services, is decreasing $5.20 per month to $164.90. That’s good news in light of the 14.5% increase in Part B premiums in 2022, the largest dollar increase in the history...

Read More »Market Currents: Impact of Fed Tightening on Home Prices

What impact does Fed tightening really have on home prices? Doug Terry, Alhambra’s Head of Investment Research, explains. [embedded content] [embedded content] Tags: Alhambra Research,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Market Currents: Banks are Keeping Oil Prices High

Who is really keeping oil prices high? Alhambra CEO Joe Calhoun says it’s the banks. [embedded content] [embedded content] Tags: Alhambra Research,commodities,economy,Featured,Markets,newsletter

Read More »Market Currents – Is The Economy Contracting?

Is the economy contracting? Alhambra’s Steve Brennan poses that question to CEO Joe Calhoun. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Weekly Market Pulse: No News Is…

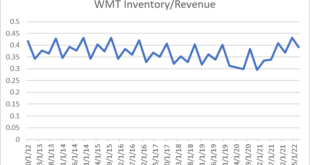

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose $500 million? In a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org