Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close. Then, “the article” hit the front page of the WSJ: Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes By Nick Timiraos The article led with this quote: “We will have a very thoughtful discussion about the pace of tightening at our next meeting,” Fed governor Christopher Waller said in a speech earlier this month. And just like that, the markets turned. Interest rates fell across the board – well, except for the very long end of the curve – and stock

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, bonds, commodities, currencies, economy, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, Real estate, stocks

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close. Then, “the article” hit the front page of the WSJ:

Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes

By Nick Timiraos

The article led with this quote:

“We will have a very thoughtful discussion about the pace of tightening at our next meeting,” Fed governor Christopher Waller said in a speech earlier this month.

And just like that, the markets turned. Interest rates fell across the board – well, except for the very long end of the curve – and stock futures rallied. The S&P closed up 2.4% for the day and 4.7% for the week.

What does this mean? Not much unless the actual inflation data starts to improve. We’ll gain some clarity on the state of the economy this week when a lot of fairly important data will get reported. We’ll get the CFNAI, a broad overview of economic growth relative to trend, on Monday. The last reading was 0 and the 3-month moving average is at 0.1 so by that measure the economy is growing right on trend (about 2%). Tuesday we’ll get the latest Case-Shiller home price index (August) which seems highly likely to be down again. That will be seen as good inflation news but this report rarely moves the market.

Wednesday will see the release of building permits and new home sales and that will likely be weak but not surprising. Thursday we’ll get the preliminary Q3 GDP report which may be surprisingly upbeat if the Atlanta Fed’s GDPNow is anywhere close to accurate (last reading +2.9%). There will be inflation data within the GDP report but it’s old data so might not mean much. We also get durable goods orders Thursday.

The big day is Friday when we get personal income and spending, the employment cost index, the PCE price index (the Fed’s preferred inflation measure), and the final look at the University of Michigan consumer sentiment report (which has an inflation expectations component).

We are also in the Fed’s blackout period prior to their next meeting so we won’t hear any of the Fed governors opine about this data. I suppose if something on the inflation front is really out of line with expectations, we could see another leak to the WSJ but frankly, I’d prefer the Fed just wait until their November meeting. I am, like everyone else I assume, exhausted with the Fed’s open-mouth policies.

So, we’re going to get a good snapshot of things next week. There are various other reports mixed in but most of them are not the market-moving variety. But with markets as twitchy as they’ve been, who knows what the market will choose to focus on.

Will any of the data matter for the course of the Fed’s tightening? Maybe. Even Powell apparently decided last week that the market was taking things too far or he wouldn’t have approved that WSJ story. And yes, I absolutely think he had to approve it. I have said for weeks that the Fed needs to slow the pace of its tightening campaign. It is nice to see some folks with more gravitas than I – like Jeremy Siegel – join that call. Will it matter? I suspect it will only if the inflation data cooperates.

In the meantime, corporate earnings are being released for the quarter and so far they aren’t that bad. With everyone scared to death that earnings estimates are too high, it doesn’t take much good news to move individual company stocks and the market as a whole. We’ve only seen about 20% of the S&P 500 report yet though so there’s a long way to go. What we’ve seen so far is 72% of companies beating estimates which sounds good but is slightly below the 10-year average of 73%. Revenues have been better than expected at 70% of reporting companies which is well above the 10-year average of 62%. The problem? Net margins are down for the 5th quarter in a row (assuming current trends continue). They are still historically high at 12.2% (that’s higher than all of 2018 for instance) though so the damage hasn’t been that bad. Companies have, so far, been pretty successful at passing on their cost increases.

Energy, industrials, and real estate are the largest contributors to year-over-year growth so far. Energy probably doesn’t surprise anyone but industrials and real estate might. For industrials, airlines went from a $731 million loss in Q3 last year to a $2.9 billion profit this year. 7 of the remaining 9 industries in the sector reported earnings up greater than 10% including aerospace and defense (+28%), construction and engineering (+23%), machinery (+20%), road and rail (+18%), and electrical equipment (+12%). We think there are good reasons for industrials to be performing well and expect it to continue (you might want to download our special report to see why we think so).

Real estate FFO (funds from operations) is up 18.1% year over year, third highest of the 11 sectors, led by hotels and resort REITs (+99%) and industrial REITs (+90%). This is why we continue to hold REITs despite a drubbing this year. We knew that they would take a hit from rising rates (although we didn’t expect this bad) but in the long run, real estate performs well in inflationary environments.

The consensus seems to be forgetting that earnings are nominal and if you have NGDP growth you are going to see revenue and earnings growth. That was true in the 1970s when earnings were generally robust in nominal terms. There were only 8 months during the entire decade when year-over-year earnings were down more than 10% with the worst in September 1975 (-14.8%). Earnings continued to grow through the recessions of 1973/74 and 1980.

The question isn’t earnings but what interest rate we use to discount those earnings. That’s why in previous inflationary periods stocks bottomed when inflation and interest rates peaked. Will this time be like the late 60s and 70s? I tend to think so and I think inflation already peaked. We’ll find out more this week.

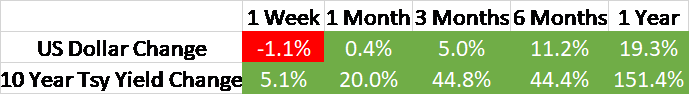

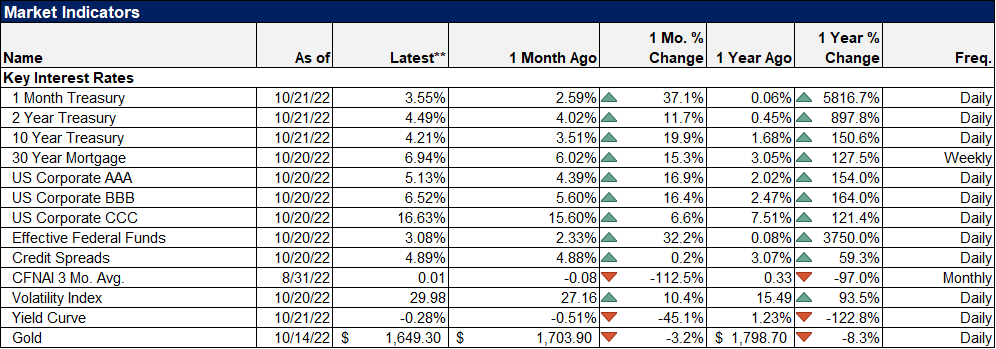

EnvironmentI said last week the rate of change on the 10-year yield and the dollar were slowing. Well, that’s still true for the dollar but the 10-year yield resumed its climb last week, up 20 basis points on the week. And it would have been a lot more than that if the Fed hadn’t decided on Friday that things were getting a little out of hand. 10-year TIPS yields were also up but not as much (10 basis points) so inflation expectations rose a bit. It was overall a strange week for the yield curve as the 10-year and 3-month yields rose but the 2-year was flat. The 10-year/3-month curve inverted by 3 basis points for about 10 minutes on Tuesday but closed the week at 12 basis points. The entire Treasury yield curve is now essentially flat with only 24 basis points separating the 3-month yield from the 30-year yield. While I don’t know of any evidence that a flat or inverted curve causes slower growth/recession, there is no doubt they are correlated. Not exactly news since the economy has been slowing all year but disconcerting nonetheless. |

The inversion of the 10-year/3-month curve is certainly attention-grabbing. I don’t know of a time when that curve has inverted and the economy has avoided recession. Does the brief inversion last week count? I don’t know but we’ve seen brief inversions before, most recently in February 2006 when the curve inverted and then uninverted almost immediately.

It inverted for good in July 2006 and recession came in December of 2007. So, yes, I guess the initial inversion “counted” but it was a long way from recession. The likely course of events, assuming we are headed for recession, is that the curve will invert again at some point and a few months before the beginning of the recession the curve will start to steepen again. That happened in May of 2007 for example. Right now, recession is something to worry about but not as an imminent event. And from a market standpoint, a lot can happen between here and there.

The fall in the dollar Friday was probably driven by the BOJ’s intervention to support the Yen. Absent major coordination among Treasury, the Fed, and the BOJ, Yen strength is likely to prove fleeting. However, it is also true that the dollar is sensitive to changes in real interest rates and short-term TIPS rates have been falling over the last month. The 5-year TIPS yield is down nearly 30 basis points just since the end of September. The 10-year TIPS yield is down too but only 11 basis points. If real rates keep falling, the dollar will probably follow.

The TIPS curve is in many ways more interesting than the nominal curve. The TIPS curve first inverted in late August and the inversion grew until it peaked at the end of September. In October, the entire curve has steepened with spreads positive at 5,7,10, 20, and 30 years. What does that mean? I interpret that as a drop in near-term real growth expectations and a slight rise in long-term expectations. I’d say that makes sense in the context of what is going on with the nominal curve.

There is little doubt the economy is slowing and we may well get conditions that are consistent with recession in the coming months. What we don’t know yet is the timing and depth of any slowdown and whether markets have sufficiently discounted it yet. The average lead time in the last 4 recessions from the inversion of the 10-year/3-month curve to the onset of recession is 12.5 months. That isn’t a prediction, just an observation. Your mileage may vary.

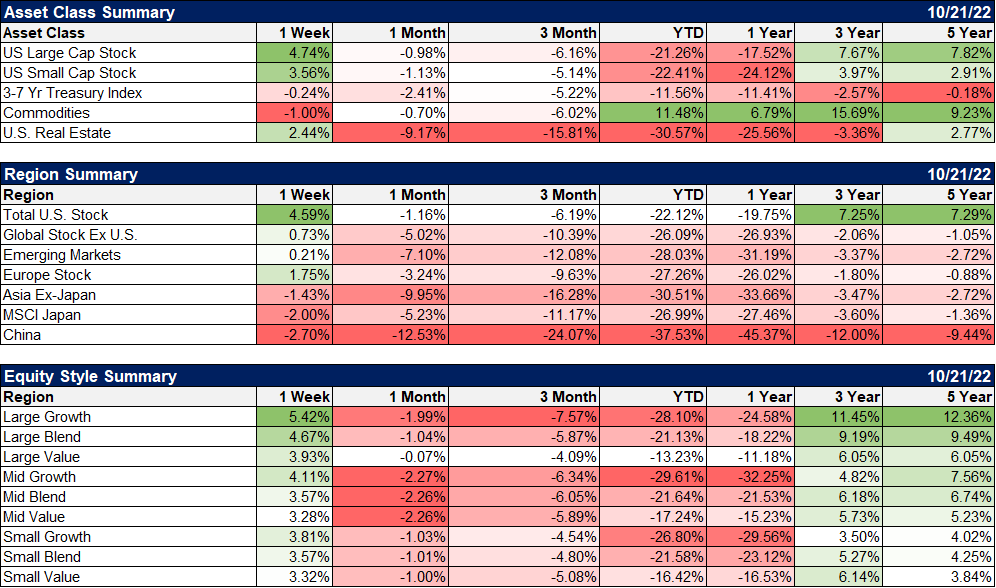

MarketsIt was nice to get an upweek in stocks and real estate but bonds and commodities were down again. The bear market in bonds this year is historic, probably the worst ever and it has made a diversified investor’s life hell. But this too shall pass as they say. The good news for bonds is that every really bad year was followed by a couple of good ones. Next year would be great if bond prices just stopped falling and we were able to collect coupons. Non-US stocks were also higher but not as much as the US. International value outperformed though and only lagged the S&P by less than 1%. International value has outperformed the S&P all year albeit by a slim margin. When you consider the strength of the dollar it is quite impressive though. You’ve lost 17% (roughly) to the dollar and yet the stocks are still doing better in dollar terms than the S&P. If the dollar really is peaking, non-US stocks will gain a currency tailwind. That may not matter if the US goes into recession but it is certainly worth keeping an eye on. |

|

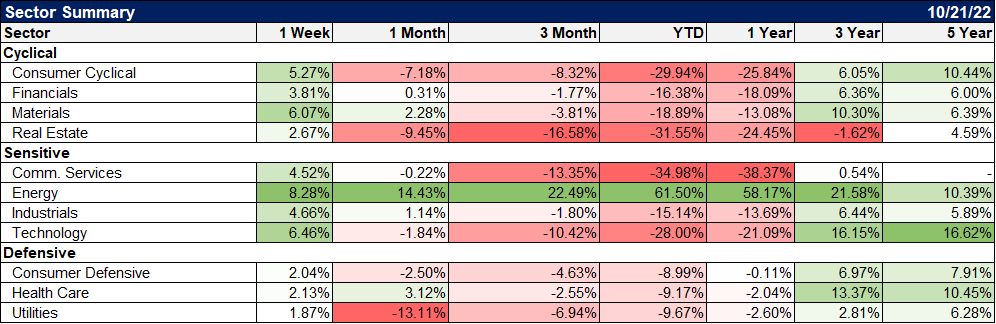

| Economically-sensitive sectors outperformed by a pretty wide margin last week. Most of that came on Friday but it may be noteworthy that they were outperforming before the big rise at the end of the week. The economic data continues to reflect the slowdown in the goods side versus the upswing in services. And Q3 GDP, based on the data released so far, looks positive.

The best-performing sector last week was energy which is interesting considering that both crude oil and natural gas were down. Nat gas was the big loser, down over 23% on the week. There are a lot of factors at work there but we have never had a shortage of gas. There were concerns that we were exporting too much to the detriment of domestic consumers but with European storage full that seems less of a concern. I would continue to be wary of the energy stocks that have become the darlings of the bear market and the only sector up on the year. It certainly doesn’t give me any comfort that the cover of Barron’s this week is all about “Big Oil’s Surprising Green Future”. The accompanying article makes the bull case for BP and Exxon Mobil. Uh oh. |

|

| Credit spreads have narrowed over the last couple of weeks and still show no credit stress. The 10/2 yield curve steepened last week but not in a bad way. The curve tends to steepen right before recession but that is because the 2-year yield falls more rapidly than the 10-year. For now, they are both in uptrends so the steepening doesn’t mean much.

In some ways, this is a unique period in economic history but in other ways, it is quite ordinary. The 1960s and 70s provide us with a bit of a guide to our current inflationary period. I don’t even think the conditions that produced this inflationary burst are that different, no matter how much the current administration wants to blame it on Vladimir Putin and the supply chain. Inflation is, in the simplest explanation, too much money chasing too few goods. A lot of people want to put the blame on the latter – too few goods – but the fact is that the cause is more likely the former. |

The Fed created this mess by accommodating massive deficits with QE. It is not a coincidence that the year-over-year change in M2 money supply hit its peak of 27.5% in the spring of last year (right as the American Rescue Plan was enacted) and we now have an inflation problem. The good news is that the year-over-year change is now just 3.1% so inflation should start coming back down. The bad news is that the monthly change has turned slightly negative recently. Unfortunately, Powell has been dismissive of money supply in the past as an indicator so we know he’s not paying attention. Let’s hope the data catches up quickly.

Joe Calhoun

Tags: Alhambra Portfolios,Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks