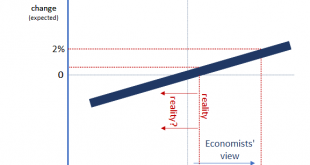

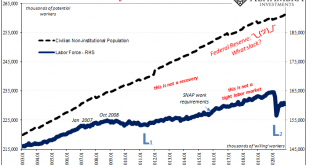

Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them. A labor shortage would’ve meant full or maximum employment, the...

Read More »Inflation Hysteria #2 (WTI)

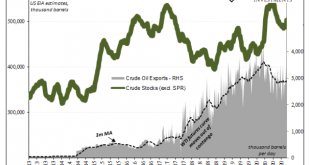

Sticking with our recent theme, a big part of what Inflation Hysteria #1 (2017-18) also had going for it was loosened restrictions for US oil producers. Seriously. Legacy of the 1970’s experience depending too much on OPEC, subject to embargoes, American oil companies had been prohibited for decades from exporting oil. Not that it would have mattered before 2014, the country never producing near enough to have ever done so. Export limitations removed, shale boom...

Read More »Inflation Hysteria #2 (Nominal UST)

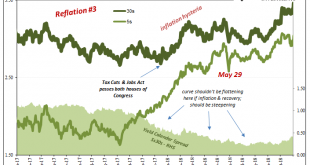

What had given Inflation Hysteria #1 its real punch had been the benchmark 10-year Treasury note. Throughout 2017, despite the unemployment rate in the US, globally synchronized growth being declared around the world (and being declared as some momentously significant development), and whatever other tiny factors acceding to the narrative, longer-term Treasury rates just weren’t buying it. Instead, the eurodollar monetary system continued to cling to these safest,...

Read More »Polar Opposite Sides of Consumer Credit End Up in the Same Place: Jobs

If anything is going to be charged off, it might be student loans. All the rage nowadays, the government, approximately half of it, is busily working out how it “should” be done and by just how much. A matter of economic stimulus, loan cancellation proponents are correct that students have burdened themselves with unprofitable college “education” investments. Without any jobs, let alone enough good jobs, an entire generation of Americans has been hamstrung,...

Read More »Take Advantage of These COVID Estate Planning Opportunities by the End of 2020

May you live in interesting times. Although that sounds like an ancient blessing, it’s believed to be a Chinese curse casting instability and uncertainty on the person who hears it. Blessing or curse, it’s a great description of the year we’ve just come through, and in spite of all the turmoil, there are some things you can do before the end of 2020 to take advantage of all the madness. Strauss Attorneys PLLC has come up with a list of estate planning insights,...

Read More »Don’t Really Need ‘Em, Few More Nails Anyway

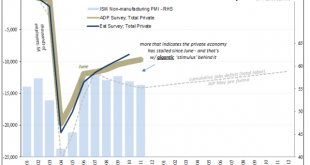

The ISM’s Non-manufacturing PMI continued to decelerate from its high registered all the way back in July 2020. In that month, the headline index reached 58.1, the best since early 2019, and for many signaling that everything was coming up “V.” Since, however, it’s been a slow downward trend that, when realizing early 2019 wasn’t exactly robust, only reconfigures the very nature of this rebound. When comparing comebacks from outsized economic contractions, the best...

Read More »There Have Actually Been Some Jobs Saved, Only In Place of Recovery

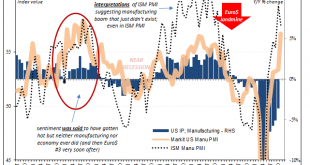

The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5. At that level, it really wasn’t any different from where it had been at its multi-year high the month before. Neither are indicative of any sort of “V” shaped recovery, or any shaped recovery....

Read More »Tesla Isn’t A Car Company

We have the luxury, the honor, of speaking to a lot of individual investors here at Alhambra. Whether they are clients or future clients (optimism is my default condition), the most common view of stocks is that they are overvalued and a fall – a large fall – is inevitable. And there is no stock that embodies that view more than Elon Musk’s Tesla Incorporated. It was once known as Tesla Motors but Musk changed the name in early 2017. There may never have been a more...

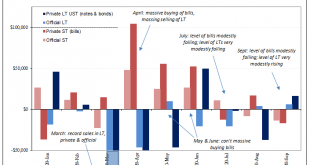

Read More »Just Who Is, And Who Is Not, Selling T-Bills

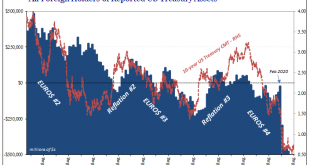

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral. Best collateral means OTR, and for standard practice this had always meant Treasury bills (as well as, noted yesterday, bonds and notes just auctioned off). According to...

Read More »Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on auctions as the sole...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org