The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5. At that level, it really wasn’t any different from where it had been at its multi-year high the month before. Neither are indicative of any sort of “V” shaped recovery, or any shaped recovery. Rebound, yes, but that’s very different. That point may have been best described by the key subcomponent most responsible for the index’s top-level decline. IHS Markit US Manufacturing, 2012-2020 - Click to enlarge The manufacturing employment estimate fell back below 50 yet again. In fact, it had

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, CARES Act, corporate profits, currencies, economy, employment, Featured, Federal Reserve/Monetary Policy, gdi, GDP, jobless claims, Labor market, Markets, newsletter, paycheck protection program, U.S. ISM Manufacturing PMI, Unemployment

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

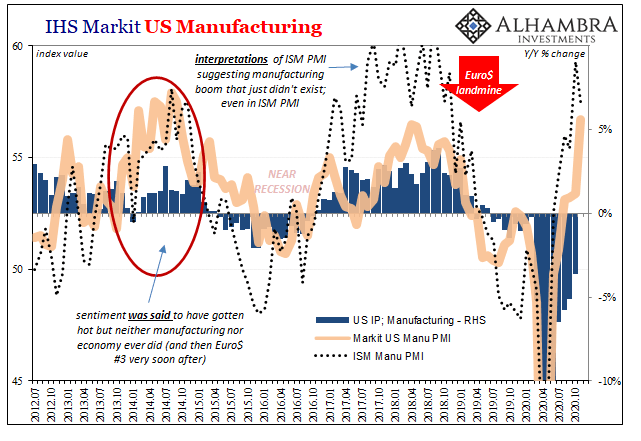

| The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5.

At that level, it really wasn’t any different from where it had been at its multi-year high the month before. Neither are indicative of any sort of “V” shaped recovery, or any shaped recovery. Rebound, yes, but that’s very different. That point may have been best described by the key subcomponent most responsible for the index’s top-level decline. |

IHS Markit US Manufacturing, 2012-2020 |

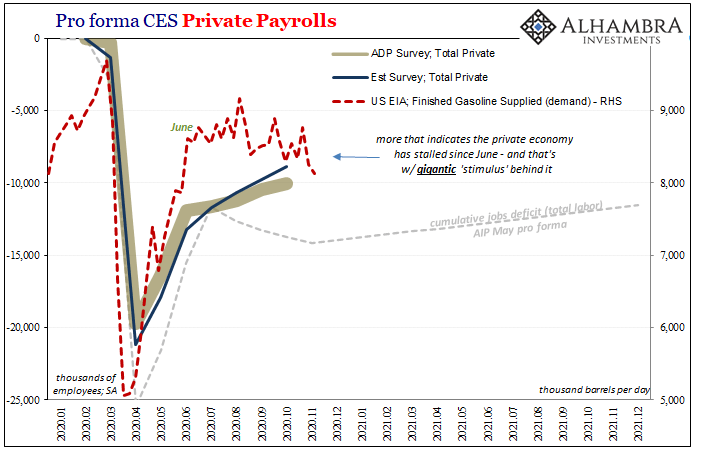

| The manufacturing employment estimate fell back below 50 yet again. In fact, it had been above that level only once (October) since July 2019. The manufacturing sector, seriously struggling long before COVID, appears to be caught up in the same imbalances unfavorable to getting workers back on their feet even during the reopening frenzy.

Not enough work because rebound doesn’t necessarily mean recovery. In many cases, as we’ve seen since 2008, it merely means lack of further contraction at this moment. |

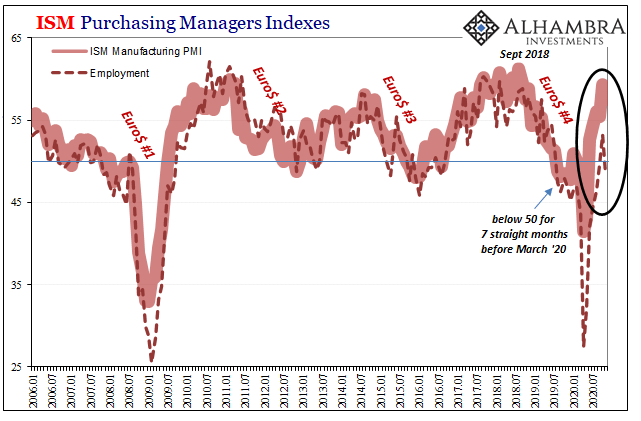

ISM Purchasing Managers Indexes, 2006-2020 |

| Not just manufacturers, it might at first seem to be a glaring disconnect between other measures of the economic rebound, including mainstream interpretations of this ISM headline. But a relatively slow increase off a very low trough, as in earlier this year, isn’t the sort of economic recovery trend which would produce a robust labor market comeback.

On the contrary, if businesses perceive a lackluster upturn, as these PMI numbers actually suggest, then they will continue to be cautious especially when it comes to their greatest cost component (and liquidity risk) – just as the slowdown in all the employment data demonstrates (save the unemployment rate which is once more caught up in the participation problem’s apparent second act). And it doesn’t really matter what “stimulus” has been unleashed along the way. |

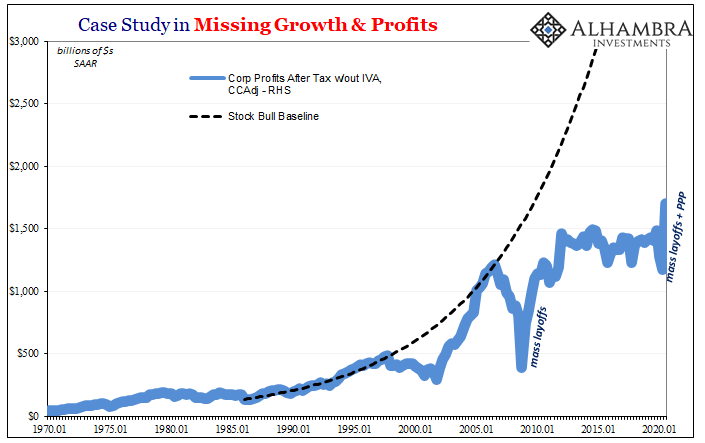

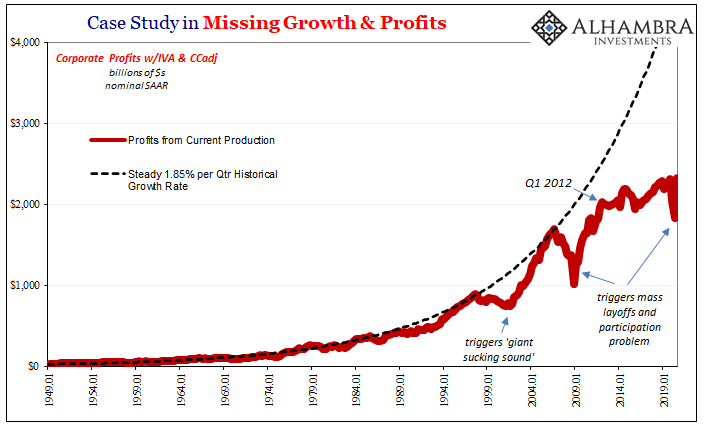

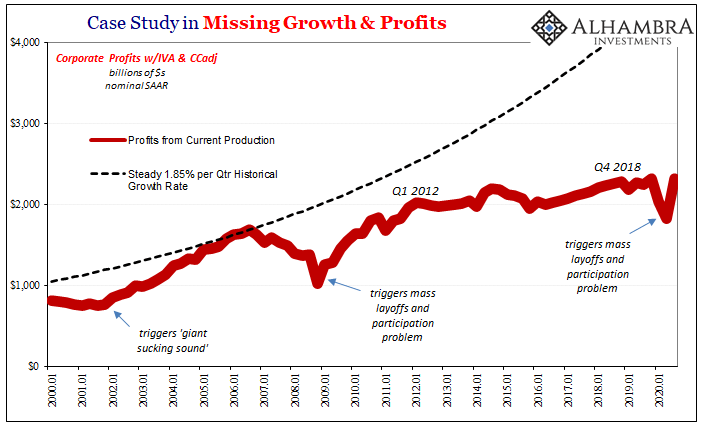

Case Study in Missing Growth & Profits, 1970-2020 |

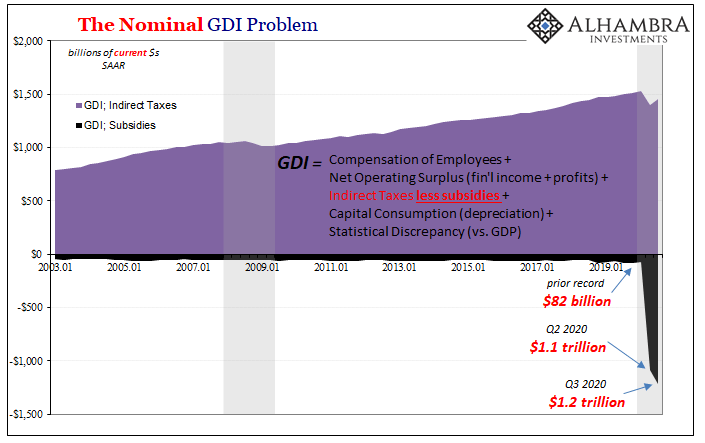

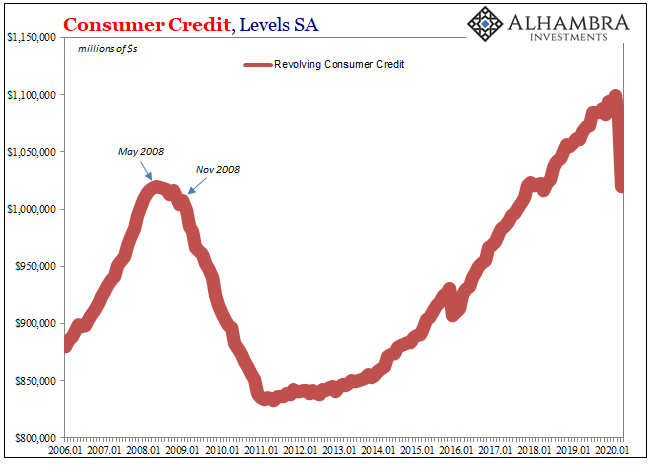

| Late last month, the Bureau of Economic Analysis (BEA) further proved the lack of stimulation in the massive government subsidies which have been paid out since the CARES Act was passed in late March. The effect in the economic accounting, as in reality, was to make things seem better than they really are.

In this case, literal jobs saved for once. Saved for what, though? This is not the same thing as recovery. In its second estimates for Q3 GDP, the BEA also provides the first set of estimates for corporate profits within the US economy. In some classifications, these absolutely surged, skyrocketed; and I don’t just mean from Q2 to Q3. In the case of after tax corporate profits (not including inventory valuations and deductions for amortized capital expenditures), the estimated level in Q3 2020 was a whopping 21% better than it had been in Q3 2019. |

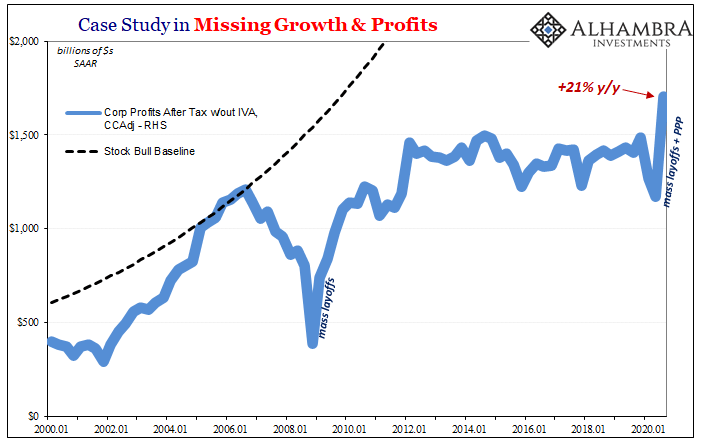

Case Study in Missing Growth & Profits, 2000-2020 |

| Not only is that the highest on record, it shatters the previous high from way back in 2014 (though still woefully short of the pre-crisis bull market trend).

So, why aren’t companies bringing back workers by the busload? As I had previously pointed out with the release of the preliminary Q3 GDP estimates, in a word, subsidies. |

The Nominal GDI Problem, 2003-2019 |

The Nominal GDI Problem |

|

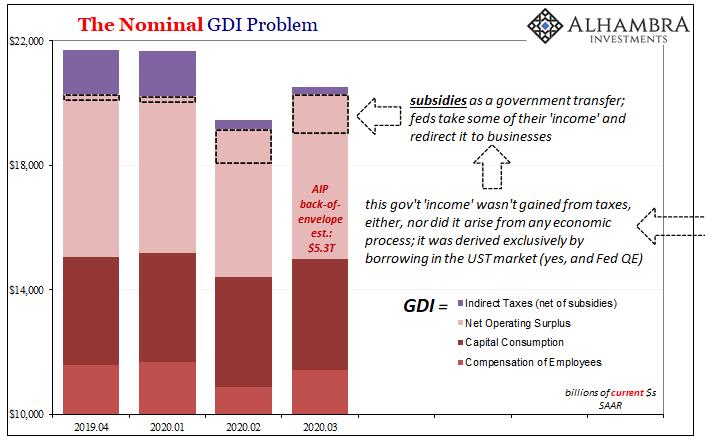

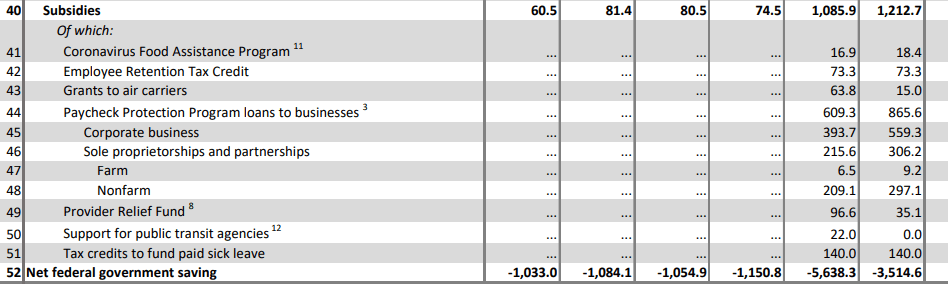

| The BEA’s updated data gives us a pretty good sense of how these have impacted specifically corporate business (and non-corporate proprietor’s firms, too, but our focus here is on corporates). The major component in the government subsidies, so far as corporate profits are concerned, has been the Paycheck Protection Program (PPP) in which the federal government initially lent hundreds of billions to companies of all sizes.

Those loans have been categorized instead as subsidies, because that’s really what they are. So long as any business uses the funds as the government intends, not reducing payrolls, as the name implies, these loans will convert into grants, meaning for GDI purposes they aren’t treated as corporate loans but, again, corporate subsidies. Very profitable ones. |

|

| The numbers are, as expected, massive:

The figures shown above are seasonally-adjusted annual rates, but still the contributions so far as corporate profits (and proprietor’s profits) are concerned are unlike anything ever seen before. You can’t really subtract the amount of the PPP subsidy paid to corporate business shown above ($559.3 billion) from the GDP estimate of corporate profits, but if you did just to get another back-of-the-envelope sense of where things stand it would reduce economic profits down to somewhere probably less than what was figured for Q1 2020. Q1 had already put Corporate America in a huge hole. And it only gets worse from there; if you use profit estimates taken before taxes, cuts to which have also increased bottom lines, while also including IVA and CCadj, even with these massive subsidies the estimated aggregate for Q3 was barely equal to what it had been in Q4 last year. |

Case Study in Missing Growth & Profits, 1949-2019 |

Case Study in Missing Growth & Profits, 2000-2020 |

|

Thus, no wonder businesses are in no mood to hire more…because there’s not any more work (revenue potential) that needs getting done. Instead, corporate profits, like the economic rebound represented by GDP and GDI, are hugely inflated and artificial. As I wrote at the end of October when first breaking down the impact of these subsidies:

|

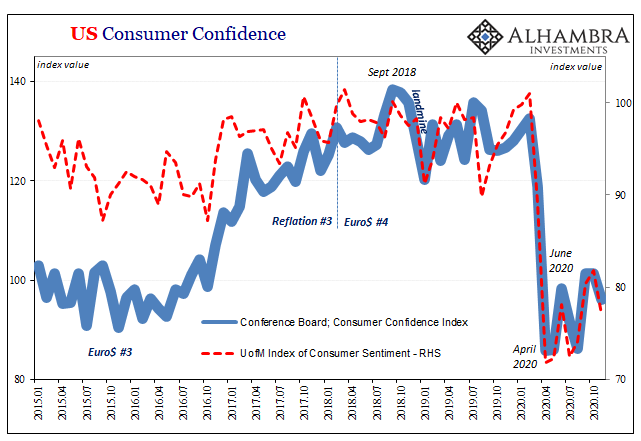

US Consumer Confidence, 2015-2020 |

| It’s instead the very obvious symptom of a deeply troubled underlying state.

And that’s why government “stimulus” doesn’t really stimulate. It has, however, in this specific case, actually saved jobs. But, and here’s the thing, many people are working at what they realize aren’t real jobs any longer so much as the creation of zombie labor beneficiaries of artificial and inflated PPP corporate windfalls. There isn’t more work, or even a return of work, for these workers to do, so, despite still being paid, they have to realize the company they work for (on average) continues to fundamentally struggle because the economic rebound doesn’t match the size of the GDP estimates. Even this significant slice of the workforce, therefore, must be cautious knowing just how precarious their own position must be – on top of the signals corporate (and proprietor’s) businesses are sending with their own quite rational caution about sustained reluctance to expand payroll levels and employment overall. These are all things connected to a lack of economic recovery. |

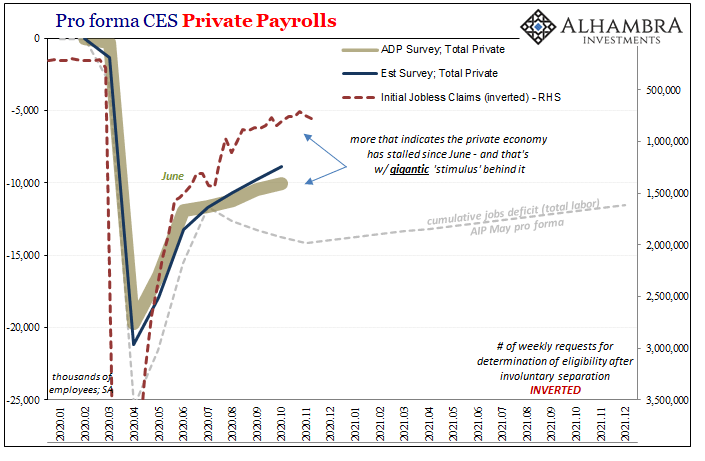

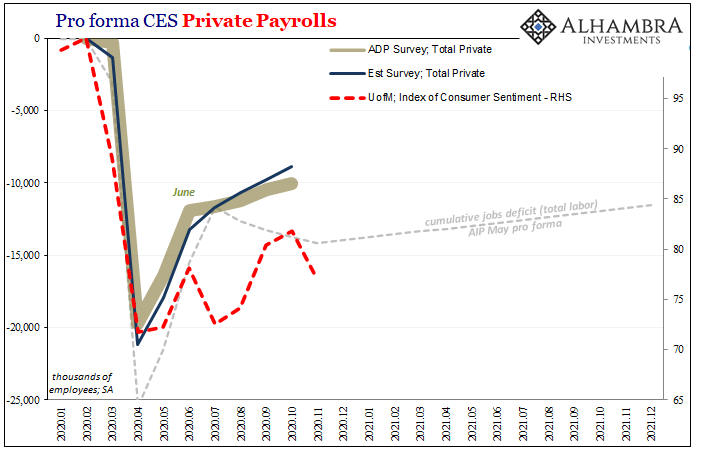

Pro forma CES Private Payrolls, 2020-2021 |

| And that’s why “stimulus” not only doesn’t stimulate, it’s once again “the only game in town.” If only actual, genuine, legitimate economic growth was. |

Pro forma CES Private Payrolls, 2020-2021 |

Pro forma CES Private Payrolls, 2020-2021 |

Tags: CARES Act,corporate profits,currencies,economy,employment,Featured,Federal Reserve/Monetary Policy,gdi,GDP,jobless claims,Labor Market,Markets,newsletter,paycheck protection program,U.S. ISM Manufacturing PMI,Unemployment