We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »Swiss Producer and Import Price Index in March 2022: +6.1 percent YoY, +0.8 percent MoM

14.04.2022 – The Producer and Import Price Index increased in March 2022 by 0.8% compared with the previous month, reaching 107.0 points (December 2020 = 100). Higher prices were seen for petroleum products in particular. Basic metals and semi-finished metal products also became more expensive. Compared with March 2021, the price level of the whole range of domestic and imported products rose by 6.1%. These are the results from the Federal Statistical Office (FSO)....

Read More »75 percent of Swiss citizens living abroad have more than one nationality

07.04.2022 – At the end of 2021, more than one in ten Swiss citizens lived abroad. This was a 1.5% increase compared with 2020. Most of these citizens lived in Europe. Regardless of the continent in which they lived, the majority were aged between 18 and 64. Reflecting Switzerland’s multicultural nature, many of them also had more than one nationality, according to the results of the statistics on the Swiss abroad from the Federal Statistical Office (FSO). In 2021,...

Read More »Swiss Consumer Price Index in March 2022: +2.4 percent YoY, +0.6 percent MoM

01.04.2022 – The consumer price index (CPI) increased by 0.6% in March 2022 compared with the previous month, reaching 103.0 points (December 2020 = 100). Inflation was +2.4% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The 0.6% increase compared with the previous month is due to several factors including rising prices for fuel. Heating oil also recorded a price increase, as did air transport. In...

Read More »In 2020, the median wage was CHF 6665

28.03.2022 – For the entire Swiss economy (private and public sectors together), the gross monthly median wage for a full-time job was CHF 6665 in 2020. The gap between the highest and lowest earners in the wage pyramid remained stable overall between 2008 and 2020. The Swiss wage landscape continues to be characterised by major differences between the economic sectors and regions. More than a third of employees (36.3%) received bonuses and one in ten people...

Read More »More than 30 300 digital offences in 2021

28.03.2022 – In 2021, the police recorded 30 351 offences having a digital component, i.e. an increase of more than 24% compared with the previous year, according to results from the Federal Statistical Office’s (FSO) Police crime statistics (PCS). In the same year, 15 women and one man were killed by their current or previous partner. Furthermore, of the 3455 minors reported for acts of violence, 261 were reported for serious violence, an increase compared with...

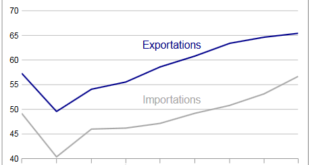

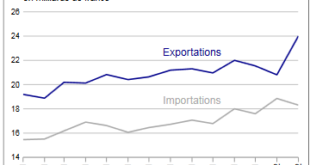

Read More »Swiss Trade Balance February 2022: chemicals-pharma propels exports to a record level

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

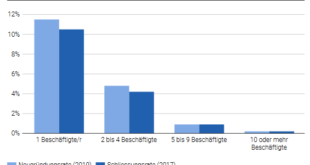

Read More »A record number of new businesses in 2019

14.03.2022 – In Switzerland, 42 606 businesses were started from scratch in 2019. This figure, the highest ever recorded, represents growth of 8.0% compared with the previous year. In the same year, the number of high growth enterprises also reached a record, with 4803 units (+8.1% compared with 2018). One high growth enterprise in twenty was less than five years old. Such businesses are referred to as gazelle companies. These are the some of the results from the...

Read More »Customs in 2021: more product piracy and non-compliant animal imports

Bern, 03.10.2022 – The figures for the year 2021 from the Federal Office for Customs and Border Security (OFDF) are again marked by the COVID pandemic. Due to the boom in e-commerce, the number of shipments seized for product piracy has once again increased significantly. Cases in the field of animal protection have also increased sharply. In addition, the number of records of migrants who entered Switzerland irregularly was higher than in 2020. Receipts increased...

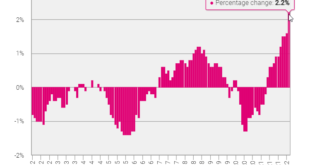

Read More »Swiss Inflation Rises to 2.2%

Swiss Inflation rises to 2.2%. This for Swiss levels very high inflation means that the Swiss franc has still upwards potential, in particular given the current political events. What is particular worrysome for the SNB is that prices for private services have risen by 1.4%. It is hence not only oil that drives the high price increases. Details in German Swiss Consumer Price Index in February...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org