We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list. To

Topics:

George Dorgan considers the following as important: 2.) Trade Balance News Service Bunt [FR], 2) Swiss and European Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

Texts and Charts from the Swiss customs data release (translated from French).

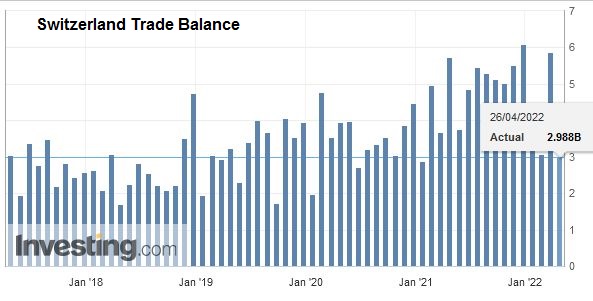

| Swiss foreign trade also grew in the 1st quarter of 2022, climbing to a record level. Imports strengthened further (+6.7%) while exports lost ground somewhat (+1.2%). Both at entry and exit, prices stood at very high levels. Due to different trends in the two directions of traffic, the trade balance surplus fell sharply (–2.8 billion francs).

In short ⇑Exports: machinery and electronics as well as metals confirm their growth ⇑Imports of energy products: +46% over one quarter (price effect) ⇑Increase in exports to North America and Asia |

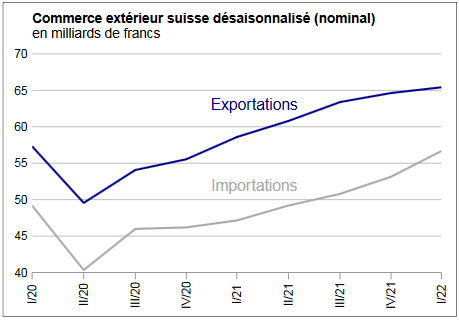

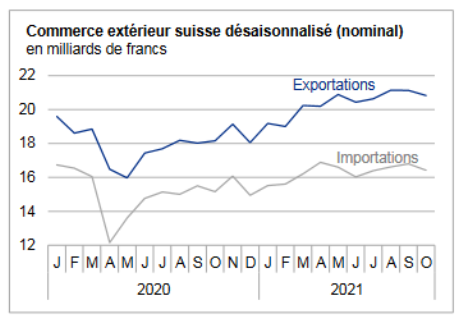

Swiss exports and imports, seasonally adjusted (in bn CHF), March 2022 |

Global developmentDuring the 1st quarter of 2022, seasonally adjusted exports increased by 1.2% or 791 million francs (actual: +2.4%), thus posting their seventh consecutive quarterly growth. Imports swelled by 6.7% (actual: +2.7%), up by 3.5 billion francs compared to the previous quarter. Both directions of traffic thus reached a record level. The trade surplus for the 1st quarter of 2022 stood at 8.7 billion francs, the smallest recorded since the 3rd quarter of 2020. |

Switzerland Trade Balance, March 2022(see more posts on Switzerland Trade Balance, ) Source: investing.com - Click to enlarge |

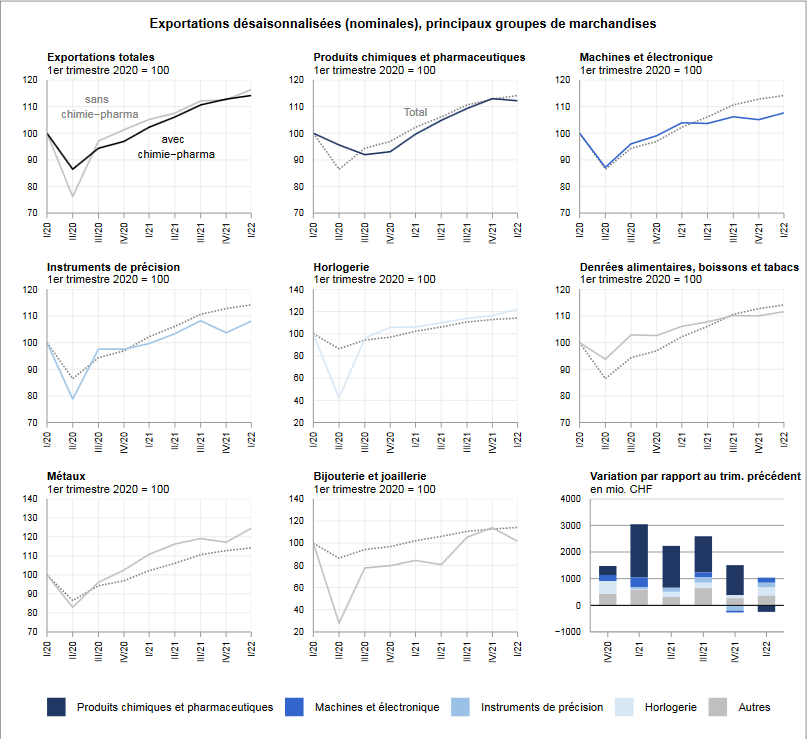

Watch exports: fourth successive quarterly growthOn exit, watchmaking (+5.3% or +306 million francs) made the strongest contribution to growth. Metals (+6.3% or +231 million) as well as the machinery and electronics sector (+2.4%; +190 million) completed the podium. Exports of precision instruments accelerated by 4.2% (+181 million). These four sectors thus confirmed their dynamism of the previous quarters. Conversely, sales of chemical and pharmaceutical products fell slightly (–0.7% or –247 million). Despite the boom in immunological products (+7.1%), the decline in active ingredients (–10.0%) drove the group’s results into the red zone. Jewelry store and jewelry (–10.8% or –337 million) also suffered a setback. Exports to North America and Asia progressed at the same rate (+3.7% or +492 million francs respectively +3.6% or +489 million) while those to Europe stagnated at 37.5 billion francs. Towards the first, shipments to the USA (pharma) grew by 5.0% (+611 million) to reach a record quarterly level. On the Asian side, China and Japan shone, this duo posting a cumulative increase of almost half a billion francs. On the Old Continent, while exports increased in particular to Slovenia (pharma), Germany and Italy (cumulative: +585 million), those to Spain fell by 541 million francs over a quarter. |

Swiss Exports per Sector March 2022 vs. 2020 |

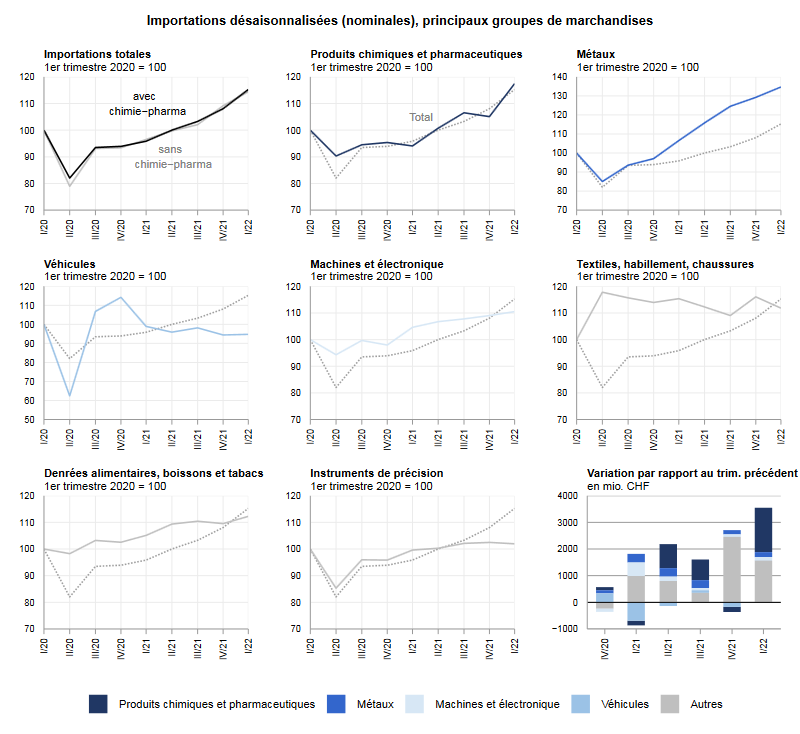

Imports: three-quarters of major groups upApart from jewels and jewelery (–15.1%), the textile, clothing and footwear sector (–3.7%) as well as precision instruments (–0.5%), all the other sectors saw their imports decline. amplify during the 1st quarter of 2022. The strongest contribution can be attributed to energy products, which jumped by 1.8 billion francs; however, this growth can only be explained by the surge in prices and not by an increase in volumes (+0.8%). Chemicals and pharmaceutical products also shone with an increase of 11.8% (+1.7 billion francs). Arrivals of metals also increased (+187 million or +4.2%), confirming their positive trend of the last seven quarters. Among the main markets, imports from Europe (+10.9%) and North America (+9.4%) took the lift. Those of Germany (+1.7 billion francs), Slovenia (+520 million), Austria and Ireland posted double-digit growth. The USA followed suit (+12.1% or +376 million). Arrivals from Asia stagnated (+0.4%), like China, which evolved at a similar level to the previous quarter (+0.2%). Singapore shipments swelled by 14.7%, proving to be twice as high as those of the 1st quarter of 2019. |

Swiss Imports per Sector Marc 2022 vs. 2020 |

Tags: Featured,newsletter