We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Les économistes de Suisse disent NON à Monnaie pleine. Sondage KOF.

Les économistes d’universités et d’instituts de recherche de Suisse ont été invités à donner leur avis sur la votation, du 10 juin 2018. Malgré le message ambitieux: « Pour une monnaie à l’abri des crises : émission monétaire uniquement par la banque nationale !», le titre n’a pas suffi à accrocher les répondants à l’enquête d’opinion menée par le Centre de recherche économique KOF de l’Ecole Polytechnique de Zurich....

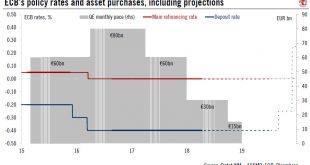

Read More »ECB: contingency plans

A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle. Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance. Still, downside risks have risen to the point where another open-ended QE...

Read More »PMIs point to downside risk to near term euro area growth

Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago. The deterioration...

Read More »Eurosceptic Italian government faces a reality check

More than two months after the general election, the Italian political impasse seems close to being broken, with the League and the Five Star Movement (M5S) likely to form a government. M5S and the League together have a majority in both the upper and lower houses. After several document leaks this week, a final common programme was published today. The document needs the approval of party members. The focus will shift...

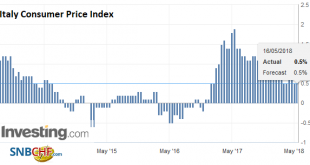

Read More »Italy Defies Gravity and Risk to Fiscal Rectitude

Italian asset markets continue to fare better than many expected. The political uncertainty following the March election has been followed by confidence that the Five Star Movement and the (Northern) League will be able to put together a government in the coming days. If so, Italy would have taken half the time Germany did to cobble a government together after inconclusive elections. Politics makes for...

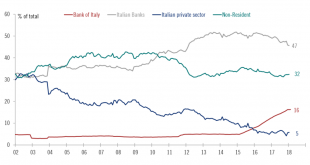

Read More »Europe chart of the week – Italy’s fiscal buffers

The incoming government’s fiscal plans could result in a sharp deterioration of Italy’s public finances. However, broader fiscal metrics are better than they were during the euro sovereign crisis. The M5S-League coalition has committed to a significant degree of fiscal easing and to the reversal of some structural reforms. Such policies will put Italy on course for confrontation with Brussels over deficit reduction...

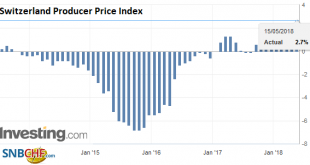

Read More »Swiss Producer and Import Price Index in April 2018: +2.7 percent YoY, +0.4 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »Spaniards back in the mood to borrow

Before the financial crisis, the real estate bubble and the parallel growth in borrowing meant that the indebtedness of Spanish households spiralled ever higher, reaching a peak of 84.7% of GDP in Q2 2010. Since then, Spanish’s households have tightened their belt, with indebtedness falling to 61.3% of GDP in Q4 2017. However, recent data suggest that the situation might be changing again. Indeed, in 2017, households...

Read More »Switzerland: ‘Sovereign money’ initiative

Switzerland: A Test Bed for Radical Ideas The ‘Sovereign money’ initiative, to be voted on in June, aims at a fundamental reform of the Swiss monetary system. In a nutshell, the initiative asks that the creation of money and the granting of loans be separated by barring commercial banks from creating deposits through lending. According to the initiative’s promoters the “Swiss National Bank (SNB) should be the sole...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org