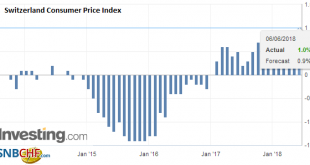

Neuchâtel, 6 June 2018 (FSO) – The consumer price index CPI) increased by 0.4% in May 2018 compared with the previous month, reaching 102.1 points (December 2015=100). Inflation was 1.0% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.4% increase compared with the previous month can be explained by several factors including rising prices for...

Read More »Espagne, victime des crises, de grands travaux inutiles, et de la… corruption. Nicolas Klein

Espagne, victime des crises, de grands travaux inutiles, et de la… corruption. Nicolas Klein Les grands travaux inutiles financés avec l’argent public, et qui engendrent dettes, déficits, et menaces de faillite, ont besoin de politiciens corrompus… Dans le contexte morose initié en 2008, l’Espagne était considérée (et l’est encore par beaucoup) comme un « pays à risque » au regard de la rapide dégringolade qu’elle a...

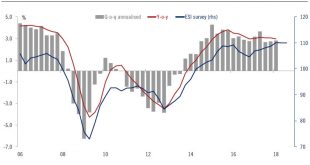

Read More »Europe chart of the week – Spanish growth

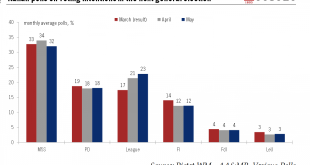

Amid domestic political uncertainty, Spanish growth remains strong. This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver. The carryover effect for 2018 reached 2.8%,...

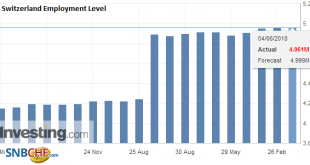

Read More »Employment barometer in the Q1 2018: Fastest growth in employment in industry for 10 years

Neuchâtel, 4 June 2018 (FSO) – In the 1st quarter 2018, total employment (number of jobs) rose by 1.6% in comparison with the same quarter a year earlier (+0.6% with previous quarter, +1.7% in full-time equivalents). The Swiss economy counted 77 000 more jobs and 11 000 more vacancies than in the corresponding quarter of the previous year. There was also an increase in the employment outlook indicator (+2.0%) and...

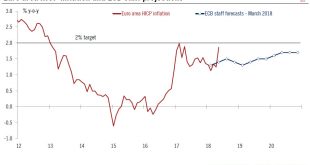

Read More »Euro area inflation close to ECB target in May

Euro Area HICP Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%). This sharp rebound in inflation will provide the ECB with a critical input for its looming decision on...

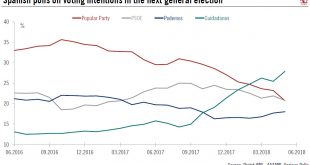

Read More »Spain Snap Elections in Sight

Political instability in Spain has added to turmoil in other peripheral countries. The situation is not comparable with the one that Italy is experiencing at the moment, but since it comes at the same time it is increasing market volatility. Last Friday, Spain’s main oppositionparty, the Socialist party (PSOE) filed a no confidence vote against Prime Minister Mariano Rajoy. The debate will start on May 31 with a vote...

Read More »Italy heads towards new elections

Fragmented politics and the risk of a financial crisis continue to hang over the country. This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo...

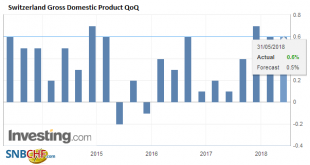

Read More »Switzerland Q1 GDP: +0.6 percent QoQ

Switzerland’s real gross domestic product (GDP) grew by 0.6% in the 1st quarter of 2018.* Although growth lost some momentum in comparison to the second half of 2017, it was nevertheless broad-based across the various business sectors. The secondary sector expanded modestly, while growth in several service sectors accelerated, including in trade and business-related services. The entertainment industry recorded strong...

Read More »Swiss Retail Sales, April: +2.2 Percent Nominal and -0.1 Percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »KOF Economic Barometer: Falls Back to its Long-term Average

The KOF Economic Barometer for May fell by 3.3 points to a new standing of exactly 100 points. The last time the Barometer had a similar standing was in December 2015. The current value of 100 points to an average development of the Swiss economy in the coming months. In May, the KOF Economic Barometer fell by 3.3 points to 100 points from revised 103.3 in April (first publication in April: 105.3). Within a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org