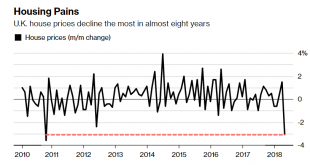

Halifax index shows property values plunged 3.1% in April Less volatile three-month measure also shows a decline U.K. home prices plunged the most in almost eight years in April, adding to signs of weakness in Britain’s property market. Values dropped 3.1 percent from March to an average 220,962 pounds ($299,140), mortgage lender Halifax said in a report Tuesday. That’s the biggest drop since September 2010. While that...

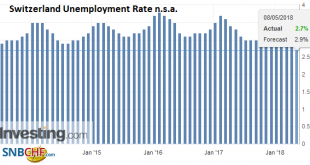

Read More »Switzerland Unemployment in April 2018: Down to 2.7 percent from 2.9 percent, seasonally adjusted decreased from 2.9 percent to 2.7 percent

Unemployment Rate (not seasonally adjusted) Registered unemployment in April 2018 – According to the State Secretariat for Economic Affairs (SECO), at the end of April 2018, 119,781 unemployed were registered at the Regional Employment Centers (RAV), 10,632 less than in the previous month. The unemployment rate fell from 2.9% in March 2018 to 2.7% in the month under review. Compared with the same month of the...

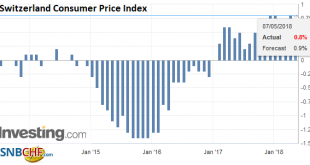

Read More »Swiss Consumer Price Index in April 2018: +0.8 percent YoY, +0.2 percent MoM

The consumer price index (CPI) rose by 0.2% in April 2018 compared with the previous month, reaching 101.7 points (December 2015=100). In comparison with the same month of the previous year, inflation stood at 0.8%. These figures were compiled by the Federal Statistical Office (FSO). Switzerland Consumer Price Index (CPI) YoY, Jun 2013 - May 2018 - Click to enlarge Swiss Consumer Price Index in April 2018 German...

Read More »Europe chart of the week – Corporate Sector Soft Patch

Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bonds purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of...

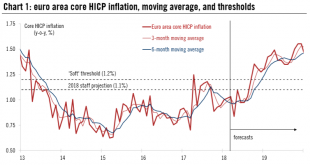

Read More »Policy normalisation may be delayed in Europe

Communication from European central banks over the last few weeks has been consistent with a more cautious stance and, in some cases, is likely to lead to delays in their monetary policy normalisation plans. Each situation is different, with a loss in economic momentum, subdued underlying inflation, and political risks playing a role to varying degrees in the euro area, the UK, Switzerland and Sweden. At the same time,...

Read More »Euro area growth: somewhere between hard and soft data

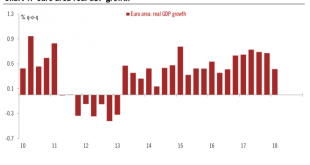

According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.4% q-o-q in Q1 2018 (1.7% q-o-q annualised, 2.5% y-o-y), in line with consensus expectations (0.4%) and down from an upwardly revised figure of 0.7% q-o-q for Q4 2017. The implications of the growth slowdown on ECB staff projections should remain limited, in our view. In March, they had pencilled in 0.7% q-o-q GDP growth for Q1, but...

Read More »Europe chart of the week – public debt

This week’s Eurostat releases revealed that public finances continue to improve in most euro area member states. As a result of falling deficits, low interest rates and stronger nominal growth, the ratio of euro area government debt to GDP fell to a six-year low of 86.7% in Q4 2017. Although sovereign debt sustainability remains shaky in countries like Italy, it is fair to say that we have moved from self-defeating...

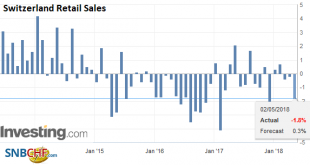

Read More »Swiss Retail Sales, March: -1.2 Percent Nominal and +0.1 Percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

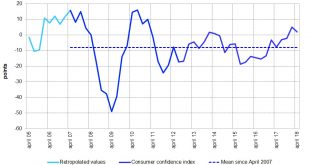

Read More »Swiss Consumers remain optimistic

Bern, 02.05.2018 – Although Swiss consumer sentiment has not shown any further improvement, it remains far above average this April, with the index coming in at 2 points. After a sharp rise in January, consumers’ expectations regarding economic growth have returned to the level seen in late 2017. Consumers remain optimistic about the labour market trend. About their purchasing power they are more circumspect than they...

Read More »Euro weakness should prove temporary

Over the past 10 days, the euro has declined significantly against the US dollar. On 26 April, the EUR/USD rate moved below the low of its 1.21501.2550 trading range, which had been in place since 18 January. Reasons for this decline can be found in the growth differential and monetary policy divergence. Indeed, moderation in leading indicators (from elevated levels) in the euro area and a cautious ECB (given muted...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org