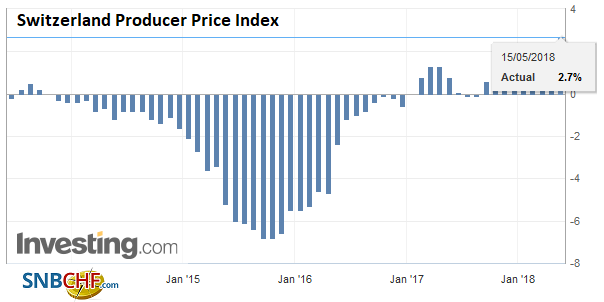

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued? Neuchâtel, 15 May 2018 (FSO) – The Producer and Import Price Index increased in April

Topics:

George Dorgan considers the following as important: 2) Swiss and European Macro, Featured, newslettersent, Switzerland Producer Price Index

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued?

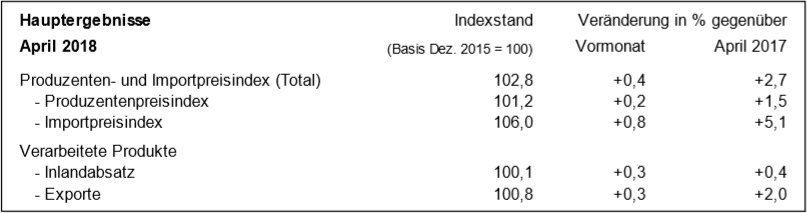

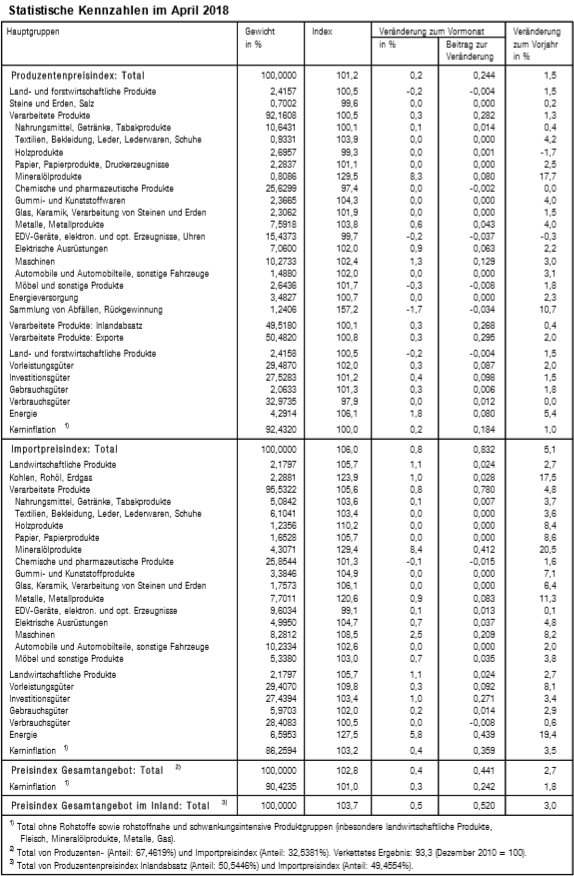

| Neuchâtel, 15 May 2018 (FSO) – The Producer and Import Price Index increased in April 2018 by 0.4% compared with the previous month, reaching 102.8 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products and machinery. Compared with April 2017, the price level of the whole range of domestic and imported products rose by 2.7%. These are some of the findings from the Federal Statistical Office (FSO). |

Switzerland Producer Price Index (PPI) YoY, Jun 2013 - May 2018(see more posts on Switzerland Producer Price Index, ) Source: Investing.com - Click to enlarge |

Download press release Producer and Import Price Index rises by 0.4% in April 2018

German Text:

| Neuchâtel, 15. Mai 2018 (BFS) – Der Gesamtindex der Produzenten- und Importpreise erhöhte sich im April 2018 gegenüber dem Vormonat um 0,4 Prozent und erreichte den Stand von 102,8 Punkten (Dezember 2015 = 100). Der Anstieg ist vor allem auf höhere Preise für Mineralölprodukte und Maschinen zurückzuführen. Im Vergleich zum April 2017 stieg das Preisniveau des Gesamtangebots von Inland- und Importprodukten um 2,7 Prozent. Dies geht aus den Zahlen des Bundesamts für Statistik (BFS) hervor.

Für den Anstieg des Produzentenpreisindexes gegenüber dem Vormonat waren insbesondere die höheren Preise für Maschinen verantwortlich. Dasselbe gilt für Mineralölprodukte, elektrische Ausrüstungen und Metallprodukte. Preisrückgänge beobachtete man dagegen für Uhren und Schrott. Steigende Preise gegenüber dem März 2018 registrierte man im Importpreisindex vor allem für Mineralölprodukte und Maschinen. Teurer wurden auch Metallprodukte, Computer, elektrische Ausrüstungen, Erdöl und Erdgas, Roheisen, Stahl und Möbel. Billiger wurden hingegen Nichteisen-Metalle und daraus hergestellte Produkte, Mess- und Kontrollinstrumente sowie Uhren. |

Tags: Featured,newslettersent,Switzerland Producer Price Index