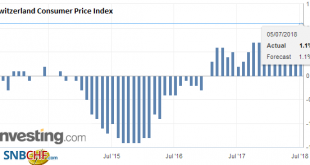

Neuchâtel, 5 July 2018 (FSO) – The consumer price index (CPI) remained stable in June 2018 compared with the previous month, reaching 102.1 points (December 2015=100). Inflation was 1.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The stability of the index compared with the previous month is the result of opposing trends that counterbalanced each...

Read More »Swiss Retail Sales, May: +0.2 percent Nominal and -1.2 percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »KOF Economic Barometer: Economic Outlook Improves Slightly

The KOF Economic Barometer rose again in June for the first time in three months. It increased by 1.7 points to 101.7 points, stopping its downward tendency in spring. The current Barometer value is now slightly above the long-term average of 100.0. Thus, the KOF Economic Barometer indicates a slightly above-average economic development in Switzerland. The tailwind for the Swiss economy is no longer as strong as during...

Read More »Tourism Balance of Payments Slightly Negative in 2017

Neuchâtel, 28 June 2018 (FSO) – For the second consecutive year, the tourism balance of payments was negative in 2017. This means that expenditure by Swiss residents during visits abroad exceeded the expenditure of non-residents during their stay in Switzerland. In an economic climate still marked by a strong franc, the tourism balance of payments was CHF -122 million, according to initial estimates from the Federal...

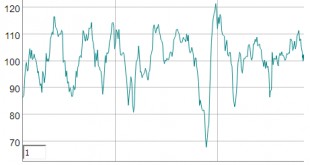

Read More »London House Prices Fall 1.9 percent In Quarter – Bubble Bursting?

London house prices down 1.9 per cent in Q2 (yoy) London house prices still 50% above 2007 bubble peak (see chart) Brexit and weak consumer confidence to blame say experts Little sign that U.K. property “weakness” is likely to change London property bubble appears to be bursting Editors Note: The London property bubble appears to be in the early stages of bursting. House prices are falling with reports of falls of as...

Read More »Swiss Balance of Payments and International Investment Position: Q1 2018

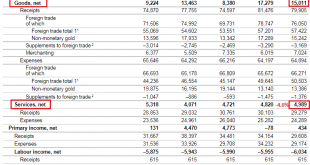

Current Account The current account surplus amounted to CHF 18 billion, a CHF 5 billion increase over the year-back quarter. It was calculated as the sum of all receipts (CHF 149 billion) minus the sum of all expenses (CHF 131 billion). Key figures: Current Account: Up 41% against Q1/2017 to 18.1 bn. CHF of which Goods Trade Balance: Up 62.7% against Q1/2017 to 15.1 bn. of which the Services Balance: Minus 6.2% to...

Read More »Rise in Bund yield will be limited

With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous note. Euro area business cycle slowdown After a very strong end to 2017, euro area economic growth has...

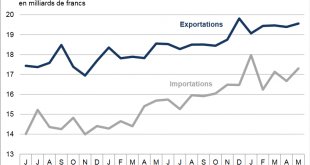

Read More »Swiss Trade Balance May 2018: Foreign trade overcomes stagnation

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

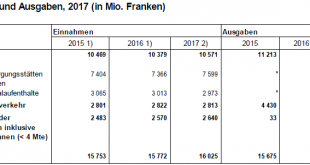

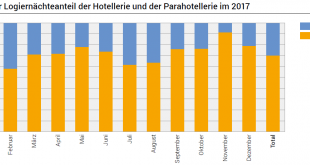

Read More »Tourist accommodation in 2017: supplementary accommodation recorded growth in overnight stays of close to 7 percent

Neuchâtel, 18 June 2018 (FSO) – In 2017, supplementary accommodation posted a total of 15.9 million overnight stays, i.e. an increase of 6.9% compared with 2016. With 10.8 million units, Swiss visitors represented more than two-thirds of demand (68.3%), i.e. a rise of 7.0%. Foreign visitors registered a 6.6% increase with 5.0 million units. Among this clientele, European visitors generated the most overnight stays with...

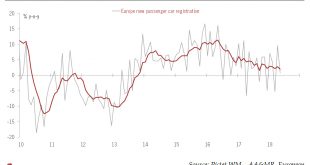

Read More »European cars at a crossroad

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry. The motor vehicle industry is of major importance to the EU economy and to global trade. According to Eurostat, total exports (to countries outside the EU) amounted to EUR205bn in 2017. Germany accounted for 52% of total motor exports. The US was the largest destination for EU motor...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org