The 2019 Annual Report of the Swiss National Bank is published on the SNB website. Download PDF Related posts: Swiss National Bank expects annual profit of 49 billion francs 2019-10-22 – Swiss National Bank opens SNB Forum for interested expert audience The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019 Swiss National Bank expects profit of CHF49 billion for 2019...

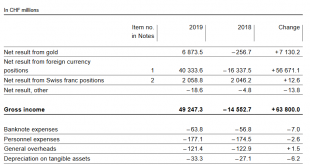

Read More »SNB Profit in 2019: 48.9 billion (2018: loss of CHF 14.9 billion, 2020 Does not Look Good)

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More »2020-02-17 – The SNB’s Karl Brunner Distinguished Lecture Series: Carmen Reinhart to hold fifth lecture

The SNB’s Karl Brunner Distinguished Lecture Series:Carmen Reinhart to hold fifth lecture The Swiss National Bank is honouring Carmen Reinhart with this year’s Karl Brunner Distinguished Lecture Series. Carmen Reinhart is an influential economist who has made outstanding contributions to macroeconomics. She has been Professor of the International Financial System at Harvard Kennedy School since 2012, and also currently serves on the Economic Advisory Panel of the...

Read More »Central bank group to assess potential cases for central bank digital currencies

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency (CBDC) in their home jurisdictions. The group will assess CBDC use cases; economic, functional and technical design choices, including cross-border...

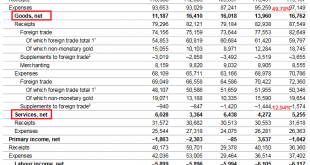

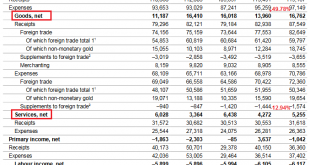

Read More »Swiss Balance of Payments and International Investment Position: Q3 2019

Current Account In summary: Nearly any change against the third quarter of 2018. About the same figures. But clearly and – as usual – a massive surplus. Key figures: Current Account: Up 39.15% against Q3/2018 to 18.09 bn. CHF of which Goods Trade Balance: Plus 49.78% against Q3/2018 to 16.76 bn. of which the Services Balance: Minus 12.94% to 5.25 bn. of which Investment Income: Plus 25.74% to 5.08 bn. CHF. Current Account Switzerland Q3 2019(see more posts on...

Read More »Swiss Balance of Payments and International Investment Position: Q3 2019

Current Account In summary: Nearly any change against the third quarter of 2018. About the same figures. But clearly and – as usual – a massive surplus. Key figures: Current Account: Up 39.15% against Q3/2018 to 18.09 bn. CHF of which Goods Trade Balance: Plus 49.78% against Q3/2018 to 16.76 bn. of which the Services Balance: Minus 12.94% to 5.25 bn. of which Investment Income: Plus 25.74% to 5.08 bn. CHF. Current Account Switzerland Q3 2019(see more posts on...

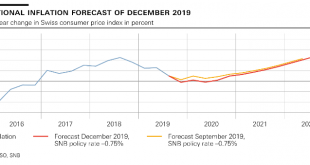

Read More »Monetary policy assessment of 12 December 2019

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. It remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The expansionary monetary policy continues to be necessary given the inflation outlook in Switzerland. The trade-weighted exchange rate of the Swiss franc...

Read More »2019-12-03 – Amendment of National Bank Ordinance

Changes due to entry into force of FinSA/FinIA andadjustments to minimum reserve requirements The Swiss National Bank is amending the National Bank Ordinance (NBO). Various terms used in the NBO will be revised in connection with the entry into force of the Financial Services Act (FinSA) and the Financial Institutions Act (FinIA) as of 1 January 2020. Moreover, technical adjustments will be made to the statistical surveys in the Annex to the NBO. And finally, two...

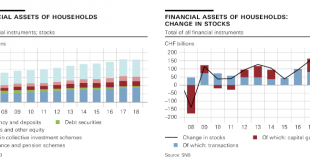

Read More »Swiss Financial Accounts, 2018 edition

Capital losses and transactions influence household financial wealth The financial assets of households were influenced by two factors in 2018: First, falling share prices led to high capital losses and, second, households grew their financial wealth through transactions. They increased their insurance and pension scheme entitlements, expanded their bank deposits and invested in securities. Overall, household financial assets fell slightly by CHF 14 billion to CHF...

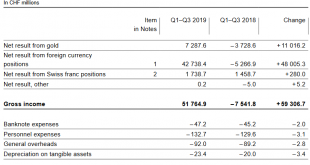

Read More »The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org