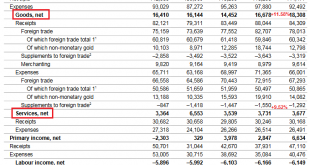

Current Account Key figures: Current Account: Down 13.72% against Q1/2019 to 17.4 bn. CHF of which Goods Trade Balance: Plus 8.05% against Q1/2019 to 17.4 bn. of which the Services Balance: Minus 53.84% to 3.02 bn. of which Investment Income: Minus 0.54% to 6.3 bn. CHF. Current Account Switzerland Q1 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch...

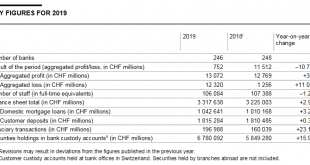

Read More »Banks in Switzerland 2019

The Swiss National Bank has today published its report Banks in Switzerland 2019 and the corresponding data for its annual banking statistics.1 The most important figures are summarised below. 1The figures in Banks in Switzerland are based on data in banks’ (parent companies’) individual financial statements, as required by law. The reporting entity ‘parent company’ includes bank offices in Switzerland and legally dependent branches abroad. Banks’ consolidated...

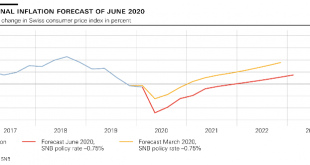

Read More »SNB Monetary Policy Assessment June 2020 and Videos

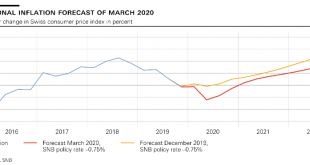

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic and the measures implemented to contain it have led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The SNB’s expansionary monetary policy remains necessary to ensure appropriate monetary conditions in Switzerland. The SNB is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and in light of the highly...

Read More »Announcement regarding recall of banknotes from eighth series

The issuance of the ninth banknote series was concluded on 12 September 2019. The Swiss National Bank intends to communicate the statutory recall of the banknotes from the eighth series two months in advance in the first half of 2021. Notes from the eighth series will remain legal tender until they are recalled and may continue to be used or exchanged without restriction. After their recall by the SNB, the banknotes lose their status as legal tender. They can,...

Read More »SNB COVID-19 refinancing facility expanded to include cantonal loan guarantees as well as joint and several loan guarantees for startups

The Swiss National Bank announced the establishment of the SNB COVID-19 refinancing facility (CRF) on 25 March 2020. This facility allows banks to obtain liquidity from the SNB by assigning credit claims from corporate loans as collateral. In so doing, the SNB enables banks to expand their lending rapidly and on a large scale. To date, the SNB has accepted as collateral for the CRF only credit claims in respect of loans guaranteed by the federal government under the...

Read More »SNB appoints new delegate Fabian Schnell for regional economic relations for Zurich region

With effect from 1 May 2020, Fabian Schnell will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Zurich region. He succeeds Rita Kobel Rohr, who is taking on a new position at the SNB’s General Secretariat on 1 July 2020. Fabian Schnell studied economics at the University of St. Gallen and completed his doctorate there. He is currently a Member of Management at Avenir Suisse and Head of Research in the Smart...

Read More »SNB appoints new delegate for regional economic relations for Zurich region

With effect from 1 May 2020, Fabian Schnell will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Zurich region. He succeeds Rita Kobel Rohr, who is taking on a new position at the SNB’s General Secretariat on 1 July 2020. Fabian Schnell studied economics at the University of St. Gallen and completed his doctorate there. He is currently a Member of Management at Avenir Suisse and Head of Research in the Smart...

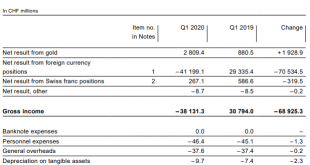

Read More »SNB Interim Results: -38 Billion, An Analysis

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Franc will rise again with crisis or inflation With a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again. Deflationary period (e.g. Corona Crisis)...

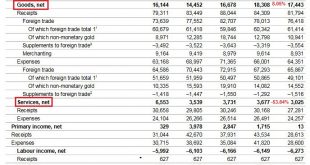

Read More »Swiss Balance of Payments and International Investment Position: Q4 2019 and review of the year 2019

Key developments in 2019 The current account surplus for 2019 was CHF 86 billion, CHF 29 billion more than the previous year. This increase was principally due to growth in primary income (labour and investment income). In the year under review, receipts exceeded expenses by CHF 14 billion, whereas in the two previous years, expenses had significantly exceeded receipts. The main contributors to this development had been finance and holding companies, which had...

Read More »Monetary policy assessment of 19 March 2020

Swiss National Bank maintains expansionary monetary policy, raises negative interest exemption threshold, and is examining additional steps Coronavirus is posing exceptionally large challenges for Switzerland, both socially and economically. Uncertainty has risen considerably worldwide, and the outlook both for the global economy and for Switzerland has worsened markedly. The Swiss franc is even more highly valued, and the world’s financial markets are under strong...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org