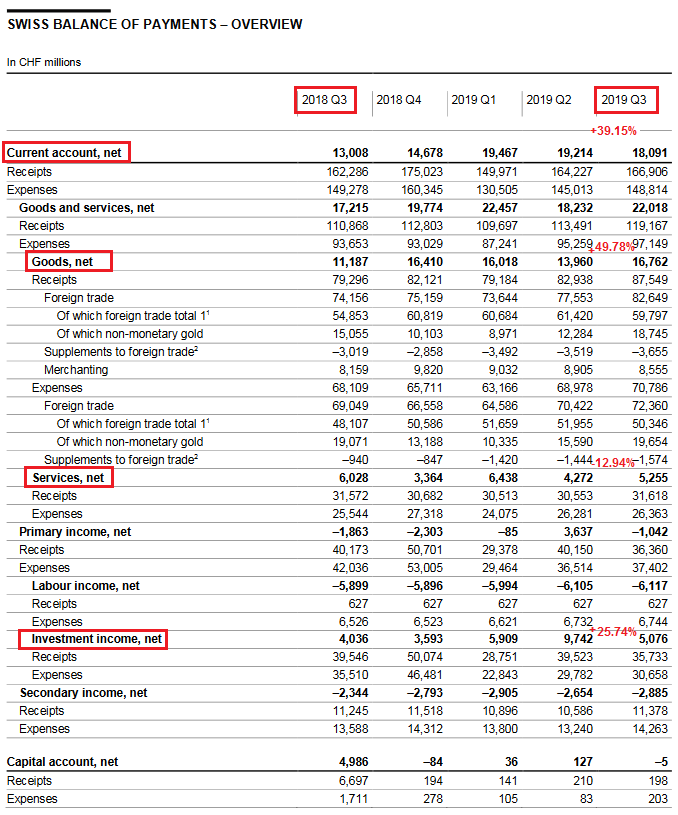

Current Account In summary: Nearly any change against the third quarter of 2018. About the same figures. But clearly and – as usual – a massive surplus. Key figures: Current Account: Up 39.15% against Q3/2018 to 18.09 bn. CHF of which Goods Trade Balance: Plus 49.78% against Q3/2018 to 16.76 bn. of which the Services Balance: Minus 12.94% to 5.25 bn. of which Investment Income: Plus 25.74% to 5.08 bn. CHF. Current Account Switzerland Q3 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) - Click to enlarge Financial account The following is from the official press release and gives more details on the other parts of the financial account. Net acquisition of

Topics:

George Dorgan considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter, Switzerland International Investment Position

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Current AccountIn summary: Nearly any change against the third quarter of 2018. About the same figures. But clearly and – as usual – a massive surplus. Key figures: Current Account: Up 39.15% against Q3/2018 to 18.09 bn. CHF

|

Current Account Switzerland Q3 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) |

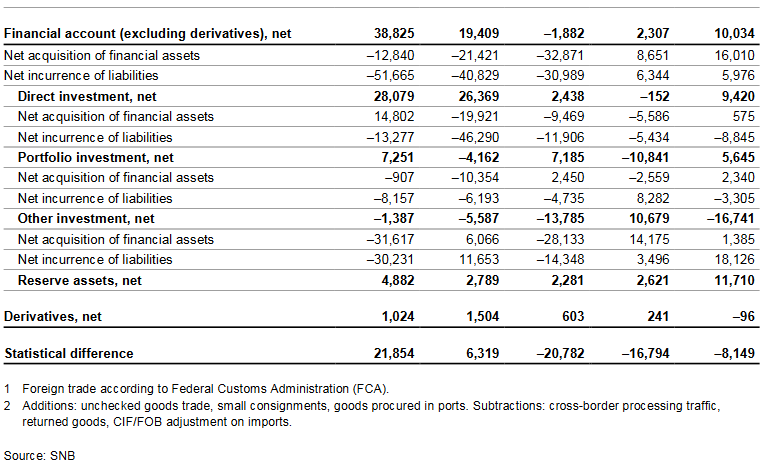

Financial accountThe following is from the official press release and gives more details on the other parts of the financial account.

|

Financial Account, Net, Q3 2019 |

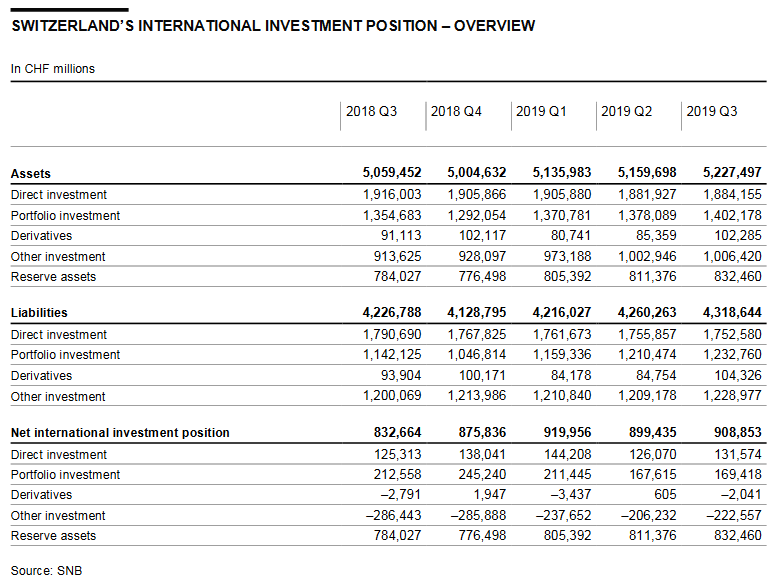

Switzerland’s International investment positionAssetsStocks of assets rose by a total of CHF 68 billion overall to CHF 5,227 billio n co mpared with the second quarter of 2019. This increase was mainly due to valuation gains in portfolio investment and reserve assets as a result of higher prices on foreign stock exchanges. Stocks of portfolio investment were up by CHF 24 billion to CHF 1,402 billion and those of reserve assets by CHF 21 billion to CHF 832 billion. Besides valuation gains, financial account transactions were another contributor to the growth in reserve assets. Stocks of derivatives also increased markedly by CHF 17 billion to CHF 102 billion. By contrast, there were only insignificant changes in the stocks of direct investment and other investment. LiabilitiesStocks of liabilities rose by CHF 58 billion overall to CHF 4,319 billion. Valuation gains in portfolio investment due to higher prices on the Swiss stock exchange contributed more than one-third of this increase. Stocks of portfolio investment were up by CHF 22 billion to CHF 1,233 billion. Other investment rose by CHF 20 billion to CHF 1,229 billion, primarily driven by an increase in transactions. Stocks of derivatives were also up by CHF 20 billion to CHF 104 billion. By contrast, stocks of direct investment declined by CHF 3 billion to CHF 1,753 billion due to financial account transactions. Net international investment positionGiven that stocks of assets (up CHF 68 billion) showed a more pronounced increase than stocks of liabilities (up CHF 58 billion), the net international investment position grew by almost CHF 10 billion to CHF 909 billion. |

Switzerland International Investment Position, Q3 2019(see more posts on Switzerland International Investment Position, ) Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,Switzerland International Investment Position