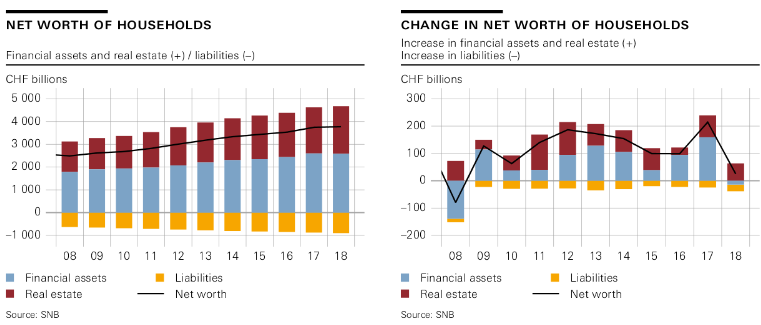

Capital losses and transactions influence household financial wealth The financial assets of households were influenced by two factors in 2018: First, falling share prices led to high capital losses and, second, households grew their financial wealth through transactions. They increased their insurance and pension scheme entitlements, expanded their bank deposits and invested in securities. Overall, household financial assets fell slightly by CHF 14 billion to CHF 2,586 billion (down 0.6%) – the first decline in ten years Capital losses and transactions influence household financial wealth - Click to enlarge Household real estate assets – and hence net worth – continue to rise The market value of real estate owned by households grew by CHF 51 billion to CHF

Topics:

Swiss National Bank considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Capital losses and transactions influence household financial wealthThe financial assets of households were influenced by two factors in 2018: First, falling share prices led to high capital losses and, second, households grew their financial wealth through transactions. They increased their insurance and pension scheme entitlements, expanded their bank deposits and invested in securities. Overall, household financial assets fell slightly by CHF 14 billion to CHF 2,586 billion (down 0.6%) – the first decline in ten years |

Capital losses and transactions influence household financial wealth |

Household real estate assets – and hence net worth – continue to riseThe market value of real estate owned by households grew by CHF 51 billion to CHF 2,053 billion (up 2.5%) in 2018. This was principally due to rising real estate prices. The net worth of households (real estate and financial assets less liabilities) also increased further. In contrast to real estate assets, financial assets declined slightly by CHF 14 billion to CHF 2,586 billion (down 0.6%). Liabilit ies, which consist mainly o f mortgages, rose by CHF 24 billion to CHF 901 billion (up 2.8%). As a result, the net worth of householdsincreased by CHF 12 billion to CHF 3,739 billion (up 0.3%). |

Household real estate assets – and hence net worth – continue to rise |

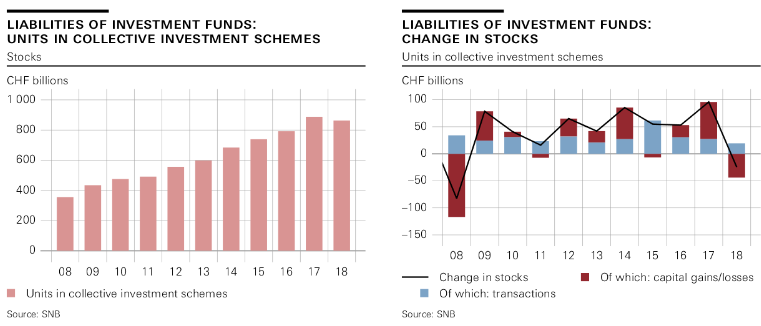

Investment fund liabilities down for first time since 2008In 2018, for the first time since 2008, the market value of units issued by investment funds (investment fund liabilities in the form of units in collective investment schemes) declined, decreasing by CHF 25 billion to CHF 863 billion (down 2.8%). This was attributable to falling stock market prices which led to capital losses of CHF 44 billion. At CHF 19 billion, transactions only partially offset capital losses. These transactions correspond to the balance between issues and redemptions of investment fund units. |

Investment fund liabilities down for first time since 2008 |

FINANCIAL ACCOUNTS IN A NUTSHELL

The financial accounts form part of Switzerland’s system of national accounts. They show the financial assets and liabilities of the economy’s institutional sectors – non-financial and financial corporations, general government, and households. The financial accounts data are presented as balance sheets for each sector and are broken down by financial instrument. In addition to stocks, information is provided on transactions, capital gains and losses, and statistical changes and reclassifications.

In order to present a comprehensive picture of household wealth, the balance sheet of households combines data on household financial assets and liabilities derived from the financial accounts with an estimate of household real estate assets. The assets side comprises financial assets and real estate at market value; the liabilities side presents loans and other accounts payable. The balance of assets and liabilities is designated the net worth of households.

Quarterly data and new publication series starting in 2020

From next year, quarterly data on the Swiss financial accounts will be released to supplement the annual data. Quarterly data are scheduled to be published for the first time in October 2020.

This is the last annual edition of the Swiss Financial Accounts. In its place, focus articles will be published exploring selected topics relating to the Swiss financial accounts.

Report

www.snb.ch, Statistics, Reports and press releases

The first section of the Swiss Financial Accounts 2018 comments on the breakdown of, and selected developments in, the financial assets and liabilities of all of the institutional sectors. The second section covers the balance sheet of households.

Data portal

data.snb.ch, Table selection, Other areas of the economy

Data on the financial accounts can be accessed here in the form of charts and configurable tables. Annual data are currently available for the period 1999 to 2018. This year’s publication of the Swiss Financial Accounts includes for the first time a breakdown of changes in stocks, for all sectors, into transactions, capital gains and losses, as well as statistical changes and reclassifications. Detailed notes on the methods used for the financial accounts and information on changes and revisions can also be found on the data portal.

Tags: Featured,newsletter